Hey, trader. Tim here.

Happy Monday.

If you hadn’t noticed, the markets are closed.

Do you know what that means?

Increased Tuesday morning volatility.

That’s volatility we can use to profit.

There’s a very specific pattern I need to share with you before the market opens.

It’s the top strategy I’m looking for, and as long as I follow the rules, it’s an absolute cakewalk.

Congratulations. You took time out of your day to prepare for profits tomorrow.

Welcome to the club, now let’s get down to business …

#1 Strategy

Last week there were a lot of dip-buying opportunities on strong runners.

- Praxis Precision Medicines Inc. (NASDAQ: PRAX) over 70% spike last Friday …

- Expion360 Inc. (NASDAQ: XPON) over 150% spike last Thursday …

- Kronos Advanced Technologies Inc. (OTC: KNOS) over 220% spike from Monday’s close to Wednesday …

$1,474 altogether. (Starting stakes were $24,636)

It’s possible the strength continues. I don’t want to be a Debbie downer.

But consider for a second … the market’s on a multi-day run and a lot of tickers are overextended. There’s a significant possibility of a pullback.

With that in mind, my main focus is on panic dip buys.

I filmed this only a month ago …

Everything you need is in the video above.

People always say “Tim, this video’s old, what about these new stocks that are spiking? We need another video.”

Respectfully, no you don’t.

It’s the same pattern over and over again.

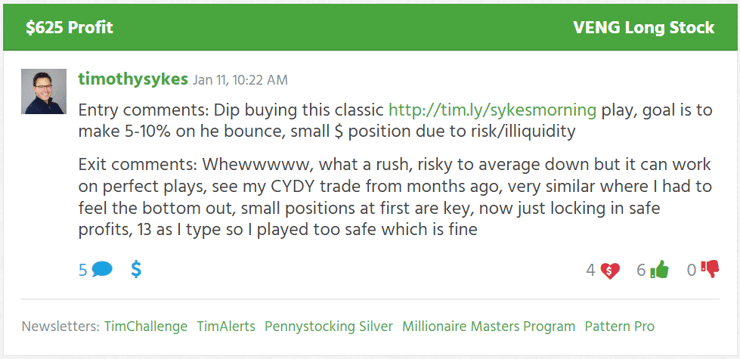

If you want a more recent example, watch the video and then check out my trade on Vision Energy Corp. (OTC: VENG) from last Wednesday…

My entry was $12.07.

I exited at $12.70.

Here’s a chart…

The pattern repetition is especially apparent on extra volatile days because the moves are more pronounced. That’s why tomorrow is so important.

Even if you’re too nervous to trade, watch the price action and learn from these opportunities.

And speaking of patterns …

Live Trade Tutorial

Every trader’s different.

For example, I have over 30 millionaire students and we all trade differently.

Sometimes we use different patterns, we trade different assets (Monaco’s been into crypto and NFTs), and we have different profits.

The process I teach shows traders how to capitalize on volatility while minimizing risk.

Within that framework, apparently, there are profit opportunities all over.

With that said, maybe the pattern I shared above isn’t a good fit for you. There’s no shame in that.

Trading is a highly personal experience and it’s unique for everyone.

That’s why I hold live meetings. So that we can grow and share our experiences as a community.

The next one is Wednesday, January 18, 2023, at 8 P.M. Eastern.

Here’s the link to reserve a seat.

These opportunities are right at your fingertips.

Reach out and grab them!

— Tim

Leave a reply