Never compare your chapter 1 to someone else’s chapter 15.

Some students who join my program hear about the success stories and how I’ve helped mentor +30 students on their journey to becoming millionaires…and think it will happen to them immediately.

However, they fail to realize that the results didn’t come right away.

In fact, my two top students, Tim Grittani and Jack Kellogg, have collectively made over $25 million in trading profits—but they didn’t make any money in year one.

Trading can be absolutely brutal…

You invest your time and energy…with no guarantees.

And when those results aren’t there, you start doubting things. You start thinking about how that time could have been spent elsewhere.

I found myself in a slump this month.

But after doing these three things, I got out of it.

Step One: Focus On The Process, Not The Money

There’s nothing wrong with wanting to make money. After all, that’s one of the most amazing things about trading一your potential is limited only by your imagination.

But trading isn’t the Powerball…

You’re not going to get rich overnight.

Becoming a consistently profitable trader requires several skills.

It’s not just about learning patterns and catalysts. You must also develop discipline and patience. And focus on risk management and capital preservation.

It takes time to acquire these skills. And you can’t skip steps.

That’s why focusing on profits early in your journey is a BIG mistake.

If Jack, Tim, or any of my other millionaire students focused on money in year one…it’s unlikely they would have achieved the success they did.

They understood there was a process they had to develop. And instead of rating their development based on their PnL…they rated it on their learning.

This month I found myself getting into trades, thinking I could make quick profits. However, several of them were not ideal setups. Instead of focusing on the process of waiting for good setups…I was thinking about the money first.

And that’s why my results suffered.

If you’re early on in your journey, don’t focus on the money. Trade small and try to learn each day. Don’t let people discourage you because the profits and losses look tiny.

Once you have the skills…then you can scale up.

Step Two: Review All Your Trades

Some traders will forget about their losses and only study their winning trades.

However, learning NOT what to do is just as important as learning what to do.

I review all my trades and share what I learned from them with my students.

When I do this, I’m looking at a number of factors.

I’m analyzing:

- My thesis: Was my idea right or wrong?

- My entries: Did I get in at a price level that gave me a good risk vs. reward?

- The Chart: Did I read the chart pattern, or did I miss something?

- My exit: Did I take profits when my target was reached or cut losses quickly?

- My overall execution: Did I follow my plan, or did I get emotional or lose discipline?

- What kind of trade was this? Was I buying off a news play? Was I trying to dip buy? Some plays work better than others. I want to know what’s working in the current market environment.

When I was reviewing my trades, I noticed I was overtrading. Moreover, I was not taking optimal setups. After realizing it, I started to tighten my belt. I was taking fewer trades, being more patient, and waiting for better setups.

When you’re not making money, it can hurt your confidence. I made the decision to trade a smaller size. This allowed me to work through my issues without the PnL driving my emotions. It allowed me to focus on the process.

That’s why I always tell my students…this is a great market for learning.

It’s important to put your reps in now when things are slow. Develop your skills— you’ll be ready when the markets heat up again.

Professional athletes spend the majority of their time preparing and practicing. They make it look easy when it’s time for them to compete. But very few know the sacrifices and preparation they took to achieve their results.

Trading is the same.

More Breaking News

- Entegris Faces CFO Transition Amid Price Target Boosts from Analysts

- Oracle’s Expansion Plans and Market Response Fuel Stock Momentum

- GTM Stock Falls Amid Latest Earnings Report and Market Reactions

- Price Predictions Fueled by Company Moves In Market Dynamics

Studying your trades and dissecting what you did right and wrong isn’t glamorous. But it’s important if you want to make it in this game.

Step 3: Give Yourself A Grade

Some traders will base their success on how much money they make or lose during the day.

But if you’ve read up to this point, you know that’s not the correct way to look at things.

After I review my trades, I like to give myself an overall grade.

You can give yourself a letter grade as they do in school…I use a scale of 1-10. A 1 is a horrible trade, and a 10 is a great trade.

Be brutally honest with yourself…unlike school…you don’t have to show these grades to anyone. It’s for your benefit.

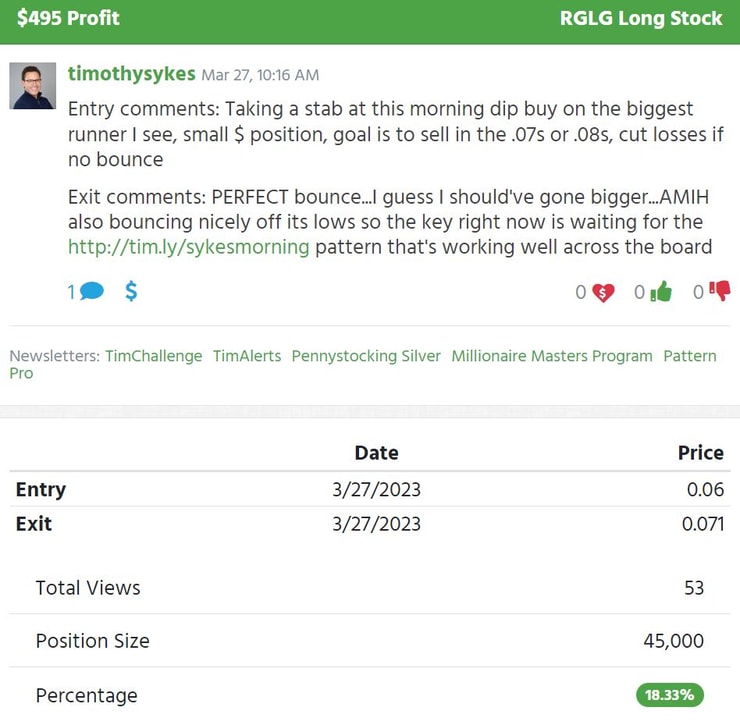

Source: Profit.ly

I gave myself an 8 on the trade in RGLG yesterday. It was the setup I wanted to see. The play worked out perfectly. I would have given myself a higher grade if I had put on more size.

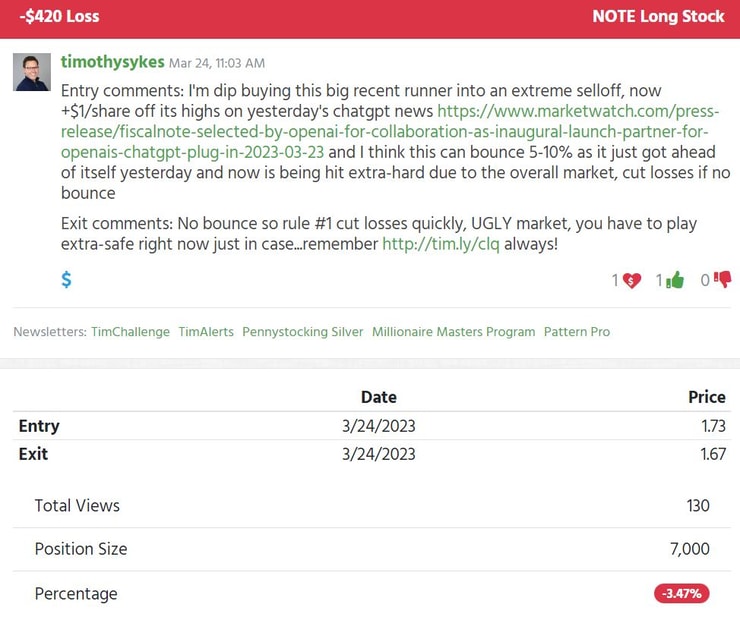

Source: Profit.ly

I gave myself a grade of 5 on this trade on NOTE. The pattern was good. However, I misread the chart and sized it incorrectly on this trade. However, I do like how I handled my emotions. I quickly cut losses and didn’t turn it into a horrible trade.

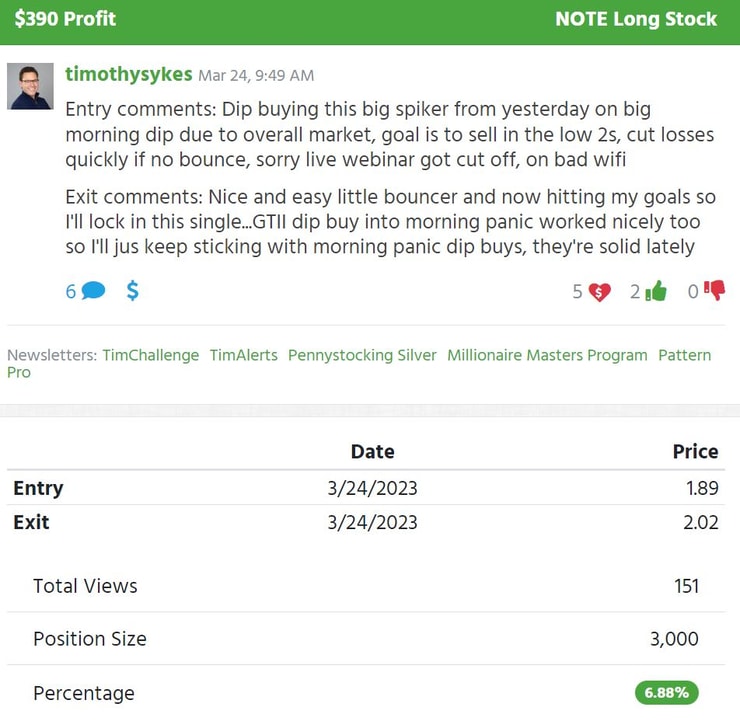

Source: Profit.ly

The same day here but earlier trade in NOTE. This one was played much better, an early morning dip buy and quick exit for profits. I gave myself a grade of 7 on this trade.

It’s important to note, I give detailed video reviews of the trades and give them to my students.

I’m just giving you a very brief overview here. I’m a lot more meticulous than what you see here.

At the end of the week, I like to give myself an overall grade too.

Right now is a great time to be learning and working on developing your skills. Invest the time to get better and when trading conditions improve you’ll be happy you put in this work.

If you’d like to learn more about my program, click here for the details.

Leave a reply