As I discussed at the 2019 Trader and Investor Summit, there hasn’t been a hot sector in months … but that doesn’t mean there aren’t great plays. Sometimes you just have to wait for them to come to you.

One of the biggest problems I see with new traders is their need to trade everything…

One day they’ll long a breakout, and the next try to short a low-float runner. There’s no discipline or pattern to their trading.

But they like to say, “I have to see what I’m good at trading.”

If there’s one thing I’ve learned over the years, it’s that I need to be extra patient.

There will always be another great trade. There will always be another great setup.

The real questions are…

Will I be prepared for it? Will I capitalize on it?

Or … will I be busy with some crappy trade? And will I be frustrated because I’ve been taking a lot of crappy trades?

As I often say, if there’s a perfect trade tomorrow, probably 90% of my students (maybe even 95%) would be unprepared.

And that’s why 90%–95% of traders will lose money: they aren’t prepared for the best trades.

2025 Millionaire Media, LLCTable of Contents

How I Prepare for the Best Trades and OTC Runners

As I discussed in this Millionaire Mentor Update, I’m in Bali working on my charities, building schools, and enjoying food tours because I love to eat. If you’ve followed me for a while, you know I’m always traveling.

People often ask me: ‘Tim, why not stay in one place so you can trade better?’

The question seems logical … but statistically, I’m a better trader when I travel because I don’t force trades.

I don’t want to trade as much when I’m in a beautiful place with good people all around me. So having the ‘retired-trader’ mindset actually helps me — it allows me to be pickier with my trades and only focus on the best setups.

Let’s go over some of my recent trades because some trades aren’t perfect. I’m human and make mistakes. But let them be lessons for you.

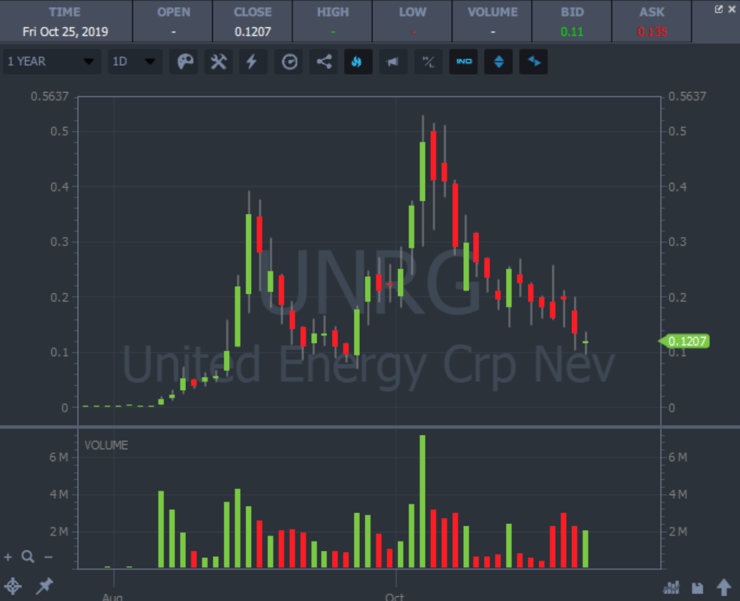

United Energy Corp (OTC: UNRG)

United Energy Corp spiked on merger rumors earlier this week. I was able to find this stock using the social media search tool on StocksToTrade. The tweets started the afternoon of October 20 and continued into the next morning.

Being a former supernova, this was high on my watchlist.

The spreading UNRG rumor was based on the company merging with another company. Mergers are typically a great catalyst, so the stock started to spike and forced me out of my retired-trader mindset.

I’m always looking for former runners to have new catalysts. People can remember stocks from previous runs and may be more inclined to buy again. So, when UNRG spiked after being down for the last few weeks, I thought…

Hey … It’s ready for a first green day move, which could lead to another supernova spike…

As anticipated, we got the volume spike. Unfortunately, it just didn’t go that much on October 21. There just wasn’t that much spike, and when it didn’t break the high of the day convincingly, I got out with a small profit.

The next day, I rebought the stock because real news came out. The rumors were true, which doesn’t always happen.

Instantly, I was like….

WOW, this is cool!

So I bought right near the open, and that was my mistake…

I got too excited about the news because I’d played it the previous day … but looking at Twitter, there were rumors. So, I think I was probably too happy the rumor was accurate.

When I saw it going up premarket, and I saw it start spiking at the open, I didn’t want to miss it. It’s one thing to be right about the news, but I wanted to profit from it. Turns out, that was the wrong instinct. The right thing to do was buy the rumor and sell the news.

The one thing I did well on this trade was cut losses very quickly. Cutting losses quickly has always been my number-one rule. Unfortunately, I let my ego take over…

There’s good news! There’s good news!

Just as a lot of newbies tend to do.

Maybe the news was already priced in from the previous day, perhaps the news was leaked, or maybe the news wasn’t as good as everyone expected. I’m not sure. In the moment, all I knew was that it wasn’t spiking.

For me, when a trade isn’t spiking or doing what I expect, I’ll exit the trade for a small profit or a small loss. In terms of UNRG, it was dropping rather quickly, and I cut losses pretty quickly on this one.

Overall, this trade is a great lesson for me and my students. Buying a news rumor on a former runner’s first green day can work. And then, when the news comes out, that might actually be a good time to sell, not buy.

Baristas Coffee Company, Inc. (OTC: BCCI)

My next trade was also on a former runner. It’s critical you keep track of former supernovas — less than 20 minutes after my losing UNRG trade, BCCI started spiking on positive news with Ben and Jerry’s.

Sometimes the market works that way and gives you more than one good setup in a day.

If you remember earlier this year, about a week before the Super Bowl, BCCI ran from $0.02 to over $0.12 on a rumor they were going to run an ad during the Super Bowl.

The stock promptly crashed after the Superbowl in the classic ‘buy the rumor, sell the news’ pattern.

This time, BCCI was partnering with a larger, well-known company — one of my favorite catalysts.

For this specific trade, on October 22, it spiked from $0.018 to $0.036 in the morning off the press release and started to pull back. As the stock began to break out from its morning high, I started buying in the mid $0.03s. I was looking for another leg up … These low-priced stocks have been hot, and I liked the press release.

The next leg spiked to $0.04ish, and then I got a little freaked out. It was already up 150%, so I decided to play it safe and lock in my gains.

It did get to my original goal of the mid $0.04s. So this was a great follow-up breakout even though it ended up failing and fading the rest of the day.

This was a good buy on the breakout of the high of the day. But I played it a little safer because I’m not comfortable with stocks up 150%–200% on the day. I don’t mind selling a little too soon.

BCCI Takeaways

Because I cut losses quickly on my failed UNRG trade, I was still green on the day. That’s the beauty of cutting losses quickly. You can make a mistake, and as long as you accept it right away, you just have to wait for the next trade. In this case, the next trade was 20 minutes later.

One good trade can wipe out small losses.

Canal Capital Corporation (OTC: COWPP)

My best trade of the week was on COWPP.

I’ve been playing this one since it went supernova a few weeks ago. It’s one of the DCGD, CLSI sympathy plays with the whole Justin Costello situation. I didn’t care about any of that. I just care that it broke out.

After the initial spike, for six days, it held below $0.30. I remember I bought it on one of these dips around $0.13 or $0.14. I also bought it on another dip around $0.09. So, I’d already profited on this two or three times, but it just couldn’t break $0.30.

Then on the afternoon of October 22, it spiked from $0.28 to $0.36 in the last 20 minutes of the day. Look how fast the stock moves!

That’s a strong breakout, but I wasn’t sure if this was real.

The next morning it was on the top of the watchlist I put together for my students. At the open, there was some dipping action, but it was hanging around $0.37–$0.38. By failing to break down, COWPP confirmed the breakout because it was holding onto its previous day’s gains. Then again, as I did on BCCI, I bought the high of the day breakout.

This is a very simple strategy, but one many of my Trading Challenge students implement successfully often.

COWPP Has Multiple Breakouts

If a stock is breaking out on a multi-day basis or having a first green day with news, I like buying high-of-day breakouts. But here, you have not only an intraday breakout, but you also have a multi-week breakout with both breakout levels right around $0.40.

For me, an intraday breakout plus a multi-week breakout on a former supernova is a pretty easy trade for me to take. That said, it isn’t a big-money trade or guaranteed.

Notice I’m not buying this heading into midday. I took this trade at nearly midnight here in Bali, so I wasn’t the most awake. I was aware of my situation and mental state, but COWPP forced me out of retirement kinda like UNRG and BCCI.

If you read my alert, you’ll see I was watching this but got distracted by a good conversation. It went all the way up to $0.47–$0.475. I sold it around $0.46. I’m pretty happy with this trade. I was trading on weak Wi-Fi in a crazy time zone. But I recognized the former supernova, I recognized the pattern, and I took a small dollar amount just in case I was wrong.

If it had broken below $0.40, I literally would have just gotten out. I would have lost a penny or two a share. But I figured it could go higher.

My Trading Approach

Often I get some funny comments like:

‘You’re a multimillionaire and you’re talking about a few hundred dollars here and there? What’s the deal?’

You have to remember, I’m trading with small positions. I’m trading with an account size similar to many of my students. I think you can really learn a lot from the process of these trades.

More Breaking News

- Is It Too Late to Invest in INKT?

- Dare Bioscience Reflects on Grant Milestone

- Futu Stock Surges: A Perfect Storm?

Take What the Market Gives You

I’m better at higher-priced stocks, but it’s these low-priced, under 50 cents type stocks that are spiking.

I’m not good at trying to make 5 or 10 cents a share on these kinds of plays. I prefer $2, $3, $4 stocks, which allow me to earn 50 cents to $1 a share. But, I’m not in control of the market and can’t create plays when there are none. I go with whatever’s spiking. I go with what’s hot.

Recent Tweets, Comments, and Trades from Students

Here’s a look at some of my students’ recent comments in the chat rooms and on Twitter…

There were a ton of opportunities this week and many of my students capitalized.

There won’t always be great plays, but when there are, make sure you’re part of the 10% that’s prepared. To help you with the fundamentals, check out “The Complete Penny Stock Course” book, written by my awesome student, Jamil Ben Alluch, summarizing my best lessons.

From the Trading Challenge Chat Room

The Trading Challenge Chat Room ran like a well-oiled machine last week. The moderators and my top students all nailed UNRG, BCCI, and COWPP.

Profit.ly user tylerfrist4000: “sold half my shares. Entered Friday afternoon 10k shares @ .197 and now 5k out at .235. Waiting to sell the other half if we get a bounce after this little morning dip. Not seeing it yet, but going to have patience.”

Waiting for the right plays is critical but don’t forget to cut losses quickly.

My student Profit.ly user keeyongtn is on the right track and using the right tools: “Yesterday Sykes traded a former runner $BCCI and today $KPAY ideally with news, these can be found in the video lessons and in STT.”

To succeed in this game, you need to use the best penny stock trading software.

Sometimes filling OTCs is tough like Profit.ly user SeanLacap experienced: “$BCCI in 19,100 (partial) at .0349 out .0415 bad fill.”

Always remember to sell into strength. SINGLES, SINGLES, SINGLES!

One of my newest six-figure students, Profit.ly user Jackaroo, nailed BCCI on the long side: “longed just 30k $BCCI .04.”

Solid trade from Profit.ly user Torino13: “$BCCI sold $2,800 Profit!!”

COWPP was a tough stock to trade because it moved so fast, but Profit.ly user KarolaCrawford’s trade was perfect! “$COWPP In at .35 out at .42.” She bought the high of day break out and locked in her gains.

My newest millionaire student and millionaire mentor, Profit.ly user markcroock: “Booked $2500 all out $COWPP and NAT.” And he did all while guiding students in the Trading Challenge Chat Room. Keep up the great work, Mark!

More Comments from the TimAlerts Chat Room

Profit.ly user evanttian noticed COWPP before most of my students — great entry on the breakout! Evanttian: “in 0.365 $COWPP as it looks to be breaking out”.

Trading requires skills, which can be learned over time with hours of studying. Profit.ly user Anigai had a breakthrough: “What I’ve figured out now is that buying breakouts seems to be a fine balance between react & predict. $SGMD and now $COWPP seem to have this in common. But I don’t think I’ll trade, just watch for now.”

Whenever testing a new theory or strategy, don’t trade it right away. That’s why I always tell my students to paper trade using a platform like StocksToTrade.

And last, a great tweet from a student:

so i just sold my dip buy this am at .34 at .472 on $COWPP just now, likely goes higher but i took my single and now can live life @timothysykes especially bcuz i actually have tonight off from my day job yay

— Sean Riddell (@Chesskid90) October 23, 2019

[Please note these results are not typical. These traders have exceptional knowledge and skills that they’ve developed with time and dedication. Most traders lose money. Trading is risky. Do your due diligence and never risk more than you can afford.]

What do you think about these low-priced OTC spikers? Comment below, I love to hear from all my readers!

Leave a reply