One trade can change everything.

But not how you imagine.

Very few people hit the winning lottery ticket on one trade. But that doesn’t stop folks from trying.

And I’m not just talking about new traders who just started.

Last week, I watched veteran short-sellers, some of the best around, try to short Intelligent Living Application Group Inc. (NASDAQ: ILAG).

Few survived…

One trade CAN change everything.

Yet, without proper risk management, that one trade can ruin you.

Fortunately, it’s not hard to avoid these catastrophic situations.

All you need is the right mindset.

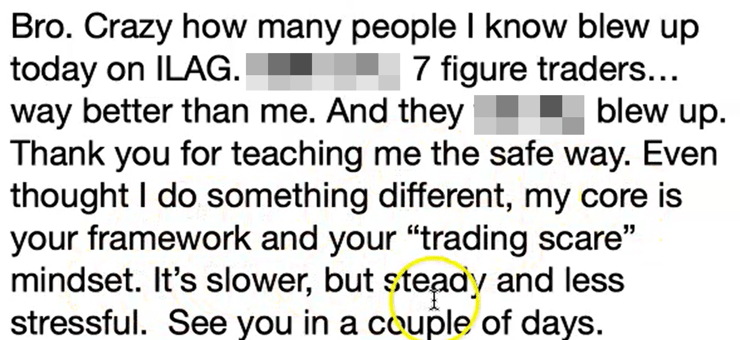

This is a text I received from one of my students.

Messages like this fill me with pride.

It tells me people used methods and mindsets I teach to avoid trading landmines.

Millionaire Challenge Students get access to my entire suite of education products, including LIVE webinars, hundreds of hours of video, premarket plans, and so much more.

I want to offer you a snippet with three simple strategies anyone can use to evade the most perilous trades.

Locate Your Weak Spots

In corporate America, they say to climb the corporate ladder, turn your weaknesses into strengths.

That’s a hot load of garbage.

I say manage your weaknesses to make them tolerable and make your strengths great.

Everyone has their own strengths and weaknesses. No two traders are the same.

Long-term success means avoiding those massive losses.

Where do you think those are most likely to occur?

The goal isn’t to get rid of our blindspots but to locate them and work around them.

For me, I suck with large accounts and large-cap stocks.

Notice I say ‘suck.’ This isn’t something that I conquered. It is always with me. It’s a part of who I am.

I accept that and create strategies to work around that weakness.

For example, I reset my account most years to a reasonable size.

I’m also more vocal about my mistakes than my wins.

Calling out my mistake, assigning myself burpees…putting my pain out there for everyone to see keeps me honest.

Weaknesses can also be technical, such as understanding how to design a setup.

Plus, as you progress through your trading career, you will probably uncover new weaknesses.

It’s human nature to deny them.

It takes a stronger person to accept and work with them.

Survival of the Fittest

Thousands of companies, funds, and traders went bankrupt during the Great Recession.

For some, it was a slow bleed over years.

MF Global was there one day and bankrupt the next.

Trading is an exercise in probabilities. We never know what the next moment brings, let alone the next day or week.

Traders only survive by expecting the worst.

Most stocks that trade below $5.00 are there for a reason – they’re unprofitable.

However, these stocks make great trading vehicles.

These are risky equities, typically of poorly run companies, that get hit with promoters and chat pumps…

Which is why I love trading them.

I don’t have to worry about as many hidden dangers lurking in the background

All the bad actors and obstacles are front and center.

That’s a lot harder with heavily traded stocks like Apple or Citigroup.

There, I compete against high-frequency traders, institutional funds, algorithms…the list goes on and on.

But even if I did trade those stocks, I would still expect the worst from them.

Back in February 2019, the SEC investigated The Kraft Heinz Company (NASDAQ: KHC) for improper accounting practices.

The stock, which typically traded in a range of 1.5% at best, dropped nearly 30% overnight.

Initially, this mindset could lead you to take a lot of small losses.

That’s ok.

More Breaking News

- Bitfarms Plans for U.S. Redomiciliation and Debt Repayment Spark Investor Interest

- RITR’s Strategic Moves Signal Potential Growth Amidst Market Challenges

- Exponent Sees Promising Growth with Dividend Increase and Upbeat Q4 Earnings

- China SXT Pharma Launches AI Supply Chain Overhaul for TCMs

With practice, you’ll learn how to slowly learn to turn those into breakeven trades and then tiny profits.

Don’t Force Big Wins

I hit plenty of home runs over the years. However, I didn’t try to make these happen.

They occur as a natural part of trading.

Just like outlier events can send a stock crashing, some send them soaring.

I teach students in my Millionaire Challenge how to manage risk, lock in profits, and leave a portion of the trade on to capture even more.

A lot of the promoters on social media only post their huge wins because they don’t want you to see their massive losses.

I’m not a flashy trader who swings six figures daily.

My accounts grow slowly, steadily, and predictably.

And THAT’s how you create long-term success.

—Tim

Leave a reply