Over the last two decades, I’ve taught thousands of folks how to trade the markets.

Some come to me with years of experience, while others are as fresh as a newborn baby.

But no matter who they are or where they come from, there is one mistake I see time and again…

A mistake that destroys a trading account faster than anything else…

Oversized trades.

Don’t assume that consistent profits or a string of wins make you immune.

Everyone needs to watch out for oversized trades, including myself.

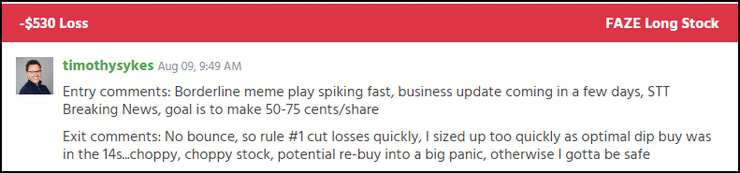

Heck, just the other day, I screwed up when I traded FaZe Holdings Inc. (NASDAQ FAZE).

Good thing I cut my loss quickly.

Good thing I cut my loss quickly.

The good news is that you don’t have to let this common mistake own you.

In fact, I’m going to show you a few ways to avoid oversized trades before you click the button.

Plus, I’ll explain how to identify and manage them when you’re already in a trade.

This will save you a ton of frustration and, more importantly, money.

Table of Contents

Why Oversized Trades Kill

Not all big trades fail. In fact, if you have a high enough win-rate, it may take weeks before you notice.

But when it happens, it becomes painfully obvious.

Every trade has a probability of success and failure.

On average, if I take enough trades using the same strategy, the results converge on the averages.

However, that doesn’t mean there can’t be a string of losers. And it’s that outside possibility we need to protect against.

Let me give you an example.

Imagine I started with a $5,000 account.

I risk 20% of the account to make double what I risk.

Assuming I win 75% of the time, that means I should make about 25% of my account per trade.

However, what happens if I lose 5x in a row?

That $5,000 account would drop down to $1,638.

The odds of that happening are 0.098%, but not zero.

Yet, a funny thing happens when you find yourself in a trade with too much at stake.

People panic and start to make bad decisions.

Consequently, while losing 5x in a row should statistically happen only 0.098% of the time, when you go ‘on-tilt’ as they say in poker, that percentage skyrockets.

Set Yourself Up For Success

I tell my students there are markets for learning and markets for earning.

2021 was a market for earning. The first part of 2022 was a market for learning. Now, we’re into an earning market.

My size reflects the market conditions.

However, I have a process to scale up.

Stair Step Size

Let’s assume I define my trades as a percentage of my account.

I start with a $5,000 account and a 5% trade size, or $250.

I am unlikely to increase that trade size until the account gets beyond $7,500.

From there, I would cautiously increase my size until it reaches 5% of $7,500 or $375.

If the account drops below $7,500, I revert back to $250.

This stairstep approach keeps me consistent in how I trade without worrying about whether I take the right size or not.

Set Daily and Weekly Limits

Some days I take one trade. Some days I take five.

It’s rare that I take any more.

Putting daily and weekly limits on the number of trades you take as well as maximum losses can keep you from going ‘on tilt.’

Plus, it avoids another common mistake, overtrading.

More Breaking News

- Vizsla Silver Corp US Market Rift: Challenging Times Ahead

- Coty Faces Uncertainties with Earnings Miss and Strategy Revisions

- Needham Upgrades Ichor Holdings to Buy Amid Positive Forecasts

- TeraWulf’s Strategic Expansion Ignites Market Interest

Cut Losses Quickly

When a trade is over, it’s over. Big losses don’t always start big. In fact, many can start with an appropriately sized trade that ignores stop losses.

I harp on cutting losses quickly simply because it’s the best method I know of to avoid massive drawdowns.

Review Your Trades

Every day, I go over my trades to make sure I executed the plan correctly.

That means correctly identifying setups, buying the right number of shares, and exiting at my target or stop loss.

The best place to keep this is in a trade journal.

Recognize and Handle Oversized Trades

Taking oversized trades starts innocently enough. But it can quickly spiral out of control.

The good news is a few simple tricks can help you identify oversized trades.

Here is what to look out for:

- Any trade that you feel the need to check on constantly and after hours. Trading is fun, but it shouldn’t consume your life.

- Your losses exceed the maximum amount you allow on any given day.

- The stock has gone beyond your stop loss.

- Your typical trade size is hundreds of shares, and your current position is thousands.

Whenever I find myself in a trade with too much on the line, I have two options:

- Cut the size down to a manageable amount

- Exit the trade completely

Whatever you choose is up to you. But letting a trade ride once you know it was not executed correctly can lead to serious losses.

Every day, I work with traders to organize themselves, learn chart patterns, and execute cleaner trades.

It takes time and practice, but it works. Just look at my success stories.

I want you to become one of them. Take my millionaire challenge.

—Tim

Leave a reply