Never underestimate your ability in this world.

There are daily profit opportunities in this market! But some people continue to doubt themselves.

Ladies and gentlemen:

In your back pocket you hold an infinite source of information. And with your complex human brain, the sky’s the limit.

YOU BETTER BE CAPITALIZING ON ALLLLLL THIS OPPORTUNITY LIKE MY TOP UPCOMING https://t.co/occ8wKmlgm STUDENTS ARE, WHEWWWWW! PLEASE CONGRATULATE THESE STUDENTS WHO REALLY GET IT!

Bazz: $VERB in at 0.519 out at 0.82 nice win of $271

sdstocks23d: $VERB 4000 shares in @ 0.532 out @…

— Timothy Sykes (@timothysykes) March 15, 2024

It’s easy to get lost in today’s society. People think:

- I don’t have a fancy car.

- I don’t have nice clothes.

- I don’t have rich parents.

- I didn’t go to Harvard.

Who cares?! These things don’t define you.

You are the sum of the actions that you take with the tools at your disposal.

As human beings in 2024, we have an unprecedented opportunity to drastically change the outcome of our lives. I’m talking about things like first generation millionaires.

The jump from your couch to a millionaire trader can seem daunting. But that’s because you don’t truly understand the power that you wield every day. The creativity and intelligence that you’re gifted with.

Don’t believe me? We see evidence of this among our closest ancestors.

I’m sharing a video from a few years ago, but it hits on our trading topic in a major way.

Orangutans in the jungle are documented using hand saws without any prior instruction:

These animals were never expected to cut through wood. But they learned how to do so by watching jungle workers. And it’s a remarkable achievement.

Just like no one expects us to trade penny stocks for lifetime profits. I’m already at $7.6 million. My student Jack Kellogg is at $12.4 million.

If an orangutan can watch a wood worker and learn to use a saw …

Surely you can watch a professional trader and learn how to profit.

Study My Trades

I’m always posting blogs and YouTube videos sharing past trades.

Let’s go over last Friday’s trade for example, starting stake of $2,418:

Verb Technology Company Inc. (NASDAQ: VERB) announced the launch of its new Facebook and Instagram online shopping technology.

In the Tweet below, you can see my students and I were alerted at 8:46 A.M. Eastern. Before the market even opened:

156% GAIN off of $VERB!🔥

Retweet & favorite if you caught a piece of this move!📈

Get the Next Alert🚨👉https://t.co/DV5c1Ke7gO #FridayFeeling #FridayVibes #StocksToWatch pic.twitter.com/nd3LE16vI8

— StocksToTrade (@StocksToTrade) March 15, 2024

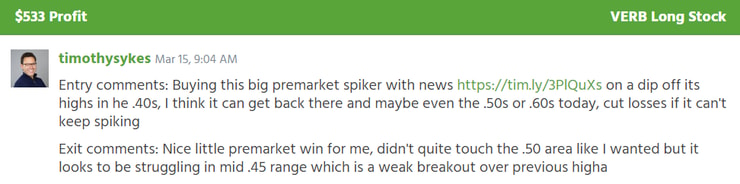

I traded it during premarket on a dip before it broke to new highs. My traded totaled a 22% gain:

This is a classic dip buy pattern where we aim to sell into the breakout strength.

VERB spiked +500% last Friday. I only caught a fraction of the move. But I’m proud of my 22% profit.

When most traders lose … a 22% gain within a few minutes is a HUGE win.

And this pattern is recurring in the market as part of my larger 7-Step Framework.

This isn’t rocket science! You just need trading experience.

Monkey See, Monkey Do!

Technically, orangutans aren’t monkeys. They’re apes.

And humans are more closely related to apes than monkeys … But you get my point.

Don’t let this process frustrate you. It can take time to perfect. But, like the orangutan, we can learn how to adopt this process by watching professionals.

“I’m not an orangutan, Tim. And trading isn’t the same as using a hand saw”

No duh …

Stop limiting yourself. See?? You’re doing it again!

I have over 30 millionaire students as proof. And that number continues to grow.

You’ll probably suck at first. I’m just being honest. The orangutan made for a pretty horrible contractor on day one.

I’d never hire that bloke …

But give it a few weeks, a month or two, even a year from now. You’ll be surprised what you’re capable of.

Don’t miss out on the biggest opportunities for small-account traders this week. At the very least, learn from these setups:

Watch professionals track the best plays LIVE.

Soak up as much information as you can. This 2024 market continues to run wild.

And there’s still time to capitalize.

Cheers.

*Past performance does not indicate future results

Leave a reply