I’ll be the first to admit that I like to stay active and I’m not just talking about trading.

Life is simply too short. I don’t want to look back and feel like I missed any opportunities.

That’s why I donate my trading profits and time to charity, helping to build nearly two dozen schools in Bali.

Check out the story on my Instagram Feed.

A lot of people assume that means I get frustrated when markets put together a string of days where my setups don’t materialize.

But nothing could be further from the truth.

As I tell my students, preparation is key to profits.

So on the days where I trade few — if any — stocks, I’m working to level up my skills and calibrate my trading.

And there are three things I focus on specifically.

Look for Missed Setups

Every day, there are two tools I use.

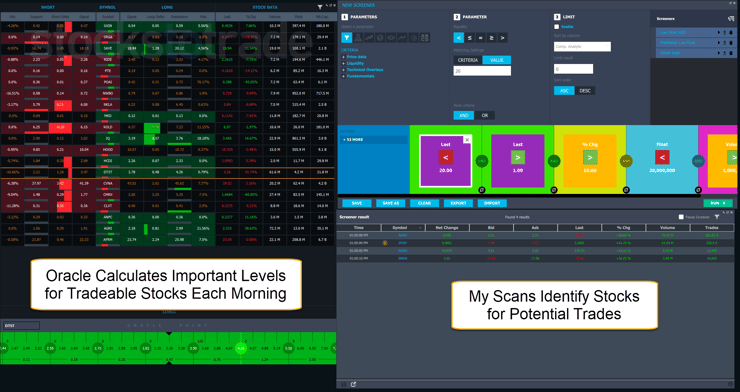

First, is my StocksToTrade Stock Screener.

I’ve talked about this before as it’s my go-to stock seach tool for penny stocks.

Unlike other scanners and screeners, this one includes features specific to penny stock traders including stock float, premarket volume, and more.

Plus, I can look at our proprietary Oracle tool which calculates various support and resistance levels for the top tickers every morning.

The second place I look is our Breaking News chat feature.

We hired some of the best analysts around — they comb through the news and popular chat rooms to bring you relevant and actionable trade ideas.

These two tools save me countless hours.

On top of these, I also prepare and update my watchlist of stocks that could offer potential setups.

On my prep days, I’ll go through and highlight the handful of stocks I feel provide the best trade setups.

Then, I go back later and look through the other stocks I didn’t follow to see if there are any setups I missed.

You see, some traders think you can find and play every setup on the board.

That’s not how it works.

I can identify most stocks that provide possible setups. But I have to limit my focus to just a handful based on my style of trading.

The reason I go back and look at other setups that I missed is to see if there were any overarching themes in them.

For example, this week was dominated by oil and gas stocks like Imperial Petroleum Inc. (NASDAQ: IMPP).

However, there were also plays in some Chinese companies including Huya Inc. (NYSE: HUYA).

And I’ve been a big fan of trading Sysorex Inc. (OTC: SYSX) lately.

What I don’t want to do is get so focused on one stock or sector that I miss the bigger picture.

Spotting Market Trends

Speaking of the bigger picture, I also take some time to look at the markets I don’t trade including the major indexes.

While penny stocks often trade independently from major companies like Apple Inc. (NASDAQ: AAPL), they follow sector trends.

That’s why oil and gas stocks are in vogue with crude oil and natural prices through the roof.

A great way to see what’s working is to take a look at sector ETFs.

S&P provides a handful of them, all starting with an ‘X’, that covers everything from financials to biotech to technology.

I don’t need to go deep in my analysis. Just look at which ones are holding up and which aren’t.

Right now, the Energy Select Sector SPDR Fund (ARCX: XLE) and the SPDR S&P Oil & Gas Exploration & Production ETF (ARCX: XOP) are good for watching oil and gas stocks.

But just as important, I want to look at the trading trends as well.

Back in late 2020 and all of 2021, stocks would pop and run for days on end.

Right now, they’re lucky to make it more than a week.

This is a notable trend that can and will shift. Once it does, that tells me it may be time to look at my risk profile.

One way I do that is by taking small trades in different stocks to ‘test the waters.’ These aren’t huge positions, and frankly, you could do it with a simulated account.

More Breaking News

- Oracle’s $50B Cloud Expansion Plans Fuel Stock Surge

- Sezzle Inc. to Announce Q4 Results in Late February

- QuantumScape Launches Eagle Line for Solid-State Battery Pilot Production

- Sezzle Inc. Sets New CFO, Anticipates Financial Empowerment Initiatives

What it does is keep me connected to the market movements and helps me spot patterns I might otherwise miss.

Practice Cutting Losses

I practice what I preach. I like to lose small and fast.

When I feel like I’m straying from this and holding onto positions too long, I will actually practice taking losses.

Again, this doesn’t need to be in a real money account. A simulated account will do just fine.

But I want to get used to the feeling of cutting a trade when it’s not going to work.

That way, I don’t freeze or rationalize my actions when I’m in the moment.

Now, I know that being accountable to yourself can be tough.

That’s why I created my millionaire challenge.

My students get access to loads of content to help them study and learn how the market works.

And now is your chance to join them.

Leave a reply