Folks who enter my Millionaire Trading Challenge come from all walks of life.

Mariana joined right after high school graduation as did Jack Schwartz.

Jack Kellogg parked cars as a valet before becoming another of my millionaire students.

Anyone can turn a profit in the market.

But you won’t get there following social media promoters.

Many of these keyboard jockeys claim they have the ‘special’ indicator or edge to dominate the market.

Yet, as soon as the bubble bursts, they’re nowhere to be found.

In my opinion, anyone worth their salt should be able to back up their claims.

That’s why I log EVERY one of my trades here on profitly.

So what exactly are the keys to success? What do my millionaire trading students all have in common?

After teaching thousands of students over the last decade, I’ve narrowed it down to three key elements that every one of my student success stories has in common.

Master these three items and you’ll quickly discover more reliable and consistently profitable outcomes.

1. Manage Your Losses

Trading is an exercise in risk management.

As a trader, I’m responsible for minimizing my potential losses and maximizing my possible gains.

Over the years, I found that most traders lose money not because they can’t win but because they lose poorly.

That’s why I always advocate and practice cutting my losers quickly.

Heck, if a trade doesn’t start winning for me quickly, I’ll drop it.

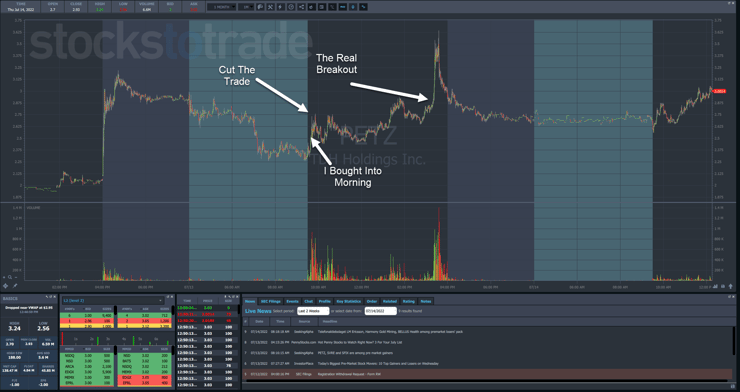

Take the trade I had in TBH Holdings Inc. (NASDAQ: PETZ) the other day.

While I managed to turn a profit, I quickly released my position when the stock failed to continue its rally.

If you look through my trade history, you’ll see dozens of trades where I only make $30 or $40.

These are positions I entered that failed to provide the required move.

Rather than hold and hope, I cut and run.

Now, what you’ll notice with these trades is that on many, I still manage to turn a small profit.

That comes with practice and patience.

You see, the first step towards profitability is removing those big losses that offset my gains.

The second step is to optimize your trades, getting better entries and exits.

Over time, this turned from small losses to small gains, which add up.

2. Adjust to the Market

Markets can and do change.

As I tell my students, some markets are for learning and some are for earning.

The meme stock craze and bubbles built in 2021 created some of the best trades I’ve seen in my lifetime.

2022 has been much slower.

However, that doesn’t mean there aren’t trades, nor that you can’t be profitable.

Year-to-date, I’m up more than $80,000. While it’s not the +$1 million I made in 2021, it’s a heck of a lot better than the average investor.

And even throughout the year, the conditions can rapidly change.

Lately, I’ve seen many more multi-day runners and squeezes worth trading and fewer morning panic dip buys.

Three months ago, it was the exact opposite.

While penny stocks trade more independently from the broader markets, general risk appetites driven by the Fed and other factors all still play into the environment.

More Breaking News

- Huntington Bancshares Faces Earnings Miss, Market Considers Impacts

- Credo Technology Unveils AI Retimer Amid Strategic Partnerships

- SoFi Technologies Stock Surges: Q4 Wins Spark Analyst Upgrades

- Oracle’s $50B Cloud Expansion Plans Fuel Stock Surge

Put simply, if markets are crashing, penny stocks will struggle just as much to rally for more than a day or two.

3. Focus on Fewer, Better Setups

I earned most of my first $1 million with just one pattern.

Many traders I know only take 2-3 trades a week.

And there are some that trade once a week at most.

You don’t need a lot of trades to become successful.

Early on, I tell my students to work on just one setup that they feel comfortable with and get really good at that before expanding.

Folks who have never found consistent success need to build their confidence and a baseline to work from.

Otherwise, they’ll fear losing on every trade, which is a recipe for moving stops and a host of other bad habits.

Here’s some quick math to prove my point.

If you win 65% of your trades and risk $1 to make $3, starting with $1,000 and risking 5% of your account on each trade, you will hit $1 million in 90 trades.

At one trade per week, that’s a little under 2 years.

That’s why I want you in my millionaire challenge today.

—Tim

Leave a reply