While the overall market continues to get battered and Treasury yields hitting 16-year highs…

There are still incredible trading opportunities if you’re a day trader.

Best of all, you don’t have to be a short seller to take advantage of them.

In fact, the only way to play this recent trading phenomenon is on the long side.

Short squeezes, in particular, have become the boogeyman of trading—a force that can either skyrocket your account or leave it in ruins.

I’ll show you how to use them to your advantage in five steps.

Table of Contents

- 1 Why We’re Still Seeing Short Squeezes While The Market Is Getting Wrecked

- 2 #1 Swiftly Cut Your Losses: No Ifs, Ands, or Buts

- 3 #2 Be the Master of Your Trade

- 4 #3 Have A Plan and Stick To It

- 5 #4 Think Like A Trader, Not An Investor

- 6 #5 Arm Yourself With The Right Tools

- 7 Ready to Master the Short Squeeze Phenomenon? 📈

Why We’re Still Seeing Short Squeezes While The Market Is Getting Wrecked

2025 Millionaire Media, LLCWhile the latest action in the market is striking fear into investors…it has a totally different feeling for traders.

You see, day traders typically end their day in cash. They don’t care if the overall market is up or down.

The only thing they care about is volatility.

As a trader, volatility is what creates opportunity.

Now, with the overall markets getting hammered, we can expect most stocks to track the market.

However, if you stick to small-cap penny stocks with catalysts, you’ll find some that trade opposite the market.

For example, over the last week, ticker symbols BNOX, ICU, APRN, FEMY, and GRTS have risen by more than 100%.

Shady brokers are over-allocating shares, and overaggressive shorts are burying themselves, creating massive short squeezes.

I’ve written about this extensively on this blog.

As well as made videos on it.

You can check out my latest one below. Just click play:

Now, let’s discuss the five steps you must nail to master short squeeze trading.

#1 Swiftly Cut Your Losses: No Ifs, Ands, or Buts

2025 Millionaire Media, LLCThe reason why most short sellers suck isn’t because their ideas are bad.

In fact, they are probably right 90% of the time.

Where they mess up, and where I lose total respect for them, is their total disregard to risk management.

They are stubborn and have a sound strategy for managing risk.

As a trader and mentor, I can’t respect that.

Every time I’ve lost big, I was too stubborn to admit I was wrong.

I’m constantly preaching to my students to protect their capital.

You must learn to cut losses quickly.

It’s the bedrock of smart trading.

The moment a trade isn’t panning out as you anticipated, step back, reevaluate and if necessary, get out.

More Breaking News

- RYTM Stocks in Spotlight: What’s Next?

- CRISPR Therapeutics Rises Amid Positive Cardiovascular Trials

- UBS Raises American Airlines’ Price Target Amid Optimism

Trading isn’t about pride…it’s about strategy.

#2 Be the Master of Your Trade

2025 Millionaire Media, LLCI want all my students to be self-sufficient.

And while I share my trade ideas and watchlist with them, I don’t want them to follow me into trades.

At the end of the day, you need to do what works for you.

Unfortunately, when I look around, all I see is herd mentality.

Traders are jumping into discord chat rooms…chasing trades…and copying other traders’ ideas.

It’s even more toxic among short sellers.

Because they all think the same things. It’s like they are all looking for the same information to justify their decision to be short.

And because so many crowd around the same trades…they all get wrecked together.

The stock market isn’t a follow-the-leader game. Carve your path, and ensure every decision is backed by robust research and understanding.

#3 Have A Plan and Stick To It

2025 Millionaire Media, LLCYou look at your screen and see a stock up 40%, 50%, 60%, or even 100%…

Everyone on social media discusses how it can be the next great squeeze play.

But you can’t simply jump into a fast-moving stock without a plan.

These stocks are volatile and trade in wide ranges.

Remember, the reason why we’re seeing so many short squeezes is because these stocks will appear weak at times, sucking in more shorts, trapping them, and then squeezing the heck out of them.

That’s why you MUST have a plan.

If you’ve been following me, you know I’m waiting for big movers who experience a panic sell-off, specifically near or around the open. But lately, I’ve been experimenting with different times.

For me, it’s offered the best risk vs. reward.

However, that’s not the only way to play these moves.

For example, my good friend Tim Bohen, the lead trainer at StocksToTrade, hates dip buying and prefers buying breakouts.

There are many ways to play short squeezes, as long as you have a plan.

#4 Think Like A Trader, Not An Investor

2025 Millionaire Media, LLCThese are all just trades.

Get in…take your profits or cut your losses quickly.

Rinse and repeat.

Don’t get into the newbie mindset of “This is gonna be the play that changes my life,” “This is going to the moon,” or “HODL.”

Remember, the biggest squeezes are happening primarily in the crappy companies.

Crappy companies often use these squeezes as an opportunity to do toxic financing, dilute shareholders and destroy their stock.

That’s why I say the shorts are often right…

Don’t get greedy when you’re playing these short squeeze plays.

Most of these stocks have no place in anyone’s long-term portfolio.

And most of them should never be held overnight.

#5 Arm Yourself With The Right Tools

2025 Millionaire Media, LLCForget about the toxic chatrooms and discord channels.

If you want actionable insight, then you must have the right tools.

For me, it’s simple: it’s the StocksToTrade Breaking News service.

They’re constantly keeping me informed in as close to real-time as possible.

For example, this last week alone, they spotted plays in:

BNOX:

Source: StocksToTrade Breaking News

TRVN:

Source: StocksToTrade Breaking News

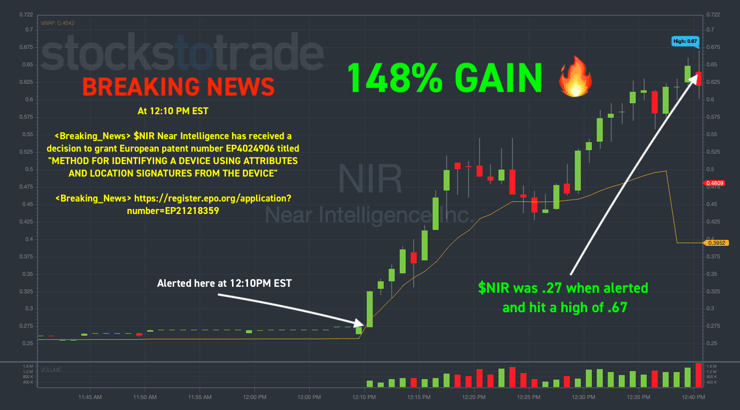

And NIR:

Source: StocksToTrade Breaking News

Day trading is all about speed…and no one is better than the StocksToTrade Breaking News service.

Ready to Master the Short Squeeze Phenomenon? 📈

2025 Millionaire Media, LLCAs the market whirls in unpredictability and stocks defy the norms, the old rulebook is tossed out the window.

Short sellers are bewildered, and those without the right strategies are left in the dust.

But for the informed trader, this chaos is nothing but a goldmine of opportunities. 🚀

🔥 Discover the secrets of riding the wave of short squeezes, not getting drowned by them.

🔥 Uncover the anomaly of stocks that rise like phoenixes amidst a plummeting market.

🔥 Learn to swiftly cut your losses, master your trades, stick to a plan, think like a trader, and arm yourself with the real-time tools that set winners apart.

But how can you transform this knowledge into actionable, profitable steps in your trading journey?

🚀 Join our exclusive live training session.

🚀 Unravel the 5 pivotal steps to mastering short squeeze trading, fortified with live examples and real-time analysis.

🚀 Receive personalized insights, tailored to equip you to turn market volatility into a playing field of opportunities.

🚀 Become the trader who thrives in uncertainty, with strategies proven to win in the current market climate.

Are you ready to turn the tables and exploit the short squeeze phenomenon to your advantage?

Ready to step into a world where market chaos transforms into well-calculated, strategic wins?

Your Blueprint to Mastering Short Squeezes is One Click Away.

👉 CLICK HERE TO SECURE YOUR SPOT! 👈

Leave a reply