Hey Trader. Tim Here.

We all take massive losses from time to time, myself included.

With practice and preparation, it becomes easier to avoid them.

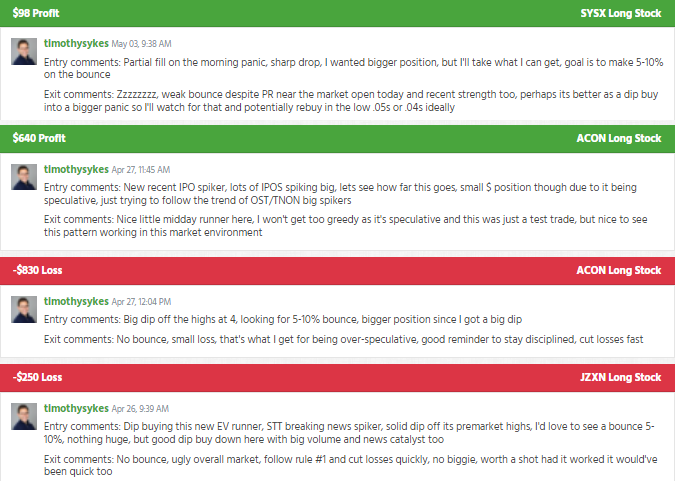

It’s a big reason I lay out my trades for my students so they understand my thought process.

I spend countless hours in webinars and trainings helping traders hone their risk-management skills

But the journey there can be painful.

However, I can help you speed up the process and make things easier.

Because I’ve whittled everything down to three key points:

- Recognize the problem

- Learn to take a loss

- Prepare to avoid heavy losses

Once you integrate these into your trading, the emotional roller coaster smooths out.

The tough part is we can have this in the bag for weeks, months, and sometimes even years.

Suddenly, emotional paralysis pops out of nowhere.

You can fight back.

Here’s how.

Table of Contents

When you’re in the trade

Our emotions make us do crazy things.

If you ever find yourself in a losing position that grew worse than you expected, you may have found yourself doing one of the following:

- Rationalize a lower stop based on “what you see in the charts” at that moment

- Increased your position size to “lower your average entry price”

- Frozen and done absolutely nothing.

Your best choice is none of the above.

When I find myself with a greater loss than expected and outside my trade parameters, I exit the trade right then and there.

Without the constraints of my trade setup, all I have is hope, which isn’t a winning strategy.

This can be extremely difficult for traders, especially when you don’t consistently turn a profit.

The reason is simple. You fear the next trade.

That’s why I advocate for small position sizes as you learn. You can always increase them later on.

Recognize the problem

This part is easier said than you might think.

Most of us know when we screw up. We just don’t act on it.

That’s fine, but let’s deal with the first step.

We know we messed up if:

- We’re uncomfortable with the total losses

- We (re)move our stops

- Are outside the trade parameters we set before starting

I want you to practice looking for these signs in every trade you take for the next dozen trades.

It doesn’t matter if they’re easy or if you don’t find a problem.

More Breaking News

- RITR’s Strategic Moves Signal Potential Growth Amidst Market Challenges

- Red Cat Holdings Poised for Growth as Drone Orders Surge

- Huntington Bancshares Misses Q4 Earnings Estimate Amid Turbulent Market Conditions

- FMC Plans Debt Reduction and Strategic Growth Initiatives for 2026

You need to get used to pausing for a moment and taking inventory.

Learn to take a loss

As I mentioned earlier, it’s tough to accept losses when you don’t consistently turn a profit.

That’s why telling yourself ‘there’s another trade around the corner’ doesn’t necessarily inspire hope.

You can get used to taking a loss with practice.

I know that sounds counterintuitive, so let me explain.

Like any athlete or musician, we want to ingrain the correct behaviors into our minds so that when the pressure’s on and emotions run hot, our body acts on autopilot.

When you practice taking a loss, you learn to break through the emotional barrier and do what you need to.

Now, I’m not saying that you blow up an account.

Rather, take very small positions in setups, they don’t have to be great ones, and get used to stopping out.

Heck, you can practice with one share.

The point is that you get used to losing when you need to.

And it’s fundamental to my philosophy of ‘lose small and fast.’

Prepare to avoid heavy losses

Nothing will help you avoid mistakes more than preparation.

That means doing your homework and creating a trading plan.

This can be difficult for new traders so here are a few tips:

- Focus on one setup or pattern at a time. This is one of my absolute favorites.

- Map out different scenarios with what actions you want to take for each outcome.

- Decide ahead of time how much you are willing to lose on any given trade, day, and week.

Again, we want to make everything as mechanical as possible.

Narrow your focus and get good at just one setup.

Once you get that down, expand from there.

If you aren’t comfortable with your performance right now, feel free to start over.

Pick a setup pattern you like and work it hard, learning how to manage risk. Use simulated trades to get a feel.

When you’re ready to start, keep your position size small.

Every day is a chance to turn things around.

You don’t have to let the market beat you.

I’ve trained students for years and watched some go from complete novices to achieve incredible heights.

I want the same for you.

If you want somewhere to start, try my Supernova Pattern.

It’s easy to understand and a great way to get started.

—Tim

Leave a reply