OTC stocks are not nearly as regulated as listed NYSE and Nasdaq stocks.

Stock promoters know this … and that’s why you see so many pump-and-dump schemes on penny stocks.

These promoters will straight up lie, cheat, and steal if you give them the chance.

However, I call them out the second I notice their B.S.

And I show my students what to look out for so they’re not deceived.

Before social media, promoters had to rely on email lists and newsletters.

Today, they pop onto my Twitter account and make outrageous claims they can’t back up.

All my trades are listed for anyone to view right here.

The good news is that anyone can recognize these jackals for who they are.

Once you do that, it’s a simple matter of exploiting them for some amazing trades.

Here’s how it works.

Purpose of Promoters

Like in any industry, there are good and bad actors out there, with many playing in the gray area.

At the good end, you get public relations and communications firms hired by a company, or working internally, to highlight material developments.

Think of a biotechnology company that puts a new drug into a trial or announces the results.

These are legitimate, newsworthy items that investors care about.

But what happens when a company puts out a press release that talks about an event that’s already known or highlights information already available in their recent earnings release?

That’s where things start to get a little murky, especially if it occurs as insiders unload shares.

At the other end of the spectrum you get social media jockeys on Twitter, Discord, and the like pushing pump and dump schemes.

These thieves will talk up a stock in chat rooms and wherever else they get eyeballs, duping people to buy shares.

Little do folks know, these guys already own the stock and are using the ‘pump’ to push price higher so they can unload at a profit.

A while back, I wrote a piece on the arrest of a promoter. This is a great piece to help you understand some of the more unsavory tactics of these guys.

The point of any of these guys is they want shares to move higher until they’ve completed the goal, whatever that may be.

Spotting Promoters

It doesn’t take much to find a stock promoted by pumpers.

Back in 2020, I created a video that highlighted many of their tactics.

You can still spot many of those same signs today.

A good example I saw recently was InnerScope Hearing Technologies, Inc. (OTC: INND).

On June 6th, the company issued a press release stating that INND had received a purchase order from Walmart for $11 million worth of product.

Okay, fair enough. When the company’s annual revenues haven’t topped $1 million, this can be a big deal. But they also haven’t completed the order yet.

And if the electric vehicle craze has taught us anything, it’s that purchase orders can vanish into thin air.

What really caught my attention were Twitter accounts talking about how the company was now the ‘real deal’ and all sorts of garbage.

Almost every company I’ve ever seen in the OTC markets is junk.

So, when I hear these promoters come out of the woodwork, I start to take notice.

And don’t get me wrong, I love them.

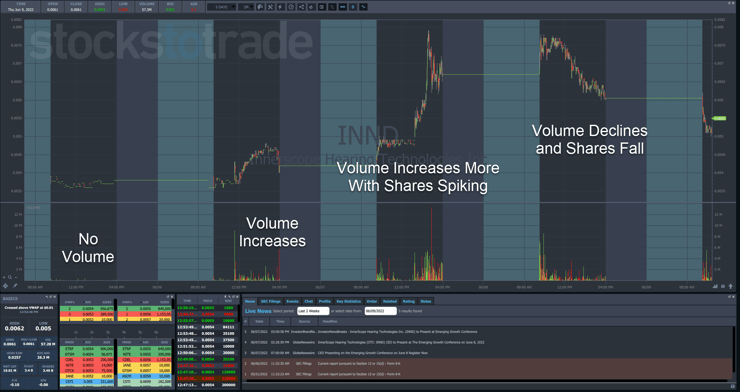

The second part of this is seeing the action in the stock’s chart.

Take a look at INND.

On a regular day, the stock sees practically no volume.

The day of the press release, you see a spike in volume and shares start to move higher.

The next day, you get this headline…

“CEO Presenting on the Emerging Growth Conference on June 8 Register Now”

That’s about as far from material information as it gets.

And yet, that’s the day you get a boost in shares that send it skyrocketing.

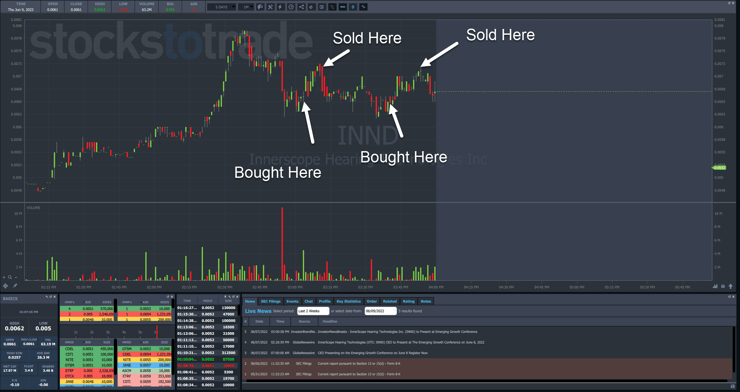

Right now, I’m taking advantage of stocks like these by stepping in when the promoters do.

You’ll see morning panics, where shares dip under selling pressure.

In the case of INND, it happened later in the day.

I used a combination of price action and support levels to find my entries and then used hype buying to exit my trades.

For example, the first trade came in several candles after that big red one with heavy volume.

This caused a capitulation that created a temporary bottom that I bought into.

More Breaking News

- Sony’s Earnings Surge Drives Stock Momentum

- Kulicke & Soffa Projects Remarkable Q2 Growth Amid Market Optimism

- Rivian’s Strategic Expansion with New Chief Customer Officer

- Santander’s Webster Financial Acquisition Boosts U.S. Market Presence

Those spikes back upward might not look like much, but they were worth plenty.

Final Thoughts

I see the same patterns play out over and over again with these stocks.

Promoters hype them up on whatever news they can grab, push shares higher, and ride the rocket.

It’s basically like GameStop Corp. (NYSE: GME) but on a smaller scale and without any short sellers.

Now, what I’m really hoping is that we start to see more of these lead to Supernovas.

Those patterns create incredible setups that I can’t wait to find.

Make sure you know what to look for.

Click here to learn more about my Supernova patterns.

–Tim

Leave a reply