No one wants to miss a profit party.

We hear about a friend of a friend who made 5x on this one stock or crypto.

Then another person…and another…

Eventually, FOMO takes the wheel and we dip our toes in right before they yank the rug out from under us.

Promoters work tirelessly to suck in victims at exactly the wrong time.

It leaves you holding ‘the bag,’ either buying before a crash or selling before the rally.

That’s why Inflection Points are so critical to trading, no matter what you follow.

It’s ‘that make or break’ spot where a chart holds the line or breaks through.

I used this concept to build my overnight setup in Meta Materials (OTC: MMTLP).

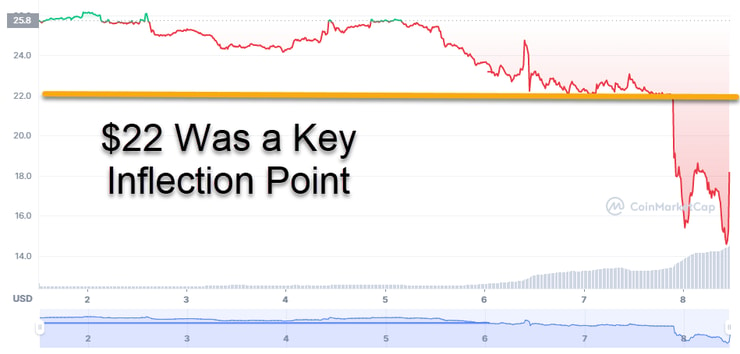

And it’s the VERY REASON FTX Token fell apart so quickly overnight when it cracked $22.

If you didn't know the #cryptocurrency world is the riskiest shit ever, let this #Binance $BNB acquiring #FTX $FTT saga that just played out in the last 12 hours educate you. The CEOs all BS/lie & its actually CRAZY how fast something can become insolvent in #Crypto so stay safe!

— Timothy Sykes (@timothysykes) November 8, 2022

Once that cracked, it all broke down.

Faced with liquidity concerns, Binance, who originally dumped FTT tokens, came to the rescue and signed a letter of intent (LOI) to acquire FTX.

You can read about the deal here.

This is a crazy story we’ll hear more about in the coming days.

And it all started with one number – $22.

Inflection points aren’t hard to spot.

Yet, they are incredibly powerful when applied correctly.

And with a little common sense, they can help you spot trade opportunities and avoid huge pitfalls.

Identifying Inflection Points

You’ve probably heard the terms support and resistance before.

They refer to levels that price should struggle to drop through or break above.

In the FTX saga, that was $22.

Last week, Coindesk published a story that triggered concerns that FTX’s subsidiary, Alameda Research, relied too much on illiquid tokens including FTX’s own FTT token.

Binance, a crypto exchange, began dumping shares, sending the price of FTT plummeting.

Alameda tried to stem the bleeding by offering to buy tokens for $22.

That worked until it didn’t.

$22 became a key inflection point for FTT.

If price held $22, it meant traders believed FTX.

If price broke $22, it meant they agreed with Binance.

Traders sided with Binance.

Inflection points arise from prices investors and traders deem important.

They can be based on technicals, qualitative information, or both.

Typically, you find them at highs and lows, although areas of consolidation can also form these points.

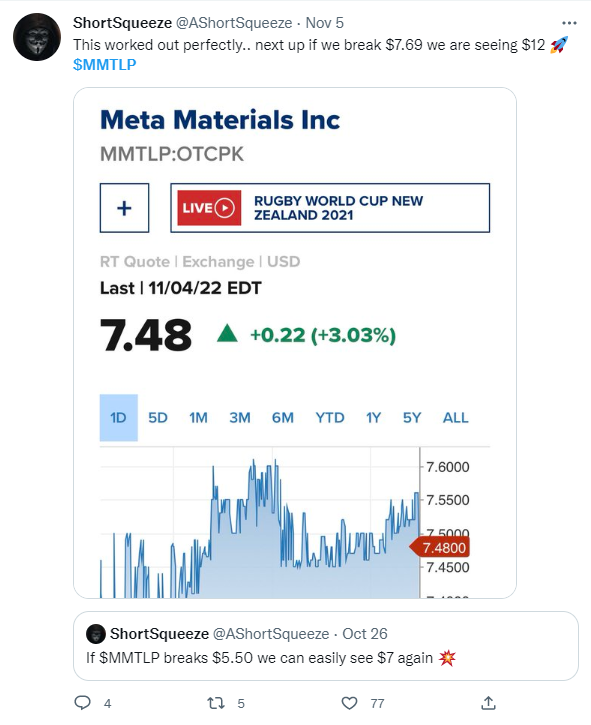

For example, my trade setup in MMTLP was a combination.

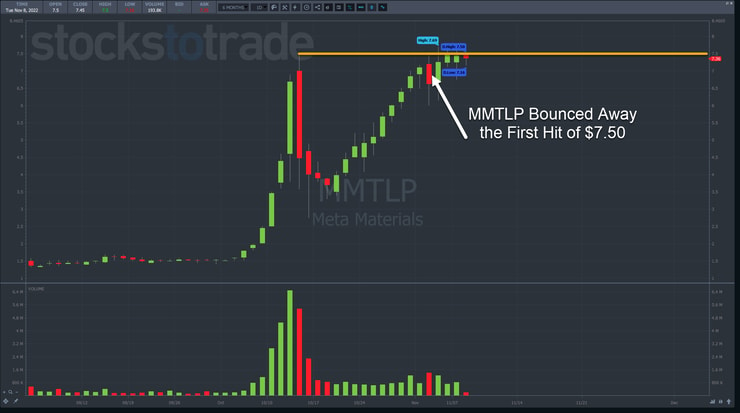

In the daily chart below, you’ll see price come up to $7.50, the previous high, and hold for several days.

From a short-sellers perspective, breaking over that high would signal a failed trade and cause them to exit their position, likely creating a short squeeze.

Dig into the intraday chart, and you’ll find more evidence of bullish behavior.

As I watched the MMTLP in the late afternoon, I knew that if the stock continued to drop, it would likely keep falling.

However, it quickly reversed, indicating buyers stepping up to the plate.

These are all technical reasons for the setup off the inflection point.

Yet, if you turned to Twitter and other social media platforms, there were promoters galore.

These folks helped pump the stock and create the setup for the overnight swing.

Here’s the thing about inflection points. They can take a while to break down.

Plus, the longer price sits next to the level, the less likely it is to hold.

As a trader, you can use this to form different setups.

For example, if a stock comes into a key inflection point for the first time, I could take a trade in the opposite direction.

But as it hits that same level again and again, it becomes more likely price will break through.

On MMTLP, that would mean if I was a short seller, I could take that first hit of $7.50 to trade in the opposite direction.

In fact, that produced a nice little scalp trade if you were so inclined.

Since I’m not into short trades, I would rather wait for the stock to hold near that key level and play for a break higher.

It didn’t work out the first time, but the longer it holds here, the more likely it is to break through.

Final Thoughts

Inflection points are great places for newer traders to cut their teeth.

They’re easy to spot and provide a wealth of information to practice your analytical skills.

All of my students learn this and so much more from my Millionaire Challenge.

With thousands of hours of video and content, you’ll have everything you need to become the trader you want to be.

Leave a reply