The life of a trader can be lonely.

You don’t need a team of employees to trade a stock for a profit.

And in most ways, that’s a huge benefit. Right? This is a job that I can do from anywhere. And I have.

I don’t need to clock in. I don’t have any superiors. No one tells me what to do.

All I need is an internet connection and a laptop.

But it can get boring and lonely from time to time. That’s why I’m so glad to be a part of a trading community.

Not a chat room that pumps stocks led by a greedy scam artist. A real community.

One that shares wins and losses, trade ideas, and helps each other grow through adversity.

The community is the reason I have so many millionaire students (31 and counting). And if you want to profit from volatile stocks, here’s how to use this community to your advantage …

Table of Contents

Access To Millionaires

Plain and simple, if you want to be a millionaire (or a successful trader) the best thing to do is shadow other millionaires.

That’s why the number of successful students has been growing so rapidly recently. Because I have more millionaire students, it provides more access and a unique perspective for upcoming traders.

And by that standard, it’s pretty safe to say it’s easier today to progress as a trader than it’s ever been.

The chat room is open 24 hours and multiple millionaires show up every day.

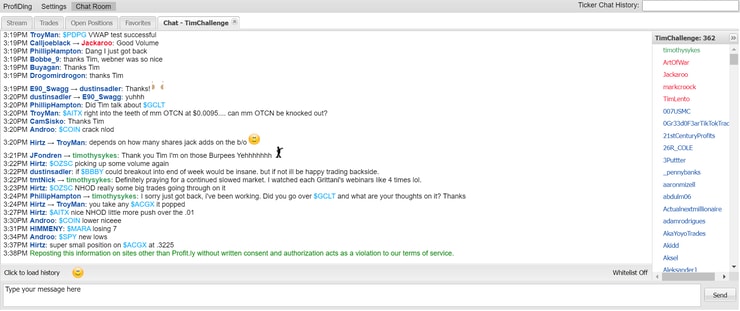

In the screenshot below you can see we were joined by ArtOfWar, Beerock, Jackaroo, Markcroock, and Tim Lento…

Have a question? Need a second opinion? Looking for the hottest stocks?

Ask away.

And it’s not just the live chat.

Live Trading

I send out entry and exit alerts whenever I make a trade.

But one of the best ways I can show you how to trade is by actually showing you how to trade.

I hold regular live streams where I do that exact thing …

Who's ready for another live https://t.co/occ8wKmlgm webinar?!?! Starting in 5 minutes, calling all challenge students, please report to this webinar & come prepared with slid questions as this is a VERY choppy $DIA $SPY $QQQ market, you don't want to be unprepared/undisciplined!

— Timothy Sykes (@timothysykes) January 18, 2023

My students get to hear the thought process and see the chart all in real-time.

And I always archive these live events for students to access later.

Just like Wednesday’s live event with Mark Croock.

We reviewed his process recently and he shared the #1 pattern he’s using to profit.

There are real opportunities in the market right now …

Ontrak Inc. (NASDAQ: OTRK)

Celyad Oncology SA (NASDAQ: CYAD)

More Breaking News

- Jumia Faces Market Headwinds Amid Rising Costs and Strategic Challenges

- Credo Technology Unveils AI Innovation and Announces 3M Partnership

- China SXT Pharma Launches AI Supply Chain Overhaul for TCMs

- Nektar Therapeutics Set to Discuss New Study Results

Magic Empire Global Limited (NASDAQ: MEGL)

If you’d like to get involved, I’d advise against going alone.

It can be a lonely path to profits. Made lonelier without a process to follow.

All my millionaire students started here.

And you can too.

— Tim

Leave a reply