Financial networks from CNBC to Bloomberg want you focused on one thing…

let’s face it, that’s where Wall Street meets Main Street.

People feel the immediate impact of inflation on their everyday lives.

What they don’t provide are solutions.

Sure, they’ll drag some talking head to pontificate about what jerks the Federal Reserve members are or how the other political party is the direct cause of expensive bacon.

When was the last time any of them offered a decent trade idea?

Heck, when did any of them talk about a stock and buying it here because it’s a ‘long-term’ hold?

Every day, my students encounter dozens of potential setups.

I’ve taught them how to identify high probability trades using the tools and concepts offered.

Talking heads want you to think there’s nothing out there. And maybe you’ve had trouble finding them on your own.

That’s why I want to show you a simple, easy way to pinpoint quality setups every day.

What I’m about to show you works no matter what you trade, from penny stocks to options. It works for all of them.

Look for Premarket Movers

One of the best places to find tradeable opportunities is the premarket.

Stocks start trading as early as 4 a.m. Eastern.

Most of the stocks moving that early are already up from news that was released overnight or in the postmarket from the prior day.

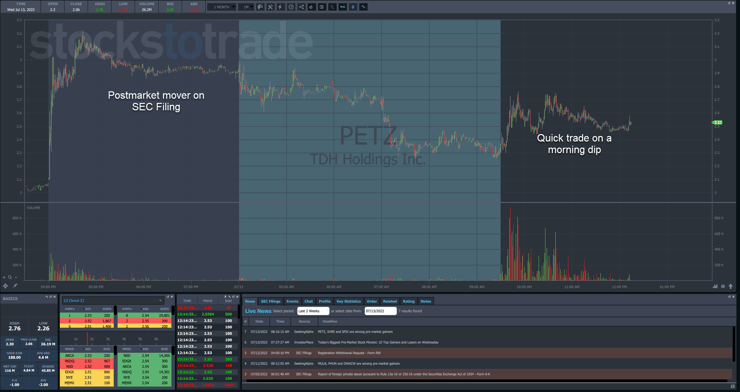

In fact, that’s how I found TDH Holdings (NASDAQ: PETZ), my morning trade on Wednesday where I locked in a quick $180 profit.

Most premarket movers have a news catalyst behind them.

This can be anything from earnings to SEC filings for tenders. Biopharmaceutical companies send out press releases for trial results or approvals.

Lately, a lot of tiny electric vehicle companies issue press releases when they secure a large order.

The most popular time for the news to hit is 8:30 a.m. Eastern.

That’s also when many major economic reports hit the tape.

You’ll see a lot of questionable press releases come out at that same time, where promoters hope to bury the details in the information deluge and turn to pumping the stock.

The premarket offers a wealth of opportunity. But you need to be careful.

If you can’t find a news catalyst causing a stock to move, I would be cautious.

I also want my students to learn the difference between good and bad news releases.

As I mentioned before, promoters will send out press releases with little to no new information, hoping to create a buying frenzy.

While that creates tradeable opportunities, it’s quite different from a drug company securing FDA approval.

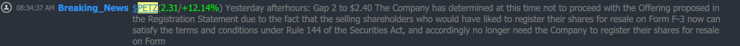

Our Breaking News Chat is a fantastic resource for market news no matter when it comes out.

We employ a team of analysts with extensive experience sifting through headlines to cover only the ones that create actionable trades.

Plus, they monitor pumps from popular chat rooms and social media.

Get Breaking News for less than $2 a day

Follow Other Traders

For some reason, people feel it necessary to become profitable traders without any help.

I can tell you from experience myself, and from teaching, that this is rare and extremely difficult to do.

You can dramatically shorten the learning curve by following an experienced trader.

Every week, I deliver loads of content to my students, not because I like to hear myself talk, but because they all come from different walks of life with different skill levels.

A huge amount of my training videos and webinars dig into how I locate potential movers.

In fact, I’ll often hold live sessions where my students can watch me as I move through the premarket and morning sessions.

One of the key concepts I teach them is to wait for the setup to come to you.

While I may identify a dozen possible stocks to trade, I only go with the ones that meet my trading criteria.

Many traders, especially newer ones, assume that because something’s on a watchlist that it has to have a setup.

More Breaking News

- Credo Technology Unveils AI Retimer Amid Strategic Partnerships

- Exponent Sees Promising Growth with Dividend Increase and Upbeat Q4 Earnings

- KeyBanc Boosts Intuitive Machines with Higher Price Target

- GGB Stock Hovers as Market Reactions Vary Amid Market Speculation

In reality, they just have the potential to form a good setup.

Keep a Watchlist

Every profitable trader I know maintains a watchlist of stocks.

Mine includes former runners, stocks moving in premarket, and others that exhibit potential.

Each morning, I send out anywhere from 2-6 stocks on average that I’m watching for trade opportunities that day.

You don’t need more than a couple of dozen names to find multiple trades each week.

In fact, I know some traders that trade just a handful of stocks for months at a time!

Chances are you can find potential trades but don’t know how to define your setup and execution.

That’s where I can help.

After years of trading the markets, I’ve seen and done it all.

I can teach you how to leverage concepts like price action, support and resistance, and more to create incredible trade opportunities.

Sign up today for my Millionaire Challenge.

—Tim

Leave a reply