Whenever we get a hot market, like the one right now in 2024, I always get to highlight new students who just started to profit.

And it’s an absolute pleasure!

Example:

While shorts complain about $APM $LYT & all sorts of other things that should be reserved for their therapists, my https://t.co/occ8wKmlgm students are just cashing in on squeeze after squeeze after squeeze….thank you shorts! Here are some of the latest batch of solid singles…

— Timothy Sykes (@timothysykes) March 7, 2024

Now, when the stock market is on a bull run, it’s easier for traders to pull profits. Because 3 out of 4 stocks follow the market.

We’re banking right now because there are more opportunities to profit.

On Wednesday we watched Aptorum Group Limited (NASDAQ: APM) spike 1,100%.

The very next day we watched Lytus Technologies Holdings PTV Ltd. (NASDAQ: LYT) spike 700%.

Attention: There will be more opportunities to profit today, Fridays are notoriously hot.

But … How a trader approaches this market determines their level of success.

There are two kinds of traders in the market.

The majority: They’re here to get rich quick. They’re not interested in safe plays. They think the stock market is an easy cash grab. And since 90% traders lose, these are the traders who usually forfeit their profits to the minority.

The minority: We recognize this is a marathon, not a sprint. We’re here to learn a process for profits that we can use for the rest of our lives. This is the 10% of traders who succeed.

My students and I are the minority.

There are a lot of people profiting right now because the market is hot.

But a year from now, even two or three years from now: Will you still have the skills to profit? Or are you just another one of the 90%?

Table of Contents

The Key To Lifelong Profits

My millionaire students are successful because they took time to prepare. They put in the work.

- If you want nice teeth, you’ve got to floss and brush.

- If you want to get fit, you’ve got to workout and eat healthy.

- If you want good food, you’ve got to put effort into your cooking.

Anything worth having comes with a certain amount of work.

My students who are profiting now, they’ve been studying for months.

Conversely, when it comes to my new students, they see a stock like APM spiking and they recognize the opportunity as clear as day:

A 1,100% spike … $1,000 worth of APM on March 5 would be worth more than $10,000 less than 24 hours later on March 6.

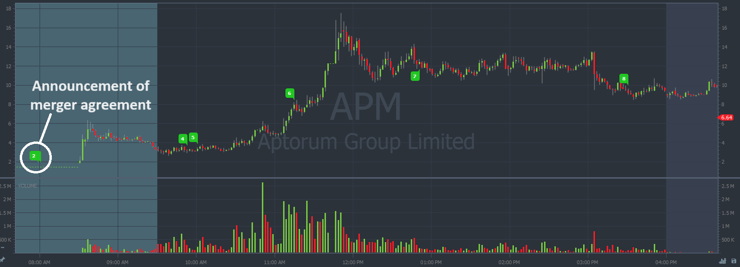

Look at the insane intraday chart after APM announced a merger at 8 A.M. Eastern. From left to right you’re seeing premarket price action, intraday, and after hours trading:

Some of my new students don’t have the preparation to truly capitalize on these moves.

That’s OK.

But don’t let yourself grow complacent. There’s always another opportunity right around the corner!

So, what are you doing to prepare for the next one?

- Are you watching my YouTube videos?

- Are you watching our Challenge live streams?

- Do you check the market every day?

- Do you have a watchlist with the best stocks in play right now?

- Are you watching StocksToTrade Breaking News for the next trade alert?

Talk about preparation: Breaking News alerted APM in premarket. My students had ALL MORNING to build a position.

Take a look:

361% GAIN off of $APM!🔥

Retweet & favorite if you caught a piece of this move!📈

Get the Next Alert 🚨 👇 https://t.co/DV5c1Kdzrg #DayTrading #StocksToWatch #BreakingNews pic.twitter.com/ka4hf2IVTy

— StocksToTrade (@StocksToTrade) March 6, 2024

And when Thursday’s LYT started to spike, Breaking News alerted it during Wednesday’s after hours.

Take a look:

356% GAIN off of $LYT!🔥

Retweet & favorite if you caught a piece of this move!📈

Get the Next Alert 🚨 https://t.co/DV5c1Kdzrg #DayTrading #StocksToWatch #BreakingNews pic.twitter.com/9JmTQErYZv

— StocksToTrade (@StocksToTrade) March 7, 2024

Some people want profits but they’re not willing to put in the work. They don’t want to use Breaking News alerts.

Instead, they use a crappy Robinhood account to try and get lucky … Those people are the majority: The 90% who lose.

Never Stop Pushing!

This is a difficult niche. There’s no doubt about it.

If trading were easy, we’d all be millionaires.

But, there IS a process for profits.

- Don’t listen to the toxic short sellers getting squeezed on plays like APM and LYT.

- Some of these stocks are garbage. But we can profit off short term volatility. And squeezing short sellers adds to the momentum.

- Don’t listen to the Twitter gurus who pump their positions and hide their losses.

- They’re not part of the intelligent minority. They’re selling positions as their followers buy the deflating stock spike.

- Don’t listen to ignorant but profitable newbies who think trading is easy.

- The market’s on a huge bull run. 3 out of 4 stocks follow the market.

There are a small number of YOU who are doing this correctly.

You see the opportunity. You still recognize the risk. And you’re willing to work toward lifetime profits.

Understand: I can see and recognize your progress.

Go to bed or watch more @timothysykes videos? I don't need sleep. I need to hone my first green day skills.

— Dr. Elana Kahn (@emk808) March 7, 2024

I LOVE MY https://t.co/occ8wKmlgm STUDENTS SO MUCH! PLEASE RETWEET/CONGRATULATE LINDA SHE JUST NAILEDDDDDD $APM FOR THE MEAT OF THE MOVE AND SHE'S BEEN IN MY CHALLENGE ONLY A FEW MONTHS!

LindaDKing: WOW. $APM great trade in @ $10.95 out at $14.85. Tim you are a great coach!!!

— Timothy Sykes (@timothysykes) March 6, 2024

As we enter Friday trading, this is where we separate the men from the boys. The women from the girls.

The hard working traders from the gambling majority.

How To Approach Friday Trading

There will be opportunities to profit today.

The stock market pushed to new all-time highs yesterday. The bull run continues. Take a look at the S&P 500 ETF Trust (NYSE: SPY) below:

Pull up the StocksToTrade software today and flip through the built-in scan of big percent gainers.

Follow the price action of the hottest stocks. Make a trade if you see a good setup.

But … If you’re unprepared, now is the time to work toward Monday’s volatility.

There’s a new profit opportunity every day. And if you’re not ready on Friday, you have a perfect opportunity to prepare for next week.

The 90% of traders who lose, they’re going to spend Friday gambling with their accounts. Then they’ll go out and spend more money on the weekend. They’ll probably waste time watching Netflix shows. And when Monday rolls around, they won’t be prepared for market profits. And that’s why they lose.

Feel free to relax this weekend. But take an hour or two on Saturday and Sunday to prepare.

Don’t miss next week’s opportunities to grow your account! Put in the work this weekend.

And understand that you’re not alone.

- I’m preparing.

- Matt Monaco is preparing.

- Jack Kellogg is preparing.

- Bryce Tuohey is preparing.

- All of my millionaire students are gearing up for another CRAZY week.

I created the Challenge chatroom so that we can all collaborate and prepare together. No matter where you are in the world.

Follow the links that I shared in today’s blog post and soak up as much information as you can before Monday.

When the starting bell rings at 9:30 A.M. Eastern, we’re off to the races.

Everyone wants to make money … Few are truly prepared.

Cheers.

*Past performance does not indicate future results

Leave a reply