Jack Kellogg has made over $10.5 million in trading profits over the last two and half years.

However, it wasn’t always smooth sailing.

In fact, Jack lost $2600 his first year trading. And it took him twenty months before he had his first solid green month.

Of course, he’s had some massive wins…but it’s the losses that have given him the most valuable lessons.

I had a chance to sit down and talk with him about some of those devastating losses and he used them to improve holes in his trading and take it to the next level.

Here are five invaluable lessons he learned after taking some of his worst hits.

Table of Contents

#1 Admit When You’re Wrong And Bail

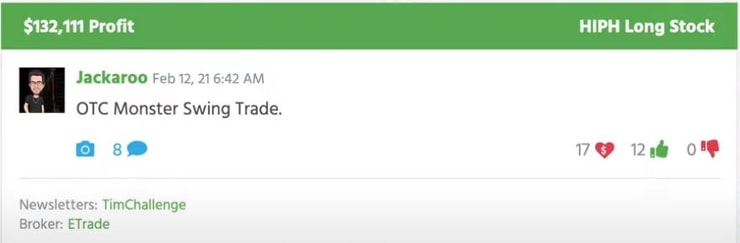

Jack was having some incredible success in 2021 swing trading OTC stocks. He funded an account just to do that style of trading.

In most of these plays he was putting in $10K and getting back $100K or more…

Before he knew it that $100K he funded was up to $1M.

Naturally, Jack thought if it worked so well…why not do it again…but this time with more size.

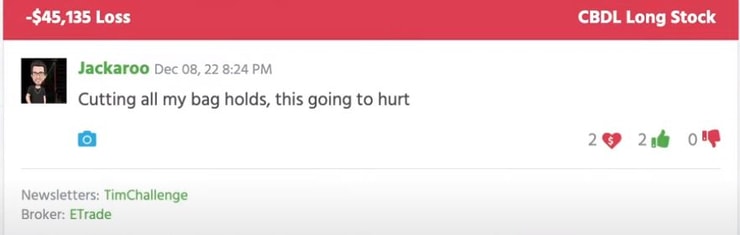

He got into junk marijuana stocks…

Instead of cutting losses he held on to them because thought that pot stocks would eventually have their moment and he would get a chance to sell at a pop…

After nearly two years of holding he bailed out on his positions and took a massive drawdown.

#2 It’s Better To Miss A Trade Than To Be Too Early

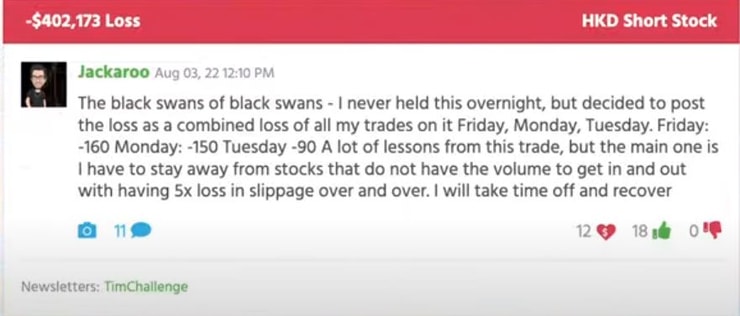

One of the strategies that Jack likes trading is short-selling high flying pumps.

Unfortunately, he got caught in shorting the ticker symbol HKD in 2022, in one of the sickest Supernovas we’ll ever see…

The stock went from $13 to $2,555 in a few short weeks.

Jack was relatively early in his short position…and he got tattooed.

More Breaking News

- SoFi Technologies Stock Surges: Q4 Wins Spark Analyst Upgrades

- Red Cat Holdings Poised for Growth as Drone Orders Surge

- Breaking News: Ondas Navigates Market with Enhanced Strategy

- Credo Technology Unveils AI Innovation and Announces 3M Partnership

It’s a lot harder to trade when you’re trying to climb out of a hole.

#3 Diversify Your Accounts

Jack likes to keep several brokerage accounts. Some of them he has just to trade specific strategies.

But the big lesson is that he doesn’t want all his money in one trading account.

We’ve all heard horror stories of traders keeping all their money in one brokerage account, getting involved in one bad trade and getting wiped out.

That’s why he believes that you should have your capital spread out.

Many of the new accounts he opens are $100K or under. He prefers to build his accounts up vs. funding them with millions of dollars.

#4 Profit and Loss Does Not Define You?

Jack didn’t have his first good month of trading until he was 20 months in.

In his first year he lost $2,600.

Does that mean he was a loser?

No…because he was gaining knowledge, experience, and developing skills.

You see, it was a slow build up for Jack.

You shouldn’t base your first few years on how much money you’ve made or lost. Instead, judge it on how much you’re studying, and improving from your earlier mistakes.

#5 Don’t Chase Euphoria

A new group of traders made money in 2020 and 2021 but then began to lose it all in 2022 and 2023.

Having a high appetite for risk paid off in 2020, but if you didn’t adjust then your flaws were quickly exposed.

Jack doesn’t believe that luck has a role in long term success.

He’s not trying to get lucky with one stock, options play, or YOLO idea.

That’s why he believes in locking gains early and often to build confidence and consistency up.

He studies his best patterns and focuses on scaling up on his top ideas.

Final Note

If you’d like to learn more about my mentoring program, the same one Jack was in, then click here for the details.

Also, if you’d like to watch the video of this discussion with Jack and I, you can watch it below…

And don’t forget to comment…

Leave a reply