We can find plays in the market by following hot sectors.

For example, one of the hottest sectors right now is AI stocks. That extends into similar tech sectors as well.

NVIDIA Corporation (NASDAQ: NVDA) is one of the overall sector leaders. And when NVDA runs, we often see more AI plays in the small-cap sector.

The small-cap sector has the stocks that we want to trade.

- They’re cheap.

- They can spike +1000%.

- The charts can follow popular trading patterns.

And momentum from the AI sector helps to make these spikes stronger.

AI stocks are still red-hot … but on Friday I noticed another sector creeping back into focus.

Pay attention to hot sectors! Friday’s momentum could continue today, Monday, and this week.

I’ve got all the details …

Weed Stocks

Let’s use Canopy Growth Corporation (NASDAQ: CGC) as our example. The chart shows a lot of good price action and it spiked on Friday, March 22.

This stock spiked 150% last week.

Like NVDA in the AI sector, it’s possible CGC is acting as one of the weed-sector leaders. So when you go to trade a weed play this week, check on the strength of CGC’s run. The price action will give us a lot of hints about continued sector strength.

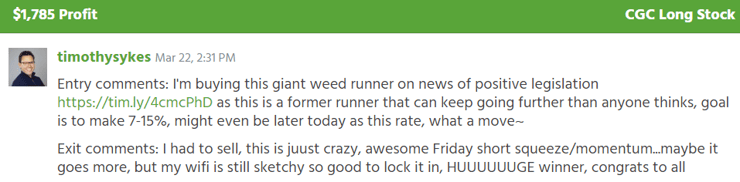

I already snagged a profit from Friday’s run, starting stake of $21,420:

And CGC is still in play today!

But keep an eye out for any other weed plays that are on the move. This news likely spread over the weekend. With any luck, this week we’ll see a bunch of FOMO traders piling into weed stocks.

WEED STOCKS LETS GOOOOOO! WHO ELSE IS RIDING THESE TO NEW HIGHS?! WEEEEEE

— Timothy Sykes (@timothysykes) March 22, 2024

Let me make this clear: I’m not trying to predict price action.

I don’t know which stocks will spike. Or even if the weed run will continue. Instead, I let the stocks come to me.

Winning Framework

We’re looking for stocks that …

- Are in the weed sector.

- Have a history of running.

- Are spiking more than 20% on the day.

- Have at least 1 million shares of trading volume.

- Have less than 10 million shares in the float

- Have a low price. Below $5 is the most ideal.

Also, understand that this is an inexact science. For example, CGC offered some great trade opportunities on Friday. But the stock’s float is 66 million shares.

More Breaking News

- SoundHound AI’s Expanding Partnerships Propel Growth Prospects

- Nvidia’s $2B Investment Supercharges CoreWeave’s AI Expansion

- Sezzle Inc. to Announce Q4 Results in Late February

- Archer Aviation Faces Legal Drama Amid Stock Fluctuations

That’s above our goal of 10 million shares or fewer. But it’s far from the float of blue chip stocks in the industry, NVDA has a float of 2.4 billion shares.

Monday Runners.

I’m looking for weed plays.

I’m looking for AI plays.

I’m looking for biotech plays (another hot sector right now).

There is so much opportunity in this market to profit! Already a lot of my students are realizing the potential right now. See my tweets below:

Do you guys understand NOW is the time to really push it with your trading and education, the $ being made in 2024 is life-changing, fuck normal jobs, fuck slow markets & capitalize…some of you need a good shake to realize it and actually take advantage, nobody should be…

— Timothy Sykes (@timothysykes) March 22, 2024

Small Gains while Live during a state boards review. Sneaking in my trade making:

8% on $NVFY in at 3.8 out at 4.1 😂 pic.twitter.com/0K1jZnUtkY— Karinadlamb (@karinadlamb) March 22, 2024

Like @timothysykes says, you can trade and invest from anywhere as long as you have WiFi! pic.twitter.com/UeGP9qf8kF

— Avery Turner Jr. (@AveryTurnerJR) March 22, 2024

Get inspired!

There’s another full week of spikers in front of us. Don’t miss your opportunity to profit.

Join my next trading live stream to follow along.

Cheers.

*Past performance does not indicate future results

Leave a reply