Friday’s are notoriously volatile.

- It’s the last trading day before the weekend.

- Longs are trying to capitalize on a Monday gap up.

- Shorts are buying back shares to safeguard against the same Monday gap ups.

In summary, there’s usually a lot of bullish momentum.

The strength of these plays can outshine the spikers from earlier in the week. My students and I use a specific pattern to capitalize on this unique price action.

The last two weekends alone, I’ve seen back-to-back setups.

On Friday, March 8, I watched as Airship AI Holdings Inc. (NASDAQ: AISP) closed the week on a strong note. Judging by the price action, my Friday pattern hinted at a weekend play … By Wednesday of this week the price spiked 45% and made new highs.

A week before, on Friday, March 1, The RealReal Inc. (NASDAQ: REAL) exhibited the same price action. By Wednesday the next week, prices spiked 45%.

They won’t all spike 45%. That’s just a coincidence.

The point is: I’m 2 for 2 in March, baby!*

And I’m watching for another stock to match this pattern today, Friday, March 15.

If you’re reading this BEFORE the market closes, there’s still an opportunity to build a position.

If you’re late and the market is closed for the weekend … Use this pattern to find next week’s most likely runner.

Friday Strategy

I posted my trade notes in the section below. But understand: I sold my positions waaaaay too early.

You could do better than me …

I’m not good at trading with patience. So I lock in gains to protect my account. That strategy is what helped me pull $7.6 million from the stock market.

Some of my students are more patient than I. Like Jack Kellogg, he’s already profited $12.4 million from the market in a fraction of the time.

But I digress … Study my Friday trade notes below.

Chronologically …

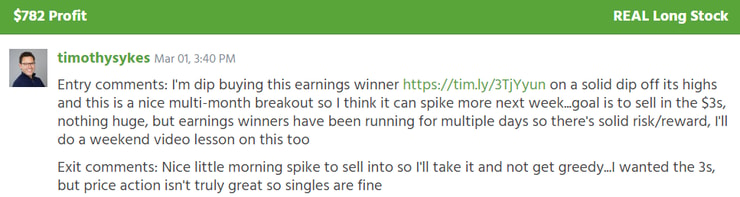

March 1, starting stake of $13,550:

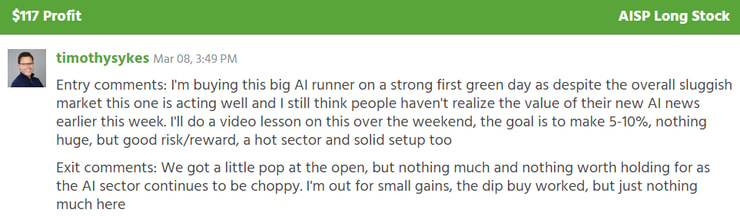

March 8, starting stake of $17,577:

I’m in the right place at the right time. I’m just not giving these plays long enough to build. The 2024 market is way stronger than anticipated.

For example, my $117 – 0.66% profit on AISP … I’m trying to stay positive, lol.

At least some of my students found better positions.

Remember to log your entire trade @brohdie:

Trading transparency helps us build healthy habits. The market is full of sketchy promoters who only show their profits. Meanwhile they’re secretly drowning in losses.

I show ALL of my trades so that my students can learn from my successes AND my failures.

Now, let’s get back to the Friday strategy …

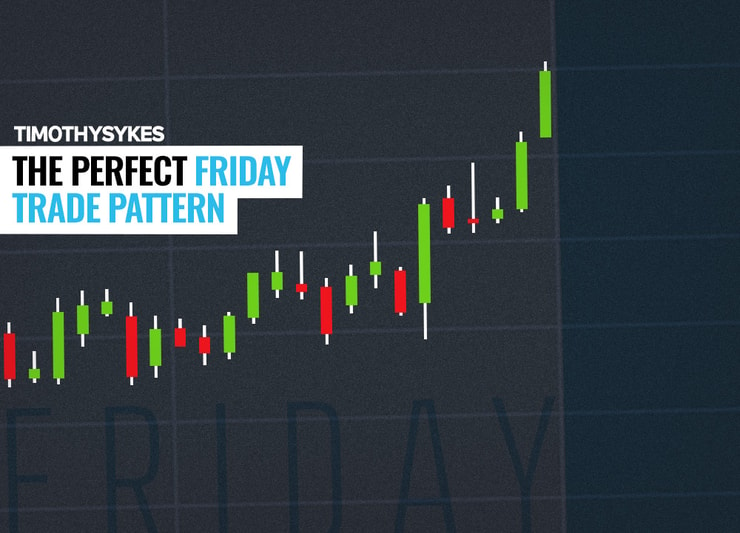

Today’s #1 Pattern

Like I said, there’s still time today if you’re reading my blog post before the market closes.

We want stocks that match THIS price action.

It’s a decently simple process, IF YOU FOLLOW THE RULES.

I can’t stress this enough. New traders see stocks like REAL and AISP spiking over the weekend and they lose their heads.

These trades are not a 100% guarantee.

The Friday pattern helps us build a position with risk in mind. If anything goes wrong, there’s a clear path that we can use to exit.

Good luck today, and make sure to keep your head on straight.

Cheers.

*Past performance does not indicate future results

Leave a reply