Nature can teach us so much about markets. It’s all around us if we take the time to stop and listen.

I teach my students to work WITH markets, not against them.

Anyone who tried to force a setup or took a revenge trade knows what I’m talking about.

When we take the time to understand what really drives markets, it makes us unstoppable traders.

My trip through Switzerland took me to the beautiful countryside with luscious landscapes and nature-inspired architecture.

Walking through, what I can only describe as a dreamlike valley, I came upon a waterfall.

Pretty cool backdrop for my YouTube lesson.

Waterfalls are nothing short of beauty in motion powered by gravity and unwieldy amounts of water.

When we disrespect nature, we disrespect the power behind it.

The beauty and serenity of my Florida home create a vibrant, tropical paradise few other places on Earth can match.

Yet as a hurricane bares on the state, I’m reminded that we are players in nature, not the other way around.

Trading is no different.

We are players in the market, subject to its powerful forces.

But that doesn’t mean there’s nothing we can do.

3 powerful forces drive stocks no matter their size.

I’m going to explain what they are and, more importantly, HOW to use them to design consistent, profitable trades.

Table of Contents

#1 Trends

2021 was one of the best years for penny stock traders.

I made over $1 million, with many of my millionaire students performing exceptionally well.

Meme stocks created Supernovas left and right, making it easier than ever to find profitable trades.

Some markets are for earning, and some are for learning.

2021 was an earners market.

2022 has been a learning market.

Navigating the market route this year hasn’t been easy.

But if you followed the right trends at the right times, there were plenty of profitable setups.

Early in the year, oil and gas plays were huge, like Indonesia Energy Corp. Ltd.(AMEX: INDO).

Then we had MonkeyPox with names like SIGA Technologies (NASDAQ: SIGA).

Recently, IPOs have been the hot spot with AMTD Digital Inc. (NYSE: HKD) rising over 2,000% at one point.

Trends create pockets of opportunity if you know how to find them.

That’s where our next market drive comes in.

#2 News Catalysts

With markets in a freefall, the Federal Reserve made a bold pronouncement – they would back credit markets with ‘whatever it takes.’

While the news took a few days to take hold, they stopped the epic 2020 stock plunge and sent them on a rocket ride that lasted another two years.

News and events are the single greatest catalyst that moves a stock or a market.

Nearly every trade I take starts with Breaking News.

You see how earnings move stocks all the time.

On penny stocks, and especially OTC stocks, the results are even bigger.

The chart below is just a sample of what our StocksToTrade Breaking News Team found.

Within a minute of the opening bell, the Breaking News Team highlighted a $1.9676 billion Federally Funded Mitigation Agreement for Western Sierra Resource Corp. (OTC: WSRC).

Over the next hour, shares nearly tripled on heavy volume.

With the right software and knowledge, anyone can find multiple possible setups every day, regardless of what the broader markets are doing.

More Breaking News

- Huntington Bancshares Expands in Southern US with Cadence Merger: $279B Assets

- ENPH Stock Surges Amid Strong Financial Forecasts and Strategic Advances

- Boardroom Moves Shake Recursion Pharma Stock

- Money Woes for Tesla as Legal Battles and Price Targets Impact Shares

That’s because news catalysts for individual equities, especially penny stocks, are incredibly powerful.

#3 Price Action

Trends sets the stage.

News gives us the reason for the trade.

Price action validates our setup.

Price action is the change in price and volume relative to the recent trades.

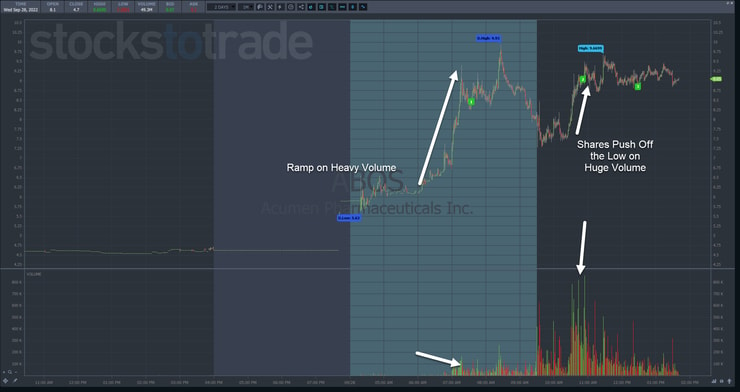

For example, Acumen Pharmaceuticals Inc. (NASDAQ: ABOS) barely traded 200,000 shares per day. Then, Breaking News on Wednesday drew heavy buying with tens of millions of shares trading in a single day.

After the stock pulled back and found a low, huge buying volume stepped in, taking shares from the low of the day back up near the premarket highs.

The heavy volume and price movement confirmed the importance of the news story.

Not every news story is worthy of a trade. We have to investigate its value based on the price action.

Which News Works

Headlines are a must for traders.

But if you don’t know how to interpret them, you might as well be looking at a map in a foreign language.

That’s why my Millionaire Challenge coursework includes training materials to help you quickly identify and evaluate the news.

Seconds matter in this business.

Make sure you stay ahead of the field.

Take my Millionaire Challenge.

—Tim

Leave a reply