Making money in the stock market is fun.

But I get a greater thrill from seeing my students succeed.

And despite heavy weakness in the overall market, many of my students have been thriving.

Took a nice play after $bnox with ipo $vsme in at $5.60, out at $6.60. Thanks to #breakingnews and @StocksToTrade pic.twitter.com/oUzuvT7XHC

— Jennifer Faith (@faithinmarkets) September 28, 2023

Beautiful, beautiful, beautiful trades for me, $BNOX on the way up and dip bought. The first time In @ 5.07 and out @ 6.48. The second time in @ 4.95 and out @ 5.45. Thanks @timothysykes for valuable lessons

— Babak Yaghikosh (@BYaghikosh) September 28, 2023

Please retweet and congratulate these two GREAT upcoming https://t.co/occ8wKmT5U students who are capitalizing on the short squeezes I went over in this https://t.co/4BvrBH4QHe blog post! WEC: 1 trade $FEMY in @$1.09 out $1.55 for 41%, JRifkin: $FEMY +$200 1.2-1.6, had a plan and…

— Timothy Sykes (@timothysykes) September 26, 2023

What are these students doing so differently from most traders right now?

They’re focused on catalysts…

And if you want to be successful at day trading, you should, too.

Today, I will walk you through my four top catalyst trades and how to play them.

Table of Contents

#1 Pump and Dumps

Pumps come in many shapes and sizes these days. And for the most part, I used to short them at will.

However, since so many traders are looking to short pumps, they have a better chance at squeezing before they nose dive.

These usually come from trading groups on social media and Discord chat rooms. As well as good old-fashioned stock promoters.

Sometimes, finding the source can be tricky, but it doesn’t have to be if you’re using something like StocksToTrade BreakingNews.

Another thing you can do is look at a historical price chart of a stock.

For example, many of the same companies will pump to boost their stock price up to make an offering.

By studying these historical charts, you can better understand how good the company is at pumping.

#2 Press Releases

This is pretty straightforward.

It’s when a company releases positive information about itself.

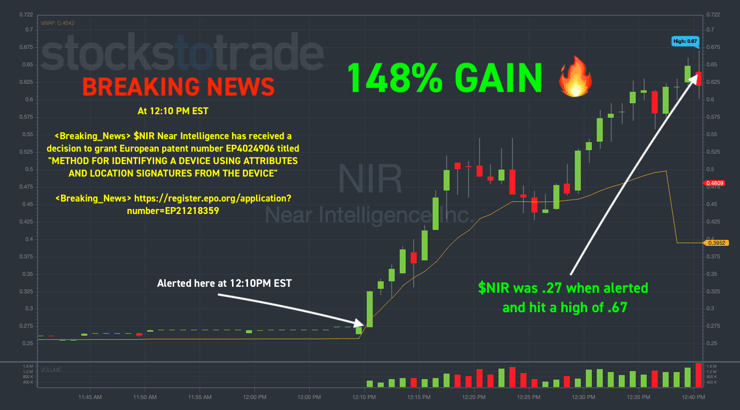

Take the ticker symbol NIR as an example from earlier in the week.

Source: StocksToTrade Breaking News

The company announced it received a decision to grant European patent number EP4024906 titled “Method for Identifying a Device using Attributes and Location Signatures from the Device.”

WOWOWOW $NIR Whewwww, what a rush, same exact pattern/news/rocketship as $DMK yesterday, if you are not using https://t.co/uZsGI8OfGS you are truly missing the best plays every single day…now .50 so I sold too early but couldn't care less, solid runner! Fuck the $DIA $SPY $QQQ

— Timothy Sykes (@timothysykes) September 27, 2023

The stock soared from $0.27 to $0.67 following the announcement.

More Breaking News

- Valterra Platinum Strengthens Position with Impressive Earnings Surge

- Redfin’s ChatGPT Integration Enhances Home Search, Boosts Rocket Companies’ Market Presence

- Datadog Battles Price Target Reductions Amid Growth Hopes

- Strategic Moves Propel CCH Holdings: Stock Soars

You can read about how I traded NIR here.

#3 Earnings Reports

Earnings season can be a goldmine for traders. Every quarter, public companies release their earnings reports detailing their performance over the past three months.

A company’s earnings report can greatly exceed, meet, or miss analysts’ expectations. When they exceed expectations, stocks can see a rapid spike.

On the other hand, if a company reports earnings that miss expectations, its stock might tank.

While many traders avoid holding through earnings due to the unpredictability, others use tools like StocksToTrade Breaking News to gauge the market’s response and get in on the action shortly after the report is released.

I bought AYTU, a big earnings winner, just yesterday on a dip off its highs.

You can read about the details of that trade here.

#4 Low Float Short Squeezes

This is by far the hottest trend in the market right now.

The catalyst combines shady brokers allocating shares and overaggressive short sellers.

These short sellers are attacking weak companies on BS news…which, in theory, is smart.

But because they are targeting low floats, the supply vs. demand dynamics work heavily against them.

The more they short…, the greater the squeeze.

I'd like to send my heartfelt gratitude to all the small cap short sellers out there in all the groupthink chatrooms, I cannot thank you enough for your sacrifice, over-aggression & narrow-mindedness shorting plays like $FEMY & $SLNO too early. In the famous works of JFK, "ask… pic.twitter.com/OkeUxG9Qc3

— Timothy Sykes (@timothysykes) September 26, 2023

Click the video below to see how I’ve been playing this catalyst:

Discover The Secrets Behind Successful Day Trading 📈

The stock market can be a playground for gains, but what truly excites me is witnessing my students making real profits, even when the market’s down. Just like them, your success could be one catalyst away!

🔥 Want to master the art of playing catalyst trades? Every detail matters, from the shady grounds of Pump and Dumps to the timely significance of Press Releases and Earnings Reports.

🔥 Are you aware of the rage that Low Float Short Squeezes are causing in the market? Learn how to capitalize on these trends instead of getting squeezed out.

🔥 Think you know the game? Think again. Old strategies might be failing you in this volatile market landscape. Instead of trailing behind, stay a step ahead with strategies tailored for the present-day scenario.

🚀 Dive into the heart of the action with our upcoming live training sessions.

🚀 Unveil actionable strategies, precise for the ever-changing stock market climate.

🚀 Experience real-time analysis, illuminating the dark corners of the market’s unpredictable behavior.

🚀 Why simply follow when you can predict and lead?

Ready to crack the day trading code and redefine your trading success?

Your roadmap to mastering the market’s catalysts is just a click away.

👉 CLICK HERE TO SECURE YOUR SPOT NOW!👈

Leave a reply