You probably don’t realize how good of a trader you are.

It’s true.

Half the folks that sign up for my Millionaire Challenge know what it takes to trade profitably.

Yet, +90% of trading accounts go bust in the first few years.

Why is that?

Because folks lack the patience to trade properly.

It’s not a skill that comes naturally.

No one wants to wait to make money.

But we can’t let our impulses take over.

Otherwise, complacency sets in, and you screw up trades you were correct in the first place!

Heck, I did this just the other day, botching several in a row, even though I had the right idea.

Click on the link to see why I’m all about the January effect…

Like any talent, you need to practice being patient over and over.

As someone who’s always on the go, this wasn’t easy for me.

I fought it tooth and nail.

Eventually, I noticed the more patient I was, the better my performance.

Now, this wasn’t easy…

But over the years, I discovered several techniques I want to teach you.

You’ll learn how to practice patience, making it a core strength of your trading.

Table of Contents

Pick a Specific Number

Trading is part art, part science.

When I perform a morning dip buy, I use a combination of technical analysis and Level 2 data to time my entry.

However, many traders, like Karan Khanna, use supply and demand zones (support and resistance) for their trades.

While this gives you an idea of where to trade, it still leaves some ambiguity for a lot of traders.

One of my other Millionaire Challenge students, Clay Ruf, came up with a solution.

Pick a specific number.

Say your support zone is between $1.25 and $1.30.

Stick with $1.25 to be conservative, $1.275 for the middle ground, or $1.30 if you are aggressive.

Whichever you choose, that’s your number.

If the stock comes up short and bounces without you, let it go.

At first, this will frustrate you.

Eventually, you’ll find it much easier to manage. Because once you’re in the trade, you know EXACTLY what to do since you have precise numbers.

Take an Emotional Inventory

The majority of losses happen because of our emotions.

Sometimes it’s FOMO on a stock racing higher.

Other times it’s one bad trade influencing another.

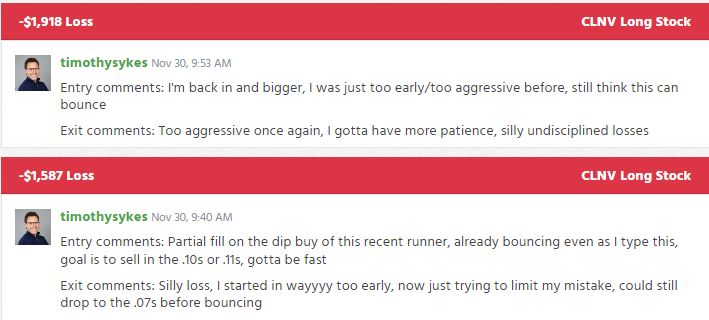

Here’s an example from a recent double loss I took in Clean Vision Corp. (OTC: CLNV).

One impatient entry led to another, leaving me with one of my largest losses for the year.

We have to recognize when we’re off our game – when we’re not in the right headspace.

It can be difficult to pull away from the screens.

Many new penny stock traders assume they’re missing out on trades just because the broader market rallied, which isn’t necessarily true.

Back in 2021, traders bounced from one meme stock to the next, afraid of missing the next big move, never taking a break, and eventually draining their accounts.

Focus on the trade at hand.

Once you notice you’ve started worrying about what other stocks are doing, pull back for a minute and reset your mind.

Focus on Decisions, Not Outcomes

Trading is an exercise in probabilities.

We can’t control the outcomes, only the decisions we make.

Select any card randomly from a deck, and there is a 25% chance you’ll choose a heart.

If you wait until 4 cards are removed from the deck, all of them non-hearts, now your odds of picking a heart increase to 27.1%.

You choose where and when to buy and sell a stock and how much.

What it does afterward isn’t up to you.

All you can do is put yourself in the best position to make a profit.

With the right pattern, setup, and risk management, your winners will outweigh your losers over time.

Limit Yourself

Marianna joined my Millionaire Challenge right out of high school

For an entire year, she didn’t trade. All she did was study.

Once she started trading real money, she did it methodically and slowly.

Bryce Touhey spent two months risking no more than $2 per day.

Adding constraints keeps you focused on making the right decisions, not profits.

Plus, it can prevent you from spiraling into serious losses.

Now, one thing you shouldn’t hold back on is your education.

Every moment you spend learning to trade is valuable.

With thousands of hours of video and content, my Millionaire Challenge is designed to help folks from all walks of life take their trading to the next level.

—Tim

Leave a reply