Energy plays have been hot lately due to the unfortunate Russia-Ukraine war. I hope this ends peacefully soon. It’s devastating to watch unfold.

Stay safe everyone, it's really just a scary world right now #StayAlive #StaySafe #BeSafe

— Timothy Sykes (@timothysykes) March 4, 2022

But as day traders, we follow the volatility. Right now, we’re seeing plenty of that in oil and gas stocks.

And no matter how hot the sector, if you don’t have a plan, you could lose BIG.

I’ve seen many traders trading the energy sector blindly, expecting massive runs. Instead, they find themselves holding and hoping in losing trades.

Don’t let that happen to you.

I want to share with you the latest strategies I’ve been implementing to trade energy stocks and how you can incorporate them to make smarter trades. Plus, I want you to know which tools I use to find the best plays.

Keep reading…

Table of Contents

Lessons From a Russian Oil Play

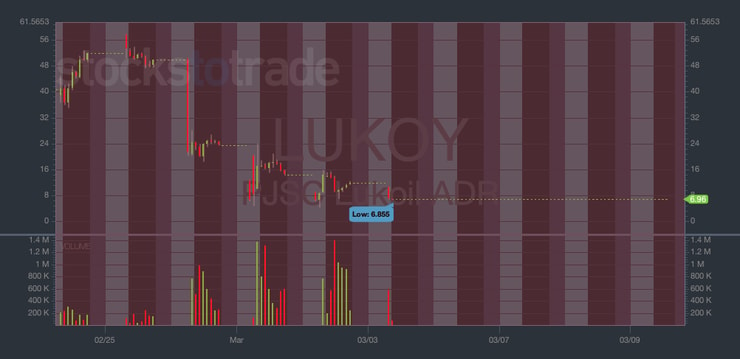

The news is scary right now. So is this stock chart:

This stock looks like it jumped off a cliff. It dropped from over $90 per share to less than $5 per share in a matter of weeks.

This can happen to stocks, even if they’re in a hot sector. Let me explain…

What Happened With LUKOY

Russia-based PJSC Lukoil is one of the largest oil companies in the world. It trades in the U.S. as LUKOY — an OTC Pink Limited Information ADR. ADR stands for American Depository Receipt. It’s how some foreign companies trade U.S. markets. (The ‘Y’ at the end of the ticker gives it away.)

Considering the war in Ukraine and the West’s response, it’s no surprise that the stock’s down.

But this isn’t a little dip. It’s HUGE…

LUKOY traded at $102.30 last October. As recently as February 10, it traded at almost $95 per share.

Right now, this Russian company is halted indefinitely. But just look at the ugly chart action on the 10-day chart leading up to the halt…

At one point before the halt, LUKOY went as low as $4.92 in the premarket. At the time of the halt, it was in the $6s.

Right now isn’t the best time to hold and hope with energy stocks. Here’s why…

Why I Didn’t Trade LUKOY

To be perfectly clear, LUKOY wasn’t even on my radar until the big crash. It’s not my favorite type of stock…

First, until a few days ago it was too high-priced for my taste.

Second, it’s an oil play.

I’m not the best at trading commodity-related stocks. That doesn’t mean you shouldn’t trade them. It means that after 20+ years as a trader, I respect what works best for me. You have to figure out what works best for you.

A ton of traders like my friend Tim Bohen of StocksToTrade have been all about oil stocks for MONTHS. And I even traded an oil play — MDM Permian Inc. (OTCPK: MDMP) — for a $396 win a couple of weeks back.

I’m not against trading plays in a hot sector — especially if I see them on my StocksToTrade scans or mentioned on STT’s Breaking News Chat.

But it’s gotta be the RIGHT play. I won’t hold and hope.

The point I’m trying to make is that there are lessons in the market every day. World news events often drive home some of the most basic lessons. Like this…

Hold & Hope Is NOT a Strategy

Before any swing traders get upset with me…

I don’t have anything against swing trading. As a matter of fact, I used to take more swing trades. And I still take some even though it’s not my forte.

My pal Paul Scolardi has an incredible track record as a swing trader. The same goes for other top traders like Chuck Hughes and his 7-Day Snowball strategy.

But if this is NOT an anti-swing-trade rant … What is it?

It’s me urging you to proceed with caution and be willing to adapt.

Millions of new traders and investors came into the markets in the past two years…

According to the article, newbie investors’ appetite for short-term profits dropped from 44% in 2020 to 28% in 2021.

So not only did they start investing, they poured cash into the markets at an unprecedented rate…

Hilariously, the article quoted the chief market strategist at National Holdings who claimed: “There’s a certain amount of logic to the markets right now.”

No there wasn’t. It was still in crazy over-hyped-bull-market mode.

Greed brought new traders into the game. Bubble hype turned them into investors…

📈 “Stonks go up!”

🚀 “To the moon!”

💎🙌 “Diamond hands!”

“Only the weak sell!”

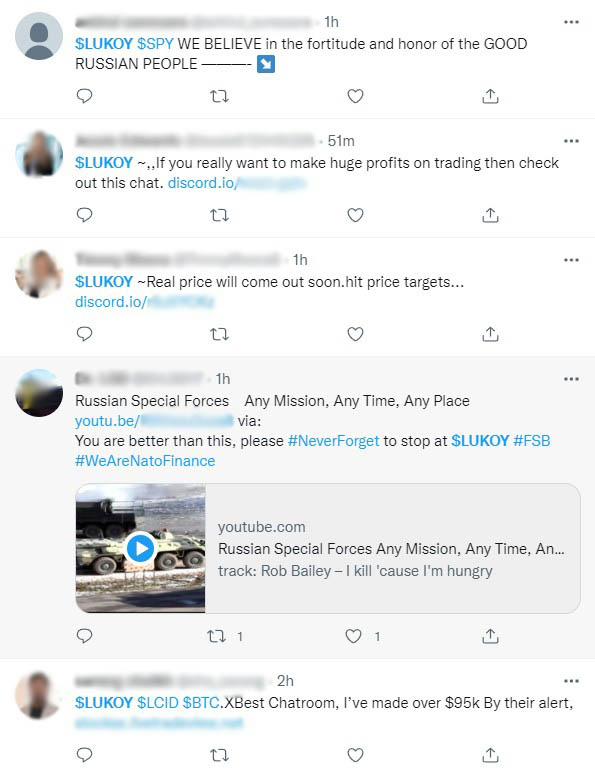

They thought the entire market would just keep going. Even with the huge drop, promoters are STILL advocating a buy, hold, and hope strategy…

Look, if the Russia-Ukraine war comes to an end soon, this energy stock could turn out to be a great play. But why take a chance? Especially now when there’s so much uncertainty.

There are other plays and other strategies working now.

What’s the point of all this?

If you want more lessons, more depth, and to give yourself the best chance in ANY market conditions…

More Breaking News

- Redfin’s ChatGPT Integration Enhances Home Search, Boosts Rocket Companies’ Market Presence

- Novo Nordisk’s Shares Surge as FDA Targets Illegal Drug Marketing

- Pagaya Technologies Sees Stock Fluctuations Amid Strategic Moves

- Credo Technology Unveils AI Retimer Amid Strategic Partnerships

Now’s the Time to Take the Bull by the Horns

Frankly, most people don’t have the dedication to pull off the promise of what traders like me can offer. I believe YOU are different.

If you’ve read this far, you’re already in the top 5% of serious students. It doesn’t matter what your favorite strategy is or if you’re profitable yet.

All that matters is YOU have made a decision to go deep, keep learning, and take your education as far as possible.

It all starts with you fully implementing what you’ve already started. Don’t hesitate. Now — today — is the time to dig into your studies.

Then, take it further. Learn as much as you can NOW while the market is scary. Maybe that means getting in Mark Croock’s Evolved Trader program.

Or maybe it means upgrading your StocksToTrade subscription with Breakouts & Breakdowns Chat.

Whatever you do, don’t hesitate.

Again, by reading this far you’re among the most dedicated readers I have. That tells me something about YOU.

You want to join the ranks of elite traders. You’re ready to escape the rat race, gain your freedom, and finally achieve all that you can.

Are you ready to go get it? Leave a comment and say, “I WILL NOT HOLD AND HOPE!”

Leave a reply