I made a total of two short trades this year.

My first was on Robinhood Markets Inc. (NASDAQ: HOOD). Their business model is questionable, but the stock followed a clear technical pattern.

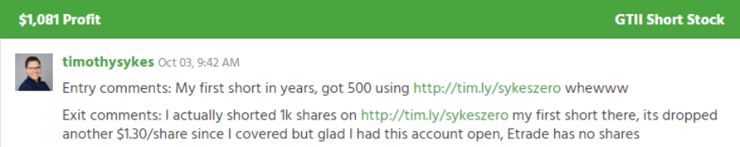

This week marked my 2nd short trade of the year.

Early in my career, I was a big short seller.

But as I told Jordan Belfort, more brokers got into the game and the space became crowded.

Short squeezes became so violent it didn’t pay to bet against stocks anymore.

So, it’s only when a setup slaps me in the face that I hit a stock from the short side.

Short selling can be an extremely profitable strategy.

Kyle Williams, one of my millionaire students who took my trading challenge, is a fantastic short-seller.

Shorting penny stocks isn’t the same as with big, liquid names like Apple or Amazon.

There are critical differences that can put you behind the eight ball if you’re not prepared.

Thankfully, I’ve got a list of everything you need to know right here for you.

Table of Contents

Shorting Isn’t Free

Last year, I wrote a blog post about the risks associated with short selling.

Chief among them was the cost to borrow stock.

Short sellers borrow stock from their broker to sell it in the open market.

Brokers don’t do this out of the kindness of their hearts. They charge a fee to borrow those shares.

The more rare the shares, the higher the cost.

That’s why you’ll hear the term ‘Hard to Borrow’ tossed around when a stock with low float sees huge price action.

When you ask a broker to short sell a stock, they have to locate shares for you to sell.

That’s not a problem with highly liquid and actively traded stocks like Apple.

But for a stock like AMTD Digital Inc. (NYSE: HKD), this could cost as much as $20 per share per day during the time it ran up nearly 2,000%.

Every broker is different. Some brokers can easily locate shares while others may struggle.

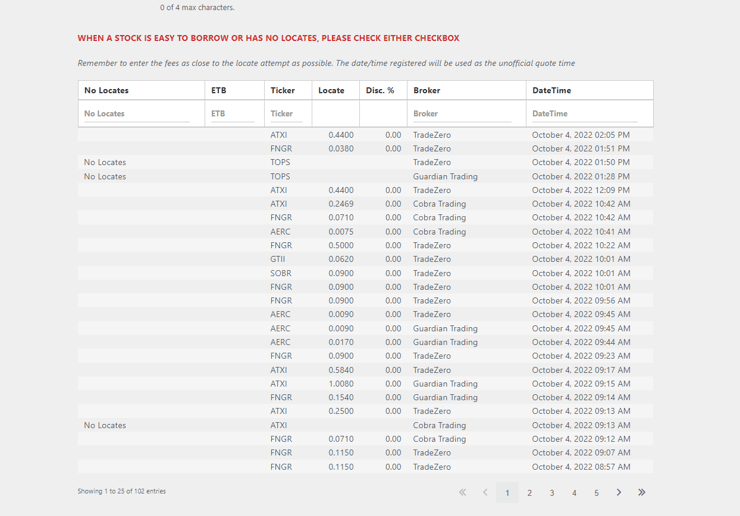

A great place to check the current costs is https://haslocate.com/

This site will give you the recent costs to borrow actively traded penny stocks.

For example, Avenue Therapeutics (NASDAQ: ATXI) can cost as much as $1.00 per share or as little as $0.2469 per share.

The costs depend entirely on the broker you use, which leads me to the next section.

You Need a Good Broker

I was lucky enough to have my account set and ready to roll with TradeZero.

Without them, I doubt I could have found shares of Global Tech Industries

Group Inc. (OTC: GTII), a former Supernova, to short sell at a good rate.

Not all brokers can readily or easily provide shares to borrow, let alone not charge exorbitant fees.

Although I don’t often short sell penny stocks, when I do, execution speed is critical.

As I mentioned earlier, short squeezes can quickly get out of hand.

To keep my losses small and fast, I ALWAYS want to make sure I can quickly get out of a bad trade.

If you are new to short selling, take a test run with a very small position to ensure you understand how to execute the trade.

You’d be surprised what little problems might pop up you didn’t consider.

Don’t Short Sub $1 Stocks

Capital requirements change for stocks priced below $5.00.

Most people don’t know that.

Traders must put up $2.50 minimum for every share of stock they short below $5.00.

That means if you short 100 shares of stock that are priced at $1.00, you need to set aside $250.

Same thing goes for 100 shares of stock that are priced at $0.01.

This holds true for listed and over-the-counter (OTC) stocks.

That’s why you don’t see many short sellers on stocks below $1.00. It simply doesn’t make sense.

And Above All Else…

Only short stocks when you have a profitable pattern to work with.

That’s why I highly recommend my Supernova pattern.

I used this pattern to help me earn my first $1 million trading and it still shows up all the time.

Click here to learn more about my Supernova setup.

—Tim

Leave a reply