Hey trader. Tim here.

You can’t trade without a setup.

That’s like driving without a road.

We all know this. And yet far too often, traders struggle to find one.

If this sounds familiar…

Let me go a little Yoda on you.

- When you can’t find setups you force setups.

- When you force setups you take bad trades.

- When you take bad trades you lose money.

Supernovas are my personal favorite. And I can show you exactly how I trade those week after week.

But I don’t want to stop there.

Let me show you how you can uncover fantastic setups EVERY DAY!

Get Your Story Straight

If you don’t get our StocksToTrade Breaking News then you are sorely missing out.

Our dedicated analysts comb through news feeds and popular chat rooms to curate the stories traders need to know.

For someone like me, it’s been a godsend.

As many of you know, I’ve been in Bali for the past several weeks helping to open 22 new schools.

However, I still manage to trade the markets and send out alerts.

Trading off a laptop on the other side of the world while helping to build schools presents some immense challenges, not the least of which is time.

That’s why having a premium newsfeed is a must, especially for penny stock traders.

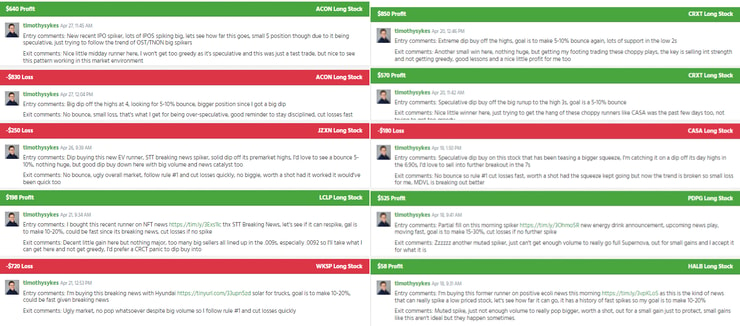

Check out these trades from my Challenge.

Go through and check how many came from news stories.

Nearly every single one.

Even if you prefer to trade big-cap names, you need to keep up-to-date with the news.

Otherwise, you risk some unknown event hitting the wires and sending the stock spiraling.

Scan for Success

Good scanners produce good results.

Great scanners produce great results.

Sure, most brokers will tell you stocks that are up or down on the day.

But how many tell you the premarket movers?

And for the ones that do, how many capture ALL the potential opportunities?

Look, I trade low priced stocks with low floats that are moving premarket.

I can tell you that the number of scanners out there that allow you to drop in this criteria are slim to none.

If you don’t believe me, go try and create a scanner that incorporates all stocks including OTC that have a float of less than 10 million shares that are gapping up more than 20% in the premarket.

And now try to bring that together with the news.

Not gonna happen…

That’s why I helped develop the StocksToTrade platform.

It’s a place where traders could incorporate comprehensive screens, news, and charting all in one spot.

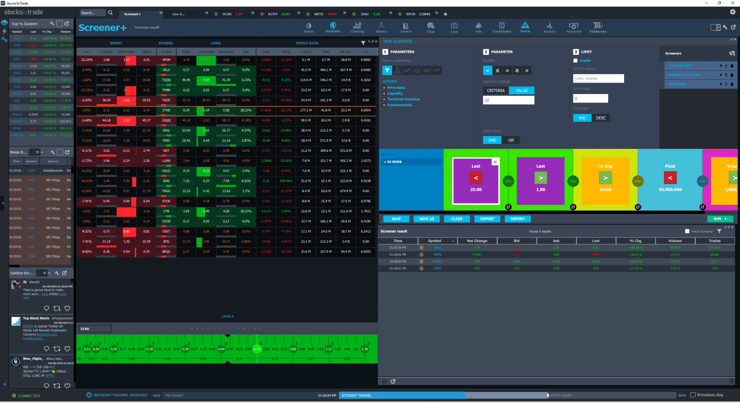

Check it out.

This is a sample layout I put together of the platform.

In just this screen I have scans set up for:

- Top % gainers

- Real time news feed

- Our proprietary Oracle system with support and resistance points

- A continuous scanner for low-flat stocks with heavy volume over $1 and less than $20 that ar running

And this is just one screen!

We offer trials for $7 because you don’t need to spend a fortune to acquire professional screeners.

So if you’re struggling to find trades, then I would definitely give our platform a try.

Create a Watchlist

I want to make my students better traders.

Period.

That’s why I provide watchlists at no cost for folks that sign up for my weekend watchlist.

And I strongly encourage you to keep a comprehensive list of your own.

You see, many times, the stocks that provide the best trading opportunities are the ones that did in the past.

Jiuzi Holdings Inc (NASDAQ: JZXN) is a perfect example of a stock that had multiple trading opportunities in the past year.

IPO’s are another great source for your watchlist. That’s how I found $ACON just the other day.

You can also peruse lists of biotech companies undergoing different trials. These stocks are especially prone to massive swing when the performance data is released.

Final Thoughts

All of these point to one simple conclusion — have a plan.

Know what trades you want to look for and then design systems and screeners to look for those setups.

Don’t make them so restrictive you miss opportunities, but they shouldn’t be too broad either.

The goal is to narrow your focus and save you time.

And one last piece of advice — have patience.

Yes, markets go through periods where there aren’t many opportunities.

It happens.

Take that time to study and catch up on your homework. Try your hand at my Supernova System.

Don’t take a trade for the sake of taking a trade.

Your time is valuable. Use it wisely. Stick with great setups. Don’t settle for mediocrity.

—- Tim

Leave a reply