You hear it all the time…

If you want to be a profitable trader, you have to take out your emotions from trading…

…scared money doesn’t make money.

What a LOAD of BS.

And if there’s one thing that’s helped more than anything, it is that I trade like a COWARD.

That’s right…even after +20 years of trading…I’m constantly focused on protecting my capital and being safe.

Maybe if some of those banks were focused more on risk and less on profits, they wouldn’t be in a crisis looking for the government to bail them out.

If you’re interested in being a successful trader for many years and not someone chasing fast money, then today’s message is for you.

I’ll show you how I’ve stayed consistently profitable in trading bear and bull markets. And why I recommend newbie traders adopt this style.

Table of Contents

The Numbers Don’t Lie

The haters love throwing dirt on my name.

They say I trade like a piker…

I can’t trade real stocks…

That my strategies no longer work…

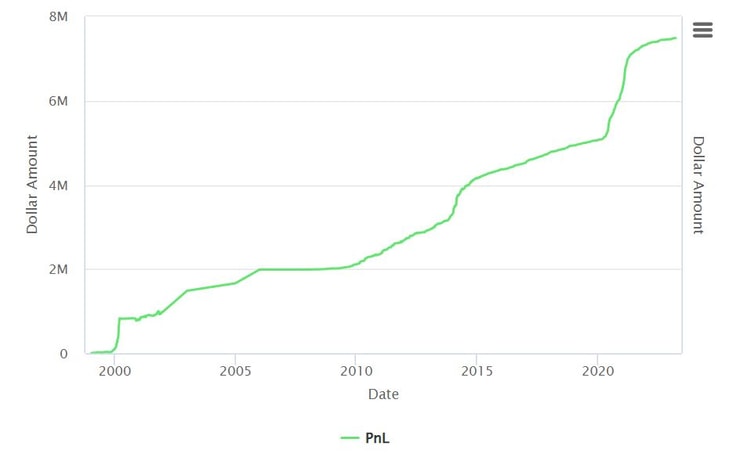

However, if you take a look at my PnL over the years, they tell a different story.

Source: Profit.ly

I’ve seen a lot come and go…But to this day, I’ve continued to be consistent.

Trading Like A Coward Pays

Looking at my PnL above, you’ll see I had some slow gain years and some large ones.

I chalk that up to experience.

You see, some traders will go balls to the wall regardless of the market conditions. Not me.

I want to trade aggressively when the markets are hot, and opportunities seem endless…like in 2020 and 2021.

But when things cool off as they did in 2022 (and 2023 so far)…I take my foot off the gas…trade smaller, and focus on risk management.

When most of the market got their butt kicked in 2022, I managed to profit six figures by being selective and trading small.

And that’s how I teach all my new students how to trade.

More Breaking News

- AMD Stock Surge: What’s Driving the Rally?

- Cipher Mining Soars: Time to Pay Attention?

- PFGC Stock Surge: What’s Driving It?

Here’s how to do it…

Learn To Be Picky

I often tell people that I’m a retired trader. Of course, I’m not, but that’s the mindset I adopt going into trading.

You see, I only want to get involved in trades that compel me to take action. Trades that are so juicy…that I’ll have regrets for not taking them.

This helps me be selective. And focus on my A+ setups.

Make Safety A Priority

Let’s face it…If these banks focused on safety, they wouldn’t be in this mess.

Before I get into a trade, I think about what I can lose if I’m wrong.

This allows me to focus better on my entries.

For example, last week, I took a trade in the ticker symbol AZYO.

It was a speculative dip buy on a stock that had a huge spike in earnings… And I bought it when it fell 15% from its intraday highs.

Now, I wouldn’t call this the perfect trade.

But what I really liked about it was my risk.

At worst, I would be out of the trade for a penny or two loss. And it best I would have made five to twenty cents.

The trade didn’t really go my way, and I cut it for a three-cent gain on five thousand shares.

A profit of $150 on a $7,350 investment. Not the most exciting trade in the world, but the risk vs. reward was there.

This Is A Market For Learning

I’ve got plenty of cash at my disposal. If I wanted to, I could trade significantly bigger than I am now.

But there are two reasons why I don’t.

First, I trade a small account because I believe it helps my students learn better.

Second, the market isn’t great for trading…it’s great for learning.

There’s no reason to slap on huge positions right now. It’s an especially difficult market if you’re a newbie trader.

That’s why you should hone your skills and develop your strategies. And the best way to do that is by staying small.

Small losses will never bankrupt you.

Think of it the way a professional athlete treats the off-season. In the off-season, they’ll work on their game, stay in shape, and prepare themselves for the upcoming season.

You want to develop these skills now when things are slow.

And when things heat up again, you’ll be more than ready to take advantage.

Several of my top students became millionaire traders in 2020 and 2021.

But they didn’t start trading those years. They were working on their craft earlier. When the right market came along…they were ready.

Bottom Line

Unlike many of those fake traders on social media…I will never tell you to remove your emotions from trading…especially fear.

Fear has kept me in this game longer than most.

Embrace it…it will keep you on the right path even during these uncertain times.

If you’re looking for training to level up…Click here to find out more.

Leave a reply