Do you often find yourself on the edge of your seat after placing a risky trade?

I can’t tell you how many newbie traders are downplaying the potential risk…

And it’s costing them more than just money.

Their confidence gets shot and the level of frustration rises.

It’s a slippery slope that rarely ends well.

I’ve even seen some of my students lose high six-figures…even seven figures because they were overconfident on a play.

However, there is a way to avoid this trap.

I am going to delve on how I avoid blowups, protect my capital, and position myself to stay consistently profitable.

Scared Money Makes Money

If there is one thing you take from today’s post is that SCARED MONEY CAN MAKE MONEY IN THE STOCK MARKET.

In fact, I tell ALL my students to trade scared.

Why?

Because you want to get in the habit of thinking about risk first.

Of course, the goal is to make money…but at what expense.

I’m not the world’s greatest trader, but I’d rather trade safe and smart than wild and reckless…

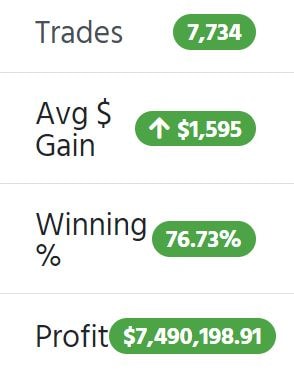

Trading scared has made almost $7.5 million in trading profits.

Sure, I often miss some of the biggest movers due to my travel schedule. But I’m not thinking about catching big moves.

I’m thinking about how I can make money while taking the smallest amount of risk possible.

I trade conservatively, often taking profits quickly, which can be frustrating.

But on the bright side…I’m also cutting losses quickly…which allows me to constantly live to fight another day.

Now, that doesn’t mean I’m not trading crazy and volatile stocks…

I am.

I’m just being extremely strategic about my entries and exits…

How I Traded The Crazy Action In SVRE

Last week SaveroOne 2014 Ltd (SVRE) went from $0.98 to $2.60.

And while a stock that volatile can be scary for most traders there are ways to trade safely in my opinion.

My first trade was in the pre-market…

A dip buy opportunity I saw after it traded above the 2s.

I got in at $1.89…and out at $1.97.

I didn’t like how it was spiking…dropping…spiking…and dropping.

Also, I have no problems jumping into a trade again if I feel I have better risk vs. reward.

On my second entry about 20 mins later it looked like the stock was going to break above $2…I got in at $1.96.

This was after it had a massive drop from a high of $2.50.

The stock did bounce above $2…but it was struggling to blast off…so I took profits at $2.09

A couple hours later I got a chance to “dip buy” this stock one more time…

I saw that it was holding the high $1.70s -$1.80 area…

I got long at $1.80 but once it struggled to break past $1.90 I was out at $1.89.

More Breaking News

- Credo Technology Unveils AI Innovation and Announces 3M Partnership

- RITR’s Strategic Moves Signal Potential Growth Amidst Market Challenges

- Bitfarms Plans for U.S. Redomiciliation and Debt Repayment Spark Investor Interest

- $30M Boost: Xinhui Solar Expands Jiuzi Holdings’ Reach in Southeast Asia

At the end of the day, I traded the stock 3 times. And while it was super choppy, I reduced a lot of stress by only trading it at times I felt offered the best opportunity.

Bottom Line

As traders we often think about the upside a lot more than the downside.

But if you want to join the ranks of my other millionaire students…then you must put risk first.

If you’d like to learn more about my program, and how it’s helped dozens of traders on their journey towards millionaire trader status…click here for the details.

Leave a reply