The latest bank crisis has Wall Street running scared.

After all, if there’s one thing the market hates, it’s uncertainty.

And you’d think being a trader right now is super stressful.

Well…it can be.

That is if you’re trading stocks tied to the macro news.

But I’m not interested in sleepless nights and worrying about how my portfolio will look the next day.

And if you want a healthy life filled with purpose, you shouldn’t be either.

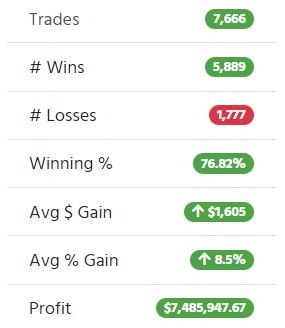

I’ve made $2.39M in trading profits over the last three years.

And I did it mainly by trading a small account. Moreover, my risk was calculated, I didn’t have to swing for the fences, and my PnL didn’t look like a rollercoaster ride.

That’s how I teach my students how to trade.

Despite all the madness you hear about in the markets, your trading doesn’t have to reflect it.

I’m about to show you how I consistently beat the markets in a low-stress way.

Read more…

Table of Contents

Safety First

There’s a wild misconception that if you want to be successful in trading, you must get comfortable taking any outsized risk.

In fact, I’ve made over $2.39 million in trading profits over the last three years, mainly by taking small positions and hitting on quick profits.

Small profits add up.

That’s why I will never look down on my new students who earn $5 to $50 when they start. We all have to start somewhere.

Please retweet and congratulate these GREAT https://t.co/occ8wKmlgm students who have learned TO FOCUS ON BIG % GAINERS AND THAT SINGLES ADD UP NICELY! Tommy_Knoxville: +$900 today….no need to force any trades. maximus1436: +$4900 $HUT, +$4470 $MARA. +9370 from these crypto… https://t.co/GVIOiT6otA

— Timothy Sykes (@timothysykes) March 14, 2023

Many of my millionaire students started off making small profits. And that took them a while.

Most of them didn’t make any profits in their first year.

Small gains add up.

Keeping Trading Stress-Free

Many traders got caught up last week trying to buy regional bank stocks on dips.

When was the right time to buy SBNY? Looks like never. The stock kept dropping until trading got halted.

And while some traders may have had success on Monday or Tuesday buying the dips in regional bank stocks, I stayed away.

Why?

Because I didn’t know which ones were going to go up and which ones were going to stay depressed.

You see, I prefer to trade setups that I’m familiar with. Setups that I’ve traded many times over and have had success with in the past.

Stick With What You Know

The reason why I trade penny stocks is that I believe they trade predictably.

I’m not a genius by any stretch of the imagination. But I manage to win 3 out of 4 trades I place. Moreover, I’ve made several million dollars trading this way, confirming my beliefs.

How I Stay Safe In A Wild Market

Penny stock companies will pay consultants and promoters to build hype around their companies. They’ll often pay these consultants and promoters with stock.

In other words, the promoters and consultants will receive shares for free.

Now, if the majority of these companies are junk…what do you think the promoters will do once they get their shares?

THEY’LL SELL THEM.

They don’t care about execution or getting filled at a good price. Why should they? They got free shares, and they want to cash out.

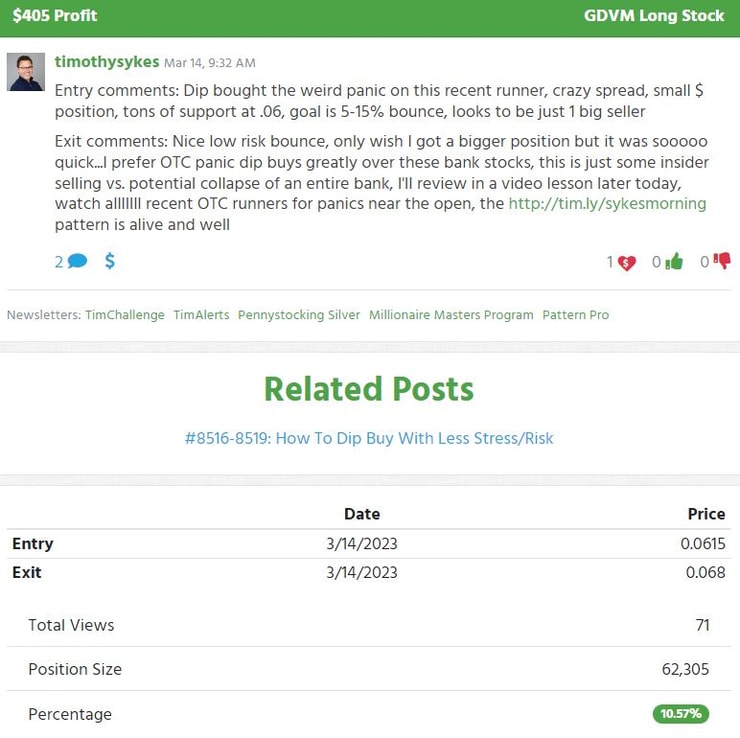

One of the trades I look for is the panic dip buy.

I look for panic sellers at or near the open and try to scoop up shares when I see them being sold off aggressively.

It’s exactly what I did when I saw this in the ticker symbol GDVM

How did I know this was a good stock candidate for a panic dip buy?

I look at the stock chart over a series of months…

If you look at the chart above, you’ll see the stock has a history of spiking higher, and then selling off hard.

I use this service to help me identify when there is a catalyst.

So I felt comfortable dip buying this stock…

Here’s how it played out:

I took it for a quick +10% gain…

I know…not as exciting as catching one of these bank stocks off the lows and riding them higher…

But guess what?

I don’t trade for thrills or excitement.

I prefer to take trades I believe are safe and easy.

And like I said earlier, small wins add up.

Why stress yourself out by slapping large positions in trades you are unsure of?

Wouldn’t you rather find patterns that are predictable and stress-free?

If so, then you should sign up to one of my trainings to find out more.

Leave a reply