This may sound hard to believe…

But most traders already know at least one winning strategy.

If that’s true, then why isn’t everyone a millionaire?

Because they never give their ideas a shot to succeed.

In their minds, the right strategy leads to instant profits.

If Matt Monaco had thought that way, he wouldn’t have a 7-figure bank account.

You see, Matt didn’t find success right away.

As a college student, he believed trading could be a way out from getting a “real job.”

In 2017, Matt joined my Millionaire Challenge. Yet, it wasn’t until three years later that it all came together.

You see, the 2020 pandemic created the BEST trading environment in decades.

After markets bottomed in March, Matt leaned into his Breakout Strategy.

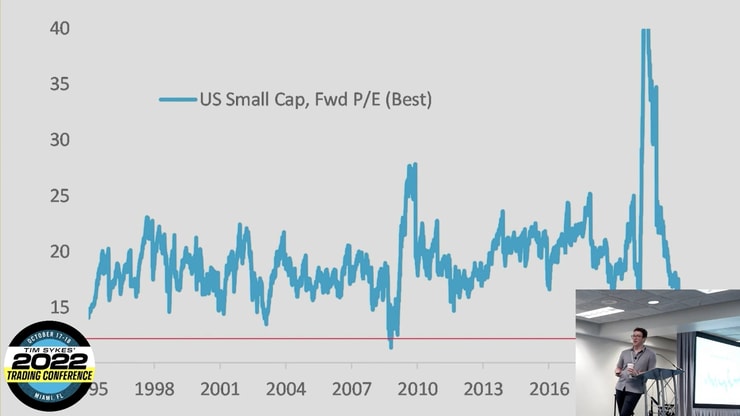

At our Trader’s Conference in Miami, Matt threw up the following chart:

And then he revealed something shocking…

The last time small-caps were this cheap was when the market bottomed in 2020.

That means breakout plays could fire up once again in the next few months.

Now, nothing is guaranteed.

However, I want to arm you with a simple breakout strategy courtesy of Matt Monaco.

This simple setup helped Matt become a millionaire trader.

And anyone can use it.

3-Step Setup

Matt didn’t reinvent the wheel.

Instead, he took what was already out there and made it his own.

Let me show you what I mean.

This is a chart taken directly from Matt’s presentation during the conference.

I added the orange arrows to draw your eye to the pattern.

The setup is pretty straightforward.

The three elements are:

- A strong move higher

- Decent volume

- Sideways consolidation that holds near the highs

From there, all Matt does is find a decent entry level and ride the next thrust higher.

Here is another example from his presentation.

The initial push on this chart took a full day rather than all at once.

As long as the move is significant, that’s all that matters.

Now, stocks need to hold those gains, whether over one day or multiple days.

If stocks start to pull back, giving up more than half their gains, then it’s likely to continue falling.

Context Matters

Traders use consolidation patterns like these all the time.

Most of them never find success.

So, how did Matt succeed where others failed?

That’s where the ‘art’ of trading comes into play.

During late 2020 and through most of 2021, small-cap stocks tended to run for days.

Multi-day runs meant Matt could buy small pullbacks and wait for the breakouts.

His win-rate went up, but more importantly, the amount he won per trade jumped significantly.

Matt combined a common breakout pattern with the right market environment to score his biggest wins to date.

Many of my other students did incredibly well in late 2020 and early 2021 because they saw the same opportunities.

This is one of the critical components every trader needs to succeed.

Markets aren’t stagnant. They go through cycles and structural changes.

People move from exuberance and fear and back again. That’s a cycle.

When too many short sellers entered the market about 5-7 years ago, I stopped short selling.

That was a structural change.

Traders need to pay attention to the stocks, players, and playing field.

If Matt’s right, plenty of breakout trades will be coming soon.

But there’s no reason to jump the gun on this one.

While there have been some multi-day runners like Meta Materials (OTC: MMTLP), it’s not as common as it was last year.

That’s why I’ve kept my position sizes small as I test different areas of the market.

Right now, I’m not looking to make huge gains.

In fact, being up over $100,000 on the year, I want to protect my profits.

So, what would make me change my tune?

First, I want to be in the right part of the year.

Markets tend to do better from November through May.

Second, we need to see the broader market find a bottom.

The chart for the S&P 500 doesn’t look that bullish.

But it will find a bottom at some point in the near future.

Lastly, I want to see several weeks and then months of small-cap penny stocks and OTC names go for multi-day runs and Supernovas.

I’m talking like a dozen or more, on a regular basis, all pushing higher.

That’s when I’ll change my tune.

And that’s when I expect Matt’s breakout plays to become monsters.

—Tim

Leave a reply