My life is awesome, and I’m truly grateful. It’s all made possible from trading. Which is why my team and I created the Trading Challenge. Are you ready? Apply today.

As you know, I was back in the U.S. briefly. It went pretty fast.

First, I was in Miami where I met with Mark Croock, his wife, and their new baby. Then I went to Chicago and spoke at the TradersEXPO.

I also met with Tim Grittani, his wife, and their new baby. I met Tim’s mother and brother, too. I met all the Grittanis. Great family.

Then Tim Bohen and I were off to Michigan where we hung out with Jack Kellogg and Dom Mastromatteo. I wrote about that in the last edition.

From Michigan, I crossed the country to San Diego for some filming. I can’t talk about it yet, but it’s gonna be cool. Also, I had some meetings with my team in Las Vegas and Los Angeles.

Finally, from LA I hopped on a flight back to Europe. I’m writing from Mykonos, Greece where I’m staying at Cavo Tagoo. It’s another one to add to your bucket list. And if you’re trading … huge bonus … they have great Wi-Fi and amazing sushi. Check it out…

After Mykonos, I’m off to Santorini again. I’ll be staying at the Santorini Cavo Tagoo for a few days. Then it’s off to Italy. More about that next time.

As you can see, it’s a whirlwind. But I’m always working no matter where I go. As a matter of fact, I’m in Greece working on charity. I can’t talk about it publicly yet, but I hope to share it with you soon.

Wherever I go, I’m trading and teaching. With that in mind, first we’ll take a look at a trade, then I’ll answer a few questions.

Table of Contents

Trading Lesson of the Week

This trade isn’t even close to being my biggest winner. But there are good lessons — it covers several bases. Also, I was wrong. Had I not learned to cut losses quickly this could have been a big loss. Instead, it was a small win. Check it out…

RiceBran Technologies (NASDAQ: RIBT)

RiceBran Technologies specializes in rice-bran additives and rice-based foods. Even though it’s not strictly vegan, it’s in the same healthy-food, healthy-living sector.

Which brings me to Beyond Meat (NASDAQ: BYND)…

I’ve been searching for a good sympathy play since BYND’s IPO in May. If a vegan burger stock can be the biggest mover in the market, then I look for lower-priced sympathy plays.

First, take a look at the BYND chart. It’s too high priced for me. It’s also the bane of many short sellers claiming the company is overvalued.

Here’s the BYND chart:

Notice the nice upward trend on the chart. Like I said, it’s been the strongest stock in the entire market. But finding sympathy plays has been difficult.

FOR EXAMPLE, I traded Lifeway Foods (NASDAQ: LWAY) on May 7. But it’s such an illiquid stock I’m reluctant to trade it. If it gets a big volume boost, that could change.

On July 29, RiceBran Technologies was mentioned in this rice protein market forecast. On July 30, the stock spiked just over 16%.

Initially, I found it using the StocksToTrade Twitter search tool. It wasn’t long before I saw links to this page on the RiceBran website in a few chat rooms. People were talking about meatless meatballs. Even though their RiBran product is a meat enhancer rather than meatless meatballs.

Take a look at the chart:

Notice the big volume spike on the far right. When the stock spiked on July 30, it was the highest volume trading day since September 2018.

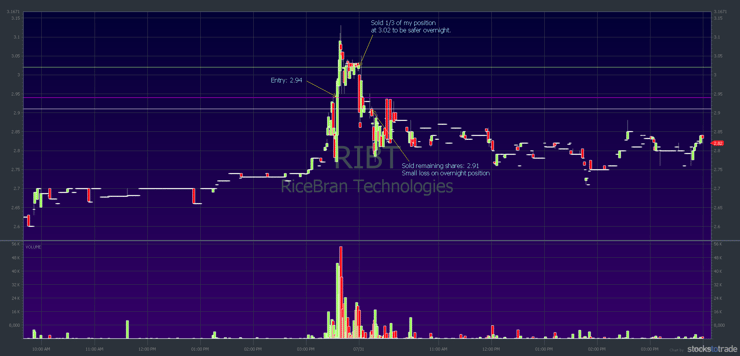

I bought RIBT spiking in the afternoon. Take a look at the chart below:

As you can see, I bought at $2.91 with a goal to sell into the low to mid $3s. Right before the market close, I cut my position by one-third. I wanted to be safer overnight even though I thought it would keep going on July 31. I often do this to lock in profits if it’s a speculative play.

On July 31, I gave it some time … but took a small loss on my overnight position. As it turns out, locking in an overnight profit gave me a cushion. The final result was an $80 profit.* A small win is much better than a big loss.

The big lesson: Make a plan and stick to it. I go for trades where the odds are in my favor. Then, if the trade isn’t going my way, I get out. Period.

Finally, onto some questions. This time from blog readers…

Questions From Readers

“Tim, would you please pick a recent trade and review it using the Sykes Sliding Scale?”

First, let me explain what the Sykes Sliding Scale is … then I’ll answer the question.

The Sykes Sliding Scale is a tool I developed to teach students how to ‘pre-grade’ a trade. It’s seven indicators I use when considering a potential trade. It wasn’t a formalized tool until my eighth year of trading. So it was like taking a step back to figure out how I think through a trade.

Now for my answer to the question:

No. If you want that, you can join the Trading Challenge. Join first, then ask that question in one of my weekly webinars. That level of reviewing a trade is for Trading Challenge students.

Look, if you’re serious about trading … if you really want to do this … join the Trading Challenge. If you’re not sure, then read every post on this blog and watch every video on my YouTube channel. Read “The Complete Penny Stock Course” by my student Jamil.

If it’s an issue with money — if you’re just not there yet — check out my post Top No-Cost Resources for New Traders. But if it’s anything else, you have to decide if you’re ready for the challenge.

Then, if you are ready…

… if you’re sure you can commit…

… then apply now.

It won’t be easy. I can’t guarantee you’ll ever be a profitable trader. But this is an incredibly comprehensive program, and whether you’re dedicated and stay the course is up to you. Building your knowledge account first is essential. But you also have to gain experience.

If you just want to learn how to use the Sykes Sliding Scale…

… get my Trader Checklist Part Deux DVD. It’s the best resource. When you join the Trading Challenge, you get access to Trader Checklist Part Deux and many other DVDs.

Better yet, join me and my top students at the Trader & Investor Summit in Orlando, September 20–23, 2019.

Be one of only 500 smart traders with the opportunity to learn from me and my top students. It’s gonna be an action-packed two days of workshops followed by one day of live trading. Witness as my top students share their strategies, tips, and trading thought process.

Next question.

“Is it necessary to review SEC filings when a stock is consolidating off a morning spike with a strong catalyst? I just want to play the breakout for a quick 10%–20% gain.”

This one gave me a little laugh. Personally, I don’t think you need to read SEC filings, really, unless you’re looking for specific things. For example, when you’re shorting a pump and dump. Then you’d want to see when restricted shares become unrestricted. Or you might want to know the value of a contract win if you’re trying to dig through earnings.

Most of the time, I don’t review SEC filings, especially for intraday trades. Things move too fast. You gotta be quick.

“At what point do you step back from a possible trade and read through recent SEC filings?”

This is a lot like the previous question. So, I’ll go into more detail about when I do read filings.

It’s a good idea to review SEC filings when considering…

Multi-day or multi-week holds

Review SEC filings any time you’re considering a multi-day or multi-week hold. For example, if you’re shorting a pump and dump and you want more confidence in your thesis.

Earnings winners

If you’re buying an earnings winner, you want to understand why the market is reacting so well. What’s in that earnings report?

It’s not just about the revenues or profits. It could be one line in a filing. It could be about the company’s excitement over a new member of management. Or maybe they’ve announced a new product in an updated presentation.

Billionaire plays

Review SEC filings when there’s news of a new billionaire investor. You want to see how many shares the billionaire bought and at what price. You want to see if it’s a new position.

Sometimes a billionaire adds to their position. But some lazy researcher says it’s a new position and the stock spikes. Then people say, “Wait a minute, this billionaire’s just adding to a position.” Don’t trust social media or other people’s research.

Fundamentals

Check the SEC filings any time you’re really digging for fundamentals. For any reason — but specifically the reasons I outlined above.

Aside from earnings, shorting pumps longer term, or digging for information on a big investor or new product…

… I don’t look at the SEC filings. Especially for intraday trades.

A lot of people want to make this game very difficult. They think they need to be that thorough all the time. But with fast-moving stocks, sometimes you have to wing it. That’s where experience comes into play.

Likewise, it’s why I trade so carefully. Because if I’m winging it on an intraday trade, I’ll miss something in a 70-page SEC filing that I haven’t read.

More Breaking News

- Symbotic Inc. Gains Momentum

- 3 Robinhood Penny Stocks Moving on Bitcoin & Trump News

- Quantum Leap Forward: QBTS Stock Dynamics

The bottom line — it’s OK to not read the SEC filings. Just remember that if you don’t, it increases the odds of your thesis being wrong. So, you have to trade more carefully.

Millionaire Mentor Market Wrap

Time flies. It’s already August! This has been a strong summer for penny stocks. Last year was strong, too. That’s good for us traders. That whole idea of taking time away from the market during the summer means…

… you’d have missed a lot of opportunities.

There’s one opportunity I think most people miss just because of where we are in history. What is it? We live in a time where you can learn about almost anything on the internet. Because of this amazing tool, you can study as little as 15 minutes a day and, over time, learn something.

My question for you — since you’ve read this far — how are you spending your free time? Are you learning something new, something to help you live a better lifestyle? Are you willing to work when others aren’t?

Study every day. Each day is a gift. Take advantage of it. If you didn’t watch the video from Cavo Tagoo in this post, watch it now.

Also, be sure to register for the Trader & Investor Summit 2019 today. Discounted pricing is still available — but this event sells out every year. Lock in the best available price before time runs out.

Are you a trader? What do you every day to become a better trader? If you’re new to trading, what are you doing to develop your skills? Comment below, I love to hear from all my readers!

Leave a reply