There I was in April, staring at my screen, dumbfounded by my first losing month in YEARS. I felt like I had been sucker-punched right in the gut.

I knew my trading was off…

With some nasty habits like overtrading and being overly aggressive.

But there was more to it than that.

The trading setups that made me millions were betraying me left and right.

You know, when the market throws you a curveball like that, you have two choices:

- Keep stubbornly doing the same thing, praying for better results

- Find out what’s working NOW and adapt.

For me, the choice was a no-brainer.

And that’s how I spotted TCRX yesterday, a biotech stock that soared over 150%

So, what’s the secret sauce behind this new pattern I’ve been testing?

And why am I convinced it’ll bring even more winners to the table in the days ahead?

Adapt Or Perish

I started trading in the dot com era…

My haters will say I got lucky because I had a favorable market.

The market was amazing back then—I’m not going to lie.

But I made millions more after that…In fact, I’ve been consistently profitable for +20 years.

Even last year…when most traders got their butts handed to them.

And that’s because I’m constantly refining my process and testing out new strategies.

Sure…it sounds logical but it’s also hard.

Whenever you’re testing something new out, there’s a learning curve.

That means you’ll probably be losing more than winning.

But that’s the only way you can survive in this game.

If I was not flexible and opened minded I probably wouldn’t be writing to you today.

You see, my primary strategy back in the day was short-selling scammy stocks.

It worked great…until it didn’t.

And if I stuck with that strategy, I’m convinced I would have blown out my account.

I feel sorry for shorts in these Supernovas that go up 200%, 300%, and even 1000% in a single day…

There’s clearly more upside potential in playing them long…

In fact, I caught one yesterday in the ticker symbol TCRX.

A New Strategy I’m Testing Out

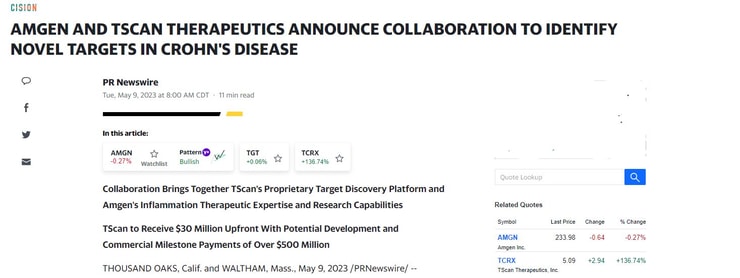

Before the market opened on Tuesday there was a press release in TCRX…

I call it a “legitimizer” whenever a small-cap company can associate with a well-known established company.

Amgen is a +$100 billion company…and this headline gives TCRX validity.

The stock absolutely exploded in the pre-market going to $4.

Of course, chasing is a dangerous strategy…and although I loved the news…I knew my only chance to play was if it dipped.

Lucky for me, it did…and I was able to snag some shares at $2.90.

I wasn’t in the trade for long, getting out at $3.16 for a solid 8.9% gain.

In hindsight, I should have stuck with the trade…as the stock hit a high above $6.

More Breaking News

- Vizsla Silver Shows Resilience Amid Unsteady Market

- Entegris Faces CFO Transition Amid Price Target Boosts from Analysts

- Datadog Battles Price Target Reductions Amid Growth Hopes

- Novo Nordisk’s Shares Surge as FDA Targets Illegal Drug Marketing

But I didn’t beat myself about it because this is a new setup I’m trading. I’ll get better at trading it.

Final Thoughts

Right now I’m seeing great opportunities in buying dips stocks that have pre-market news.

It’s a new strategy for me, and one I’ll continue to test out.

If you want to know how I’m finding these types of plays… this is my secret.

Leave a reply