One of the biggest misconceptions of newbie traders is that they have to take on high levels of risk to make above-average returns.

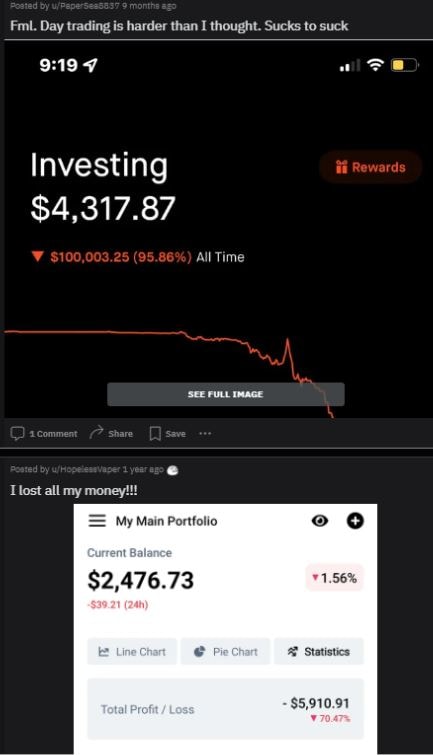

There are even subreddits that glamorize reckless trading behavior.

I understand that misery loves company…

But if you really want to be my next millionaire student…

Then you’ve got to be serious about risk management and protecting your capital.

And don’t worry…

You don’t have to give up trading those insane Supernovas…

But you do have to be strategic.

Today, I’ll show you I got into one of Monday’s biggest stock movers, and how I traded it safely and profitably.

Everything changes when you start looking at trading this way.

3 Things That Can Improve Your Risk Management

#1 Position Sizing

If I knew what the perfect entry and exit was I would have a lot more than $7.4 million in career trading profits.

The truth is, it’s impossible to pick tops and bottoms.

That’s why position sizing is so key. Personally, I will enter trades with relatively small size.

This allows me to focus on the price action…and not trade overly emotional…reacting to my PnL.

If my entry is off…I will cut losses quickly.

I have no problem re-entering if I see a better opportunity later on. And because I’m in the trade for small size, it gives me the option to average down and add if the trade looks promising.

#2 Price Matters

If I catch a breaking news headline early and I feel the catalyst is compelling I won’t hesitate to get involved.

But my travel schedule is so hectic that it doesn’t happen that often.

That’s why I’m generally looking for dip buy opportunities. I hate chasing the high of the day because the stock could dip, stop me out, and then retrace higher.

I like to find areas of support on the chart and buy around those levels. This gives me a clear out…which helps me get less emotional about my trading.

More Breaking News

- Jumia Faces Market Headwinds Amid Rising Costs and Strategic Challenges

- Vale S.A. Stock Soars as Goldman Sachs Raises Price Target

- Datadog Soars with Strategic Price Adjustments Amid Optimism

- Vizsla Silver Shows Resilience Amid Unsteady Market

#3 Trade Scared But Have A Plan

Take on crazy risks and eventually the market will humble you. I know, because it’s happened to me countless times throughout my career.

I don’t know about you…but who likes feeling sick and empty after a big loss?

I know I don’t…although there might be short-sellers who get off on it.

I respect what the market can do, and that’s why I’m constantly thinking about my risk…to the point I’m scared.

Moreover, everyone of my trades has a plan. I know what price I’m entering and where I’m looking to take profits.

And if it looks like my plan isn’t going to work…I will bail quickly.

How I Nailed FUBO

On most Friday afternoons I will look for a trade called The Weekend Trade.

You can learn about the strategy here.

But in a nutshell, I’m looking for stocks with strong momentum, with the idea that it will carry over into Monday’s session.

Why I liked FUBO

If you look at the long-term chart you’ll see that it was once a Supernova.

But since then it has more or less been left for dead.

However, last Friday, the stock reported surprising earnings results.

It topped revenue estimates and raised its guidance.

And it even mentioned that AI would be a centerpiece to its global product vision.

But that’s not all…

It was a first green day mover…a pattern that I’ve seen work well recently.

I liked the price action…as well as the strength in the overall market.

I got my entry in at $1.48…I knew that $1.60 would serve as resistance…but if it could break above it…it could be off to the races.

On Monday morning I wasn’t sure what my WIFI situation would be because of my traveling…so I bailed in the pre-market at $1.57.

It turned out that the stock eventually broke above the $1.60 level, blasting off to $1.85 for a gain of more than 25%.

I played it cautiously, but we’ve seen so many breakdowns, that I would rather be safe right now.

If I see continued momentum on plays like this one then I’ll adjust and try to hold on for larger gains. But I’m just trading on what the market has been telling me lately.

Final Note

I am consistently profitable year after year…not because I score big wins…but because I manage risk better than a lot of other traders.

You don’t have to swing for the fences to make great gains in the market. My trading the last three years is proof of that.

If you want to make it as a trader then stop treating the stock market like a casino.

And if you’re looking for some inspiration then you’ve got to listen to this story about this former NFL player’s journey into the world of trading…

Leave a reply