I just had my best trading day of the year.

It had nothing to do with me taking wild beg bets…

Or even trading more.

I spotted an obvious trend in the market…waited for my setup…and took full advantage of it.

Something tells me that this trend isn’t over yet…which means you might have a chance to make some money on it too…

But that’s only if you know what it is and how the setup works…

Table of Contents

How I Profit

2025 Millionaire Media, LLCUnderstand, three out of four stocks follow the market.

I’ve been so successful recently because we’re on a hot streak.

Here’s a chart of Invesco QQQ Trust (NASDAQ: QQQ) since the beginning of 2023…

The market’s on fire right now. And that’s why I say it’s not too late.

Prices just broke out.

I’m ready for more spikers …

And to help you prepare, I’m going to break my most recent trade.

It follows basic support and resistance. Trust me, by the end of this letter you’ll understand

Let’s go …

Verb Technology Company Inc. (NASDAQ: VERB)

2025 Millionaire Media, LLCThis was the top ‘illegal-trade investigation’ stock yesterday.

It’s the most ridiculous trend I’ve seen in a while, but that’s what we get for trading crappy companies. It definitely doesn’t surprise me.

Yes, the companies are awful, but the opportunities to profit are predictable.

Remember, don’t get attached to these tickers, we’re just here for the money.

Basically, Genius Group Limited (AMEX: GNS) announced an ex-F.B.I. director would be investigating possible naked short selling of the company’s stock.

Here’s the press release.

And the ticker launched +800%.

Naturally, a move like that sent shockwaves through the market. All the other crappy little companies wanted to inflate their stock price too.

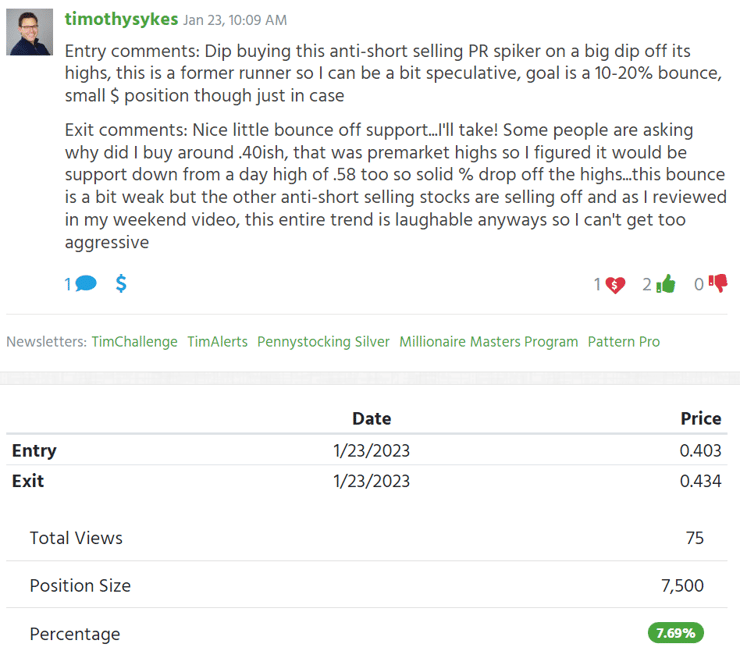

And here’s a screenshot of my trade …

This is what I saw …

Support set from this morning at $0.40 (represented by thee blue line).

I bought above support and sold into the bounce for a cool 7% profit (risked $3,022.50 in capital).

And it’s the exact same pattern the other spikers follow in this sector …

Genius Group Limited (AMEX: GNS)

From the first day of GNS’s spike.

I didn’t trade it, but look at this hypothetical trade I drew on the chart …

There’s obvious support at $1.50 from earlier in the day. Buy above support, sell into strength …

More Breaking News

- VEON’s Digital Leap: A New Era

- CLSK Shares Plummet: Is It Time To Exit?

- AMC Stock Surge: Balancing on New Debt Strategies

Hellbiz Inc. (NASDAQ: HLBZ)

Another stock investigating illegal trading.

And here’s a theoretical trade from Friday that follows the same pattern …

Support from earlier price action. Actually a double bottom on the day. Buy above support, sell into strength …

See what I mean?

It’s the same pattern, over and over again.

Yes I know, I’m missing the initial spike. But initial spikes can be dangerous and unpredictable.

The safest way to trade, in my opinion, is to wait for that volatile price action, and play the support/resistance levels on the back end.

Notice, these moves are quick.

That’s how I like it. I’m only exposed to the market for a few minutes. Then i sit in cash and wait for the next play.

But it also means I need the right tools to profit.

A Robinhood account won’t work.

Neither will Yahoo Finance.

I need up-to-date charts, and free software delays data by 10 – 20 minutes.

Sometimes my trades last less than 10 minutes … you see the issue?

I’ve presented you with a safe, reliable, and proven process to trade these volatile spikers.

All you need now is the right chart software to trade them.

I use StocksToTrade.

I helped develop it for my own strategies. So if you like what you just read … consider giving it a try.

Here’s a link to a 14-day trial.

To your success,

— Tim

Leave a reply