Hey trader. Tim here.

The reason why most traders are losing money in this market isn’t that they can’t find good trades.

It’s because they can’t sit on their hands.

They’re getting wrapped up in the emotions of trading, watching their P&L take wild swings in a news-driven market.

Whenever the market makes me feel uncomfortable, I don’t try to be a hero. Instead, I reduce the size of my positions and trade smaller.

It might not sound exciting, but it’s how I’ve racked up over $7 million in trading profits during my career.

That’s why I’m happy to wait for my opportunities — A+ setups that I’ve learned over the years to bring me consistent returns.

Which will be a key focus for my All-Day Trading Mastery Class this Friday.

As luck would have it, one of my favorite patterns came up when I was trading RedBox (NASDAQ: RDBX) yesterday.

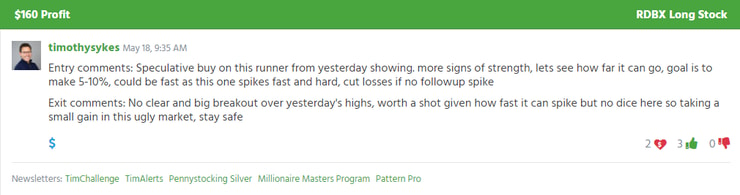

While I only walked away with a $160…

This setup offered the perfect opportunity to teach you a great way to analyze and trade the open.

Stock Selection

Every trade starts with a stock.

But I don’t want any old stock.

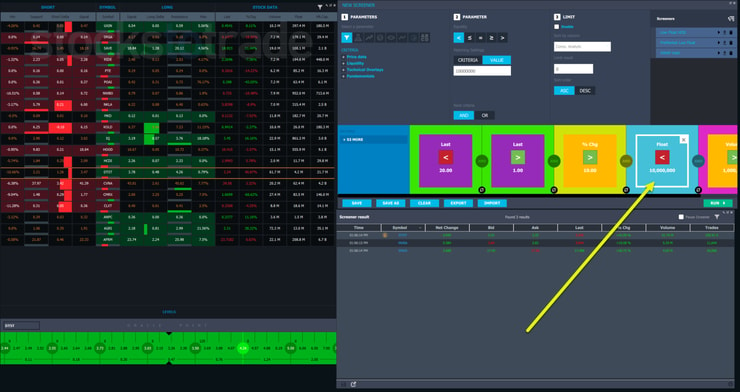

I like to pick from companies with low floats that are former runners.

Low-float stocks don’t have a lot of shares available to trade in the open market. So when a buying frenzy hits, the price tends to move higher pretty quickly.

One great way to look for these stocks is using the StocksToTrade screener.

I know that most brokers include scanners in their platforms.

However, most aren’t geared towards the premarket and they don’t screen for low floats or scan the news like StocksToTrade.

I look to my watchlists to find those ‘former runners.’

Even when I’m busy helping to build schools in Bali, I still take time out of my day to update my watchlists.

It might sound like a hassle. But five minutes now saves thirty later.

Many of these stocks surged on previous news or were former Supernovas.

Lastly, while it isn’t required, I like to see stocks trade up into the open. A bullish premarket often leads to bullish behavior at the open.

The RedBox Setup

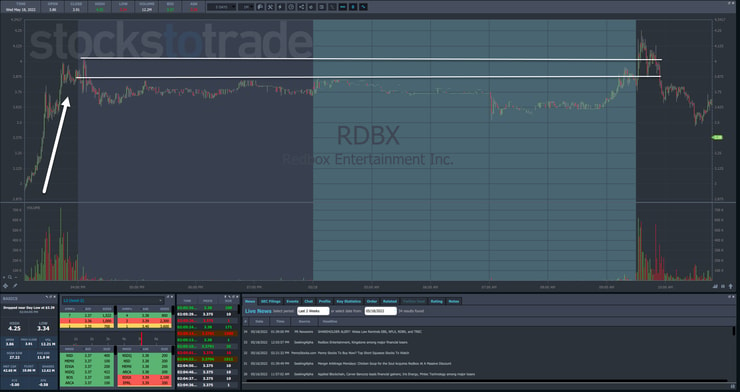

RDBX fit these parameters nicely yesterday.

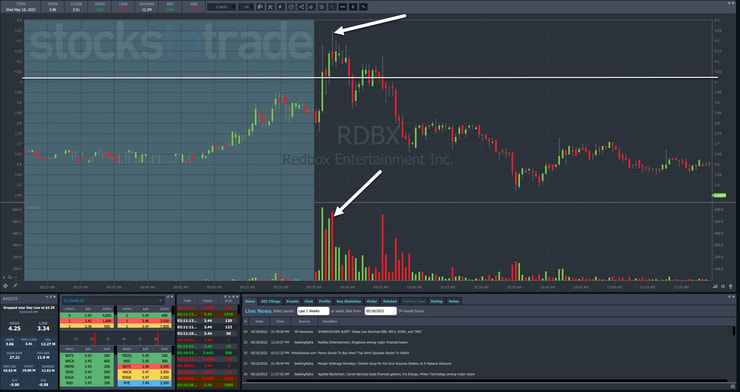

As you can see in the daily chart below, the stock kept its heavy, news-driven volume in the past few weeks.

Yesterday’s action came after a pretty significant run for the stock into the close on Tuesday.

Take a look…

There are two white lines on the chart.

The lower one sits at Tuesday’s closing price. The higher one marks the after-hour high from Tuesday.

Both of these levels are important.

I’ve talked about how breaks over these prices can cause short squeezes, especially in stocks with low floats.

When you combine this with a strong close from the prior day, it can lead to bullish behavior for the next trading day.

So I wanted to wait for a break of those highs as confirmation.

Ideally, the stock breaks the highs, trades sideways for a few minutes, and then continues its push higher.

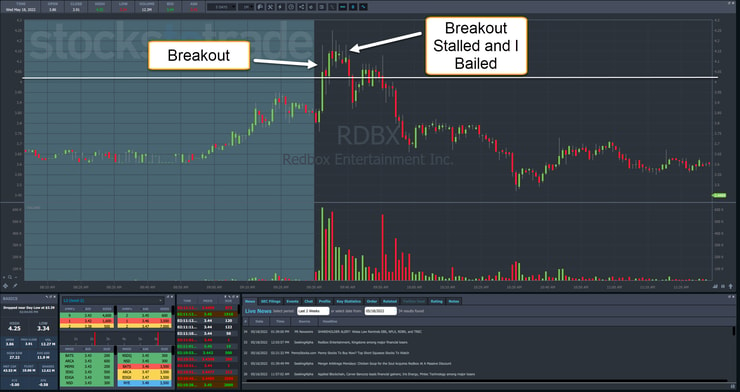

Here’s how that occurred in RDBX.

After the first candle broke the highs on heavy volume, the second candle held nicely. As the third candle began to form, I took a long position at $4.06.

I wanted to see the stock start to push higher quickly.

Unfortunately, it stalled for a few minutes. And that’s when I decided to cut my position at $4.14.

With this setup, I got in on the breakout and knew I would stop out if the stock broke down.

I didn’t expect that to happen since the price started to make what looked like another push higher…

However, I didn’t see the panic buying frenzy that I expected. Typically, when these stocks get momentum, they keep going for several minutes.

Shares could’ve consolidated before moving higher.

However, the volume was declining.

Plus, the price made a reversal candle on higher volume that nearly matched the early breakout move.

That clued me into something — shares weren’t ready to continue higher.

More Breaking News

- QuantumScape Launches Eagle Line for Solid-State Battery Pilot Production

- KeyBanc Boosts Intuitive Machines with Higher Price Target

- Skyward Surge: Momentus Inc. Soars and Faces Market Dynamics

- Exponent Sees Promising Growth with Dividend Increase and Upbeat Q4 Earnings

If they were, the volume would remain high and eventually launch the share price into the stratosphere.

Final Thoughts

This is a simple breakout setup. It doesn’t require much, just practice and patience.

Pay attention to what the market tells you. Use all of the information at your disposal.

If you’re looking for one ULTIMATE PATTERN then I’ve got just the ticket for you.

—TIM

Leave a reply