Several months ago my top student Tim Grittani wrote this blog post “How To Make $200,000 In One Day With Penny Stocks: A 3,000 Word Detailed Lesson” which is a MUST READ in itself, but it’s worth noting that was just a small step in his journey from him starting with just $1,500 of his own money and now turning it into now nearly $6.4 million with every trade detailed here**

(as opposed to the far too many fakers who claim to be rich, but only show a few screenshots, NOT the good, bad AND ugly showing ALL trades publicly like ALL my top students do — don’t believe me? Go ahead and ask to see ALL trades, not just a few screenshots or total profits, of ANYONE who claims to be a self-made stock trading expert/millionaire, just wait until you hear the creative excuses you’ll encounter…aka it’s good to be real in an industry full of scammers/liars)

And that’s why I’m SO proud of Tim Grittani, not just for his awesome dedication to studying, adapting and becoming an even better/more complete trader, his continued humbleness, his helpfulness in the trading challenge chatroom along with the awesome webinars and study guides he’s created (hit me up here for a deal on his MUST WATCH study guide), the money he’s made is nice, but more importantly, he’s FULLY TRANSPARENT about his gains AND losses and some of the big risks he’s taken/learned from in the past and that’s a model more traders should follow as I see far too much dishonesty and editing of facts and that hurts not only progress/potential of the trader himself/herself, but also the entire trading community which has a rather nasty reputation right now due to all the liars.

So, please do read Tim Grittani’s new blog post entitled “Recapping My Best Trade Ever – $212,000 CVSI Long” and learn from this awesome new trade outlined here:**

And here are my top 10 takeaways from this trade:

1. Tim Grittani resisted taking profits too soon by focusing on the chat and letting it play out…he even removes his profit/loss column from his screens so as not to be tempted and give a play maximum time to play out according to the pattern, in this case, a rather perfect breakout.

2. Too many people hate on penny stocks saying there’s no big money and that it can never be predictable. ..wrong on both counts, you just need patience to wait for the best plays like this.

3. Too many bitter short sellers think you should never buy a penny stock due to lack of fundamentals, and yet some of the best-performing stocks are companies with very few or weak fundamentals…hype and technical analysis can play great roles in pushing stocks higher than any solid fundamentals can.

4. This trade Tim Grittani did was so well executed not because of luck, but because he’s been refining his trading strategy and process for several years, never content with what he’s already accomplished, always focused on what more he can do in the future…the perfect perspective and key to his continuing success.

5. Tim Grittani is the man.

6. Some people look at the trade details here and can’t fathom why someone would take such a large position on a penny stock…well, it’s not so large given how much Tim Grittani has made the past few years and in those years he’s developed enough confidence to trade with larger size.

More Breaking News

- Snap Faces Mounting Challenges as Analysts Lower Price Targets

- Valterra Platinum Strengthens Position with Impressive Earnings Surge

- Vale’s Stock Soars Following Significant Price Target Increases

- Under Armour Faces Data Breach Affecting 72 Million Customers

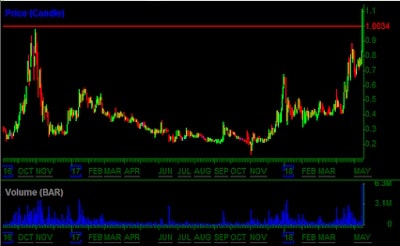

7. Look at the chart of this stock that Tim G. banked on…the breakout is literally perfect so have patience and wait for solid charts like this as they do NOT happen every day.

8. Have more confidence/patience buying penny stocks that actually do have some fundamentals, rather than blatant pumps, as Tim G. pointed out:

It’s pretty rare for me to see a small-cap company with positive net income. With revenues also above $8 million, it was clear that this company actually has and sells a real product. For once, I wasn’t trying to buy a blatant pump.

From there, I looked through a few other things to get a clearer picture of the fundamental side. I looked back at the previous three quarterly reports to see what revenues and net income looked like. I quickly scanned twitter and the Ihub message board to see if anyone had anything intelligent to say about the company (and ignored the “TO THE MOOOOON” garbage all over the place). A few quick highlights of things I noticed:

– Revenues were steadily increasing every quarter, so the most recent quarterly statement obviously wasn’t a one-hit wonder.

– Net income was improving every quarter, and the biggest expense, “Selling general, and administrative” was holding steady at around $4 million each quarter.

– On twitter, I found a mention of their earnings conference call and some things discussed in it. Instead of taking the tweeter’s word for it, I found it and listened for myself.

– The conference call discussed how the remainder of their convertible debt had been eliminated.

– The presentation slides discussed how distribution channels increasing was why revenues were increasing. This was another reason not to think it was just a “lucky quarter.”

– The conference call discussed plans to uplist to a major exchange late this year

Hopefully, by now you can understand a bit of why I was impressed. This was nothing like the 99% of the OTC trash I usually trade, this was a real company with real things going on, breaking to new multi-year highs. But I didn’t drink the kool-aid yet; there still was one thing that concerned me, the market cap valuation.

9. You don’t have to bet big in order to win on plays like this, it’s fine to start small and Tim Grittani and I actually agree it’s BETTER to start with a small account at first and practice before risking any big money until you’re confident and comfortable with these crazy stocks’ volatility…see a video we recently did in Bali discussing this:

10. Wins like this $200,000+ profit, or Tim G.’s last $200,000 profit or even the multiple $100,000+ and $200,000+ profits I’ve made and detailed here are awesome to hopefully inspire you and show you what’s possible if you study and work hard enough in this game, and have enough patience to go through the ups AND downs, and learn from both in order to get enough experience so you can eventually trade with size, but do NOT feel bad about trading with a small account…we all start somewhere and most of my top trading challenge students began with just a few thousand dollars and that small starting amount forced them to really learn and optimize their trading rules and plans in order to have a better chance at growing their account exponentially!**

And by all means, please do leave a comment below and tell me what you think the top lessons from Tim G’s latest $200,000+ profit are?**

Leave a reply