Hey, trader. Tim here.

Two words …

Boo Yah!

Yesterday morning I managed a 7% profit on a +100% runner with news.

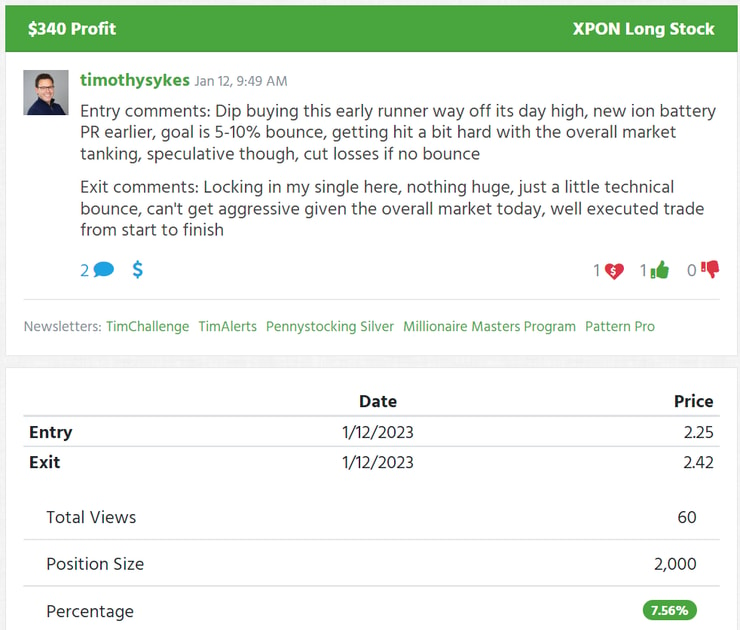

Here’s my trade verification post…

I share all my trades on Profit.ly

But I’m embarrassed to report I missed out on most of the move. As you probably could tell.

The trade itself was great! Picture perfect. And I’ll teach you exactly how to do it …

I just wish I’d been around to capitalize on the spike later on.

That’s the great thing about these stocks, they offer multiple profit opportunities throughout the day and even over multiple weeks.

But we mustn’t get greedy. That’s why I’m proud of my trade. I got out with safe profits.

The thing that’s killing me is the exact same pattern spiked the price even higher just a few hours later.

This is definitely the strategy to use right now …

How I Made $340 In One Morning

First of all, the market’s been on a bit of a run recently.

Yesterday’s CPI data caused a market gap and a mid-day price rally.

Here’s a chart …

Three out of four stocks follow the market. Which means during a bull run, there will be more opportunities to profit in our niche.

The stock I traded, Expion360 Inc. (NASDAQ: XPON) might not have spiked mid-day without the bullish CPI data and a strong overall market. It’s important to understand that.

Next, we must focus on the right stocks.

A strong market might help you get lucky, but if you’re looking for consistent profits, It’s imperative we only focus on the hottest plays.

Stocks that …

- Have a low float

- A hot catalyst/news

- Proof of volatile price action

- A high trading volume

- And a history of spiking can’t hurt

Let’s have a look at XPON …

- 3.9 million share float (this is tiny in the stock market)

- Lithium battery news

- Spiked +80% after the news broke

- More than 29 million shares traded yesterday

- And it gapped up recently in late December 2022

We have ourselves a winner!

The only thing left to do … trade it.

Top Patterns

Let’s break down how I played XPON yesterday.

Entrance at $2.25.

Exit at $2.42.

On the chart, I waited for the market to open. I confirmed positive price action, I waited for the price to dip and show sideways consolidation. That’s when I entered.

This is very important … if the price broke down and didn’t bounce, I was ready to sell for a small loss.

But because I chose the right stock, all the factors were pushing it in the right direction. The price broke out and I sold into strength for a 7% profit.

The whole trade only took a few minutes …

And this pattern worked later in the day as well.

The price had spiked up to $2.60 and consolidated until a huge breakout right after 12:00 P.M. Eastern …

I know 7% doesn’t sound like a lot.

But these patterns are scalable.

And as you can see, there’s way more than 7% up for grabs.

I’ll be the first to admit, I’m not the best trader. Actually, I’m a better teacher.

I taught Mark Croock, and he’s developed a strategy that yields +100% profits in less than 24 hours.

Next week were sitting down to discuss the mechanics.

And you’re invited to sit in the audience.

Only so many people are allowed in. Too many and the servers start to crash.

Take advantage of a shifting market and new opportunities!

— Tim

Leave a reply