At any given time in the market, certain patterns will be more popular than others.

I’ve been using the same patterns for over 20 years, but the patterns manifest within a larger framework.

Depending on overall market strength, certain parts of the framework will be stronger than others.

I can profit in every market because I have enough experience to recognize the patterns.

For my up-and-coming students: I show them which plays are hottest during each market.

Right now, the 2024 market is surging higher. It’s unbelievable! The momentum from a rallying tech sector is out of control haha. But you don’t hear me complaining …

There are more profit opportunities in our niche when the market is hot.

That’s why we have to capitalize NOW. You never know when the momentum will shift.

For example: Over the last few days, the bull market pulled back in anticipation of the NVIDIA Corporation (NASDAQ: NVDA) earnings report on February 21.

A poor NVDA report could have been the end of this rally.

The earnings data dropped on February 21 during after hours …

- Total revenue rose 265% from a year ago.

As a result, on February 22, NVDA and the S&P 500 ETF Trust (NYSE: SPY) shot to new all-time highs. There’s a chart of the SPY bull market below:

Now is the time to trade!

The best traders react to the momentum in the market. And right now, there are A LOT of stocks surging.

Despite the widespread doom & gloom from poor short-biased traders too chickenshit to show ALL trades publicly, this awesome $DIA $SPY $QQQ bounce filed by $NVDA $SMCI & the #AIRevolution should help you understand why you must remain positive & capitalize on this BULL MARKET

— Timothy Sykes (@timothysykes) February 22, 2024

Don’t get stuck on the wrong side of these patterns. There are 3 common setups that you need to watch right now.

#1: Panic Dip Buys

In my Penny Stocking Framework, this is a #5 and #6 pattern.

There are a lot of stocks spiking right now. But in our niche, most of the spikes are unsustainable. Penny stock prices will crash eventually.

“Why would you ever trade a stock that’s going to crash?”

Because these stocks can spike +1000% while following our common patterns to a T. If we’re wise to the price action, we can get in and out with a profit before things turn sketchy.

One of my favorite patterns actually involves trading on the way down. And I’m not talking about short selling.

A panic dip buy is an opportunity that manifests when a hot stock starts to fall from its highs.

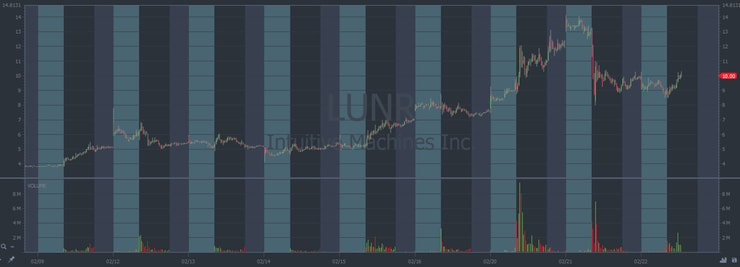

When the price falls too far and too fast, there can be a momentary and substantial bounce. We’ll use the recent runner, Intuitive Machines Inc. (NASDAQ: LUNR) as an example.

Take a look at the +230% multi-day run up and subsequent 30% selloff on February 21:

I didn’t trade the February 21 panic dip buy, but some of my students did.

The Tweet below shows a perfect example of this trading pattern.

$LUNR classic panic dip buy@timothysykes pic.twitter.com/7kOekCvxfC

— BBandit (@BlakeBandit) February 21, 2024

Keep an eye on penny stocks that are logging multi-day runs.

They’ll crash eventually, and that’s where we wait for profit opportunities.

#2: The Best Market Spikers

We can profit on the front half of a spiker too.

Here’s what I look for when trading a bullish runner as it surges higher:

- Fast spikers.

-

- Usually these stocks spike in premarket. I’m looking for anything above a 20% intraday move. If it can spike 20% it can spike higher.

- A low float.

-

- The float is the total share supply available for trading. A constricted share supply will help stocks shoot higher when demand increases. We want the float to be less than 10 million shares.

- High trading volume.

-

- The volume shows how many shares are traded. We want at least 1 million shares traded on the day. That ensures enough liquidity so that we don’t get stuck. And the higher the trading volume, the more popular the stock is. That helps it spike. A full float rotation is really exciting to see.

- A hot news catalyst.

-

- There needs to be a reason for the spike.

Here’s an example:

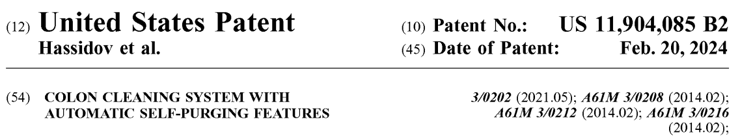

Motus GI Holdings Inc. (NASDAQ: MOTS) announced a new patent in a filing on February 20. See the date stamp below:

Oooooo, automatic self-purging features, very cool!

Just kidding: This is a perfect example of crappy stock that spiked with hyped-up news.

The float was only 551,000 shares. Prices launched 160% after the news came out and I traded it during premarket hours.

More Breaking News

- Archer Aviation Secures Strategic Partnership with Serbia for Air Taxi Revolution

- Boxlight Expands Ed-Tech Horizon with New Partnerships

- B2Gold Corporation’s Stock Fluctuations Triggered By Market Events

- NBIS Thrives as AI Revolution Looms

Find more stocks that fit the factors above!

#3: Overnight Plays

This is an attractive option for traders who also work a day job.

Some of the markets hottest stocks will continue to run after day one. Overnight swing trades help us take advantage of that momentum.

Theoretically, we find a strong stock pushing higher and build a position above support before the market closes. Then the next day, we sell our position when the market opens.

It’s easier said than done. But you don’t have to do it alone.

Since the advent of AI in 2023, I worked to create an AI bot that can find the best stock setups that follow my process.

It’s called XGPT, and one of the most recent wins was from Ventyx Biosciences Inc. (NASDAQ: VTYX).

XGPT alerted the spike a day early:

150% GAIN off of $VTYX!🔥

Retweet & favorite if you caught a piece of this move!👀

Get the Next AI Alert 🚨📈 https://t.co/nrxfrauJ2Y#DayTrading #StocksToWatch #AI pic.twitter.com/SFrqPhreSh

— StocksToTrade (@StocksToTrade) February 21, 2024

The AI system sends out a daily alert at 3:16 P.M. Eastern. If there’s a potential swing trade to play, you’ll get an alert and a trade plan.

You can enter before the market closes or wait for the next morning’s bullish confirmation.

And it’s not just the 3:16 alert … If there’s a morning runner you want to trade, enter the ticker symbol into XGPT and you’ll get a trade summary as if you asked me directly.

New traders don’t know what they don’t know.

It’s my job to teach them. And XGPT is the most advanced teaching tool that I have right now.

Cheers.

Leave a reply