Everyone gets into trading for their own reasons but with the same goal in mind — to make money.

I started this company more than a decade ago to help anyone who wanted to become a successful trader no matter their skill level or background.

Today, I proudly count 26 students who’ve made $1 million+ in their careers!

What many people don’t realize is that every one of my students who has achieved this level of trading mastery did it by developing their own style.

I simply gave them the framework to build on.

Mark Croock is a perfect example of someone who’s carved his own path.

And someone I deeply respect and admire

And while I’ve carved out a niche for trading penny stocks…

…Mark has gone on to make millions in a totally different way.

And on June 2, he’s revealing his latest strategy for the first time — Shadow Trades.

If you haven’t reserved your seat for the Shadow Trades Summit … then click here now.

Of course, we have a few days until then. So I want to talk to you a bit more about what it takes to develop your own style of trading and why it’s pivotal if you want to take your trading to the next level.

Table of Contents

1. Match Your Lifestyle

It’s so easy to look at someone like Mark (or myself) and think that just copying our strategies will bring you success.

I can’t tell you how many traders I’ve watched struggle to day trade while they worked 9-5 jobs.

Some of them probably got fired for trading on company time.

Don’t put yourself in that position.

If you don’t have the time to regularly dedicate to day trading, don’t try and day trade.

No, you don’t need to be in front of the computer all day.

My good friend Tim Bohen teaches folks how to trade primarily around 9:45 a.m. and 2:00 p.m.

However, you do need to be able to regularly set aside time to trade and do your homework.

Another thing to consider is how much risk you want to take on.

Few, if any, of my millionaire students hit the big milestone in two years, let alone the first year.

Many of my students start with small accounts and use them to learn how to generate profits consistently before stepping up their position size.

There’s no reason you need to risk $1,000 on a $5,000 account when $100 will do just fine.

I’m not an advocate for swinging for the fences on a few big trades.

All of my students look for regular, predictable trades, even if they earn the majority of their profits on only a few of them.

2. Journal Everything

I’ll be the first to admit I get caught up in my own world sometimes.

Between volatile markets, building schools in Bali, and running a company, I lose sight of the big picture.

No other tool will improve your trading faster than a trading journal.

It provides an unbiased assessment of where your opportunities lie and your weaknesses are.

This is crucial for strategy development. You need to discover which conditions work for your trades, how to execute them, and appropriate risk management strategies.

For example, I learned through trial and error how to execute my morning panic buy in such a way that I keep my losses small and turn busted setups into small gains.

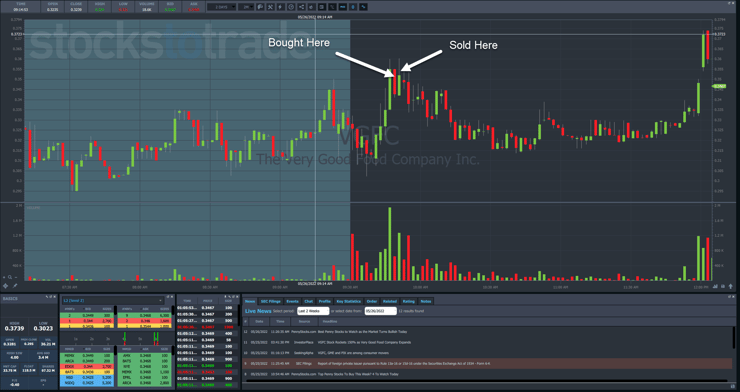

That’s what happened yesterday in The Very Good Food Company (NASDAQ: VGFC) trade.

I managed to enter at $0.344 and exit at $0.35, walking away with a tiny profit.

This isn’t something I learned naturally. It took years of practice and trade reviews to fine-tune my execution.

And once I incorporated it into my trading, I started stacking up these small wins that eventually added up to some nice gains overall.

3. Adapt to Market Conditions

I said it once and I’ll say it again — some markets are for learning and some are for earning.

2020 and 2021 were amazing for profits.

2022 is much more difficult.

While there are strategies that can (and do) work in any type of market, I have yet to find one that doesn’t do better in either a bull or bear market.

Remember all those traders who made a fortune on meme squeeze trades?

They don’t have as much to work with these days.

If you don’t adapt to market conditions, you risk forcing trades, like shoving a round peg into a square hole.

Now, not every strategy can work in all market conditions.

That’s why journals are so important. Logging my trades tells me whether the strategy I developed works or fails, during bull or bear markets.

Sometimes I find a certain setup doesn’t work — or appear — under certain market conditions.

That’s why I worked for years on my core Supernova Pattern before branching out to setups like the morning panic dip buy.

Think of it like writing a book series. You need to complete the first novel to set the stage for the later volumes.

When Your Strategy Fails

It’s easy to get discouraged when your favorite setup stops working. It’s happened to me plenty of times.

Take a step back and ask yourself what’s changed.

- Has the shape of the market shifted?

- Are you still executing the trades according to the plan?

- Do setups fail or are there simply fewer of them?

Setups can work for years before suddenly faltering.

Traders who learned how to trade in 2020 probably picked up some bad habits from those unique market conditions.

That’s why I start my traders with patterns like the Supernova that worked for years, or the morning panic dip buy…

It gives my students a foundation to learn the market and build their own strategies based on setups that regularly appear.

And believe me, that’s a much easier place to start from than with nothing.

—Tim

Leave a reply