2021 was an incredible year for my students!

Jack Kellogg, who’s surpassed $10 Million in lifetime earnings, raked in $6.893 Million that year.

Mariana, another one of my millionaire students, pulled in almost $1.395 Million.

I clocked in a healthy $1 Million myself.

And I tell you what…seeing meme stocks heat up again gets me excited.

There is definitely money to be made.

I want to make sure you don’t miss out.

That’s why on top of my millionaire challenge, which teaches you how to recognize the patterns AND trade them…

I’m going to cover three of the best short squeeze opportunities I see on the table.

Table of Contents

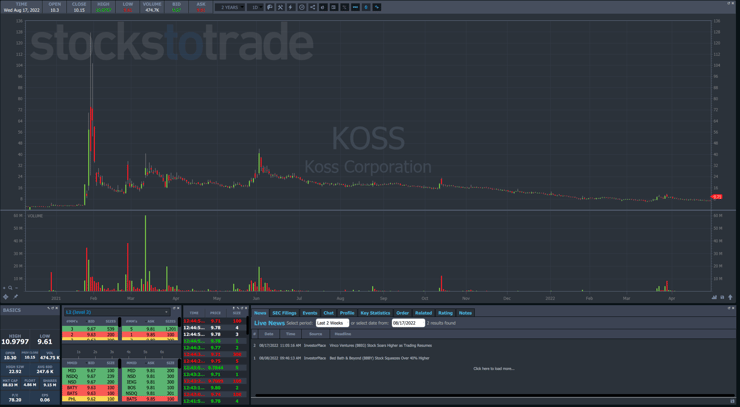

Koss Corporation (NASDAQ: KOSS)

When I look for potential squeeze plays, I want to try to find stocks that meet the following criteria:

- Former runner

- Low float

- High short interest

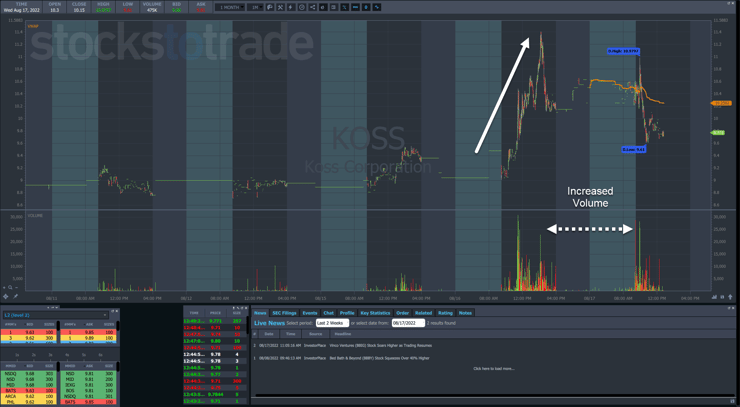

- Signs of spiking on increased volume

KOSS meets most of these criteria. It’s current short float is roughly 8%, which isn’t too high. However, its status as a previous meme stock gives it some extra eyeballs.

Like other meme stocks, shares skyrocketed in early 2021, driving from $3.45 to $127.45 in a week.

Other than a few pops here and there, the stock has died down.

That said, it only carries a 4.86 million float with an average daily volume of ~250k shares.

In the last couple of days, shares jumped about 30% on heavy volume before pulling back.

With Bed Bath & Beyond Inc. (NASDAQ: BBBY) tripling in a matter of weeks, there should be more room for this stock to run.

I like the pullback because it traps in more shorts, giving a better chance of a future squeeze.

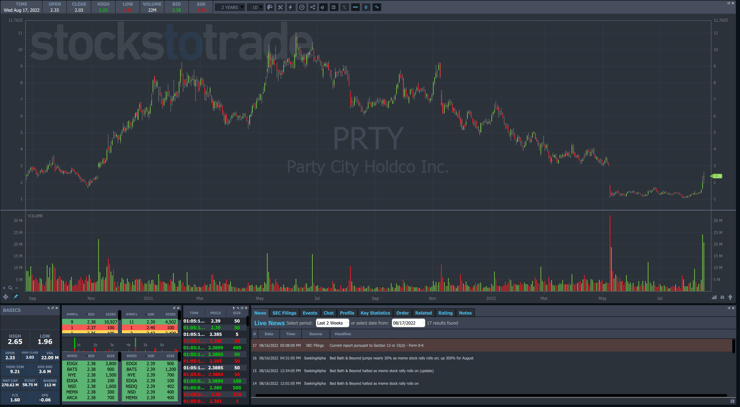

Party City Holdco Inc. (NYSE: PRTY)

Party City wasn’t one of the meme stocks from 2021, at least not in the way others were.

However, it’s got a lot to like here, and even Mark Croock, one of my top millionaire students, has this name on his watchlist.

There are a good amount of shares floating out there at 58.75 million. And the stock trades at an average volume of 3.6 million per day.

At first glance, it might not seem like there’s a lot more room to run after shares surged almost 100% in the last week.

However, if we back out to a larger time frame, you’ll see that the stock got as high as $11 back in 2021.

You can also see on a relative basis huge volume trading in the last couple of days.

There’s still a gap above $3 that should attract price.

The short float on this one ranges from 10%-18%, but the exact number isn’t important.

More Breaking News

- Price Predictions Fueled by Company Moves In Market Dynamics

- Fabrinet’s Stock Rises as Wolfe Research Raises Price Target

- China SXT Pharma Launches AI Supply Chain Overhaul for TCMs

- Cipher Mining Hikes Price Target Amidst Bold Strategic Moves

As long as meme stocks are catching a bid, there should be buyers to squeeze the shorts.

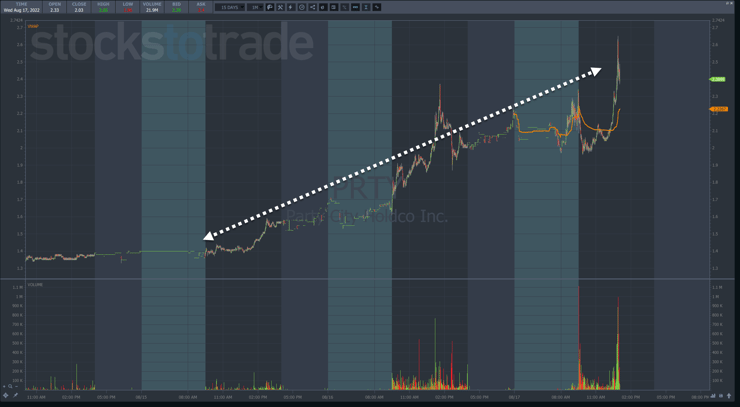

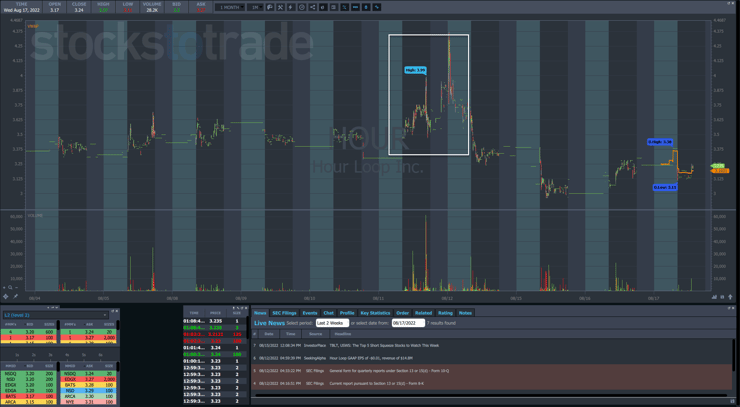

Hour Loop Inc. (NASDAQ: HOUR)

This stock began trading back in February of this year.

Currently, it has a tiny float of 1.73 million shares, an average volume of 215k per day, and a short float of around 17.5%.

So far, this stock hasn’t followed the rest. Volume has been fairly light.

However, we did see some activity a week ago when the stock caught a bid towards the close of the regular session and into the afterhours.

There hasn’t been much price action since then.

However, with traders looking for squeeze opportunities that haven’t yet popped, HOUR could be a dark horse play waiting in the wings.

Want Even More Trades?

I traded fuboTV Inc. (NYSEL FUBO) this week for a tidy profit.

In the last month, I’ve managed to ride hot stocks like FaZe Holdings Inc. (NASDAQ: FAZE) while still playing my bread and butter OTC plays.

My students get alerts when I enter and exit trades along with a host of video content to accelerate their trading careers.

Join me and learn the patterns and techniques to help you become a consistently profitable trader.

Leave a reply