I sometimes call myself the Rodney Dangerfield of the trading industry…I get no respect.

Most of my haters don’t even know—I donate ALL my profits to charity…yet they still love talking trash.

However, I invite them to show me someone who has coached more retail traders into becoming millionaires…over 20 and counting.

Maybe it’s because the industry is filled with frauds and trading gurus who present themselves as if they’re bullet-proof and never lose money.

The difference between them and myself is that I’m fully transparent. And while I’ve made over $7.4 million in career trading profits, I’m not immune to trading losses.

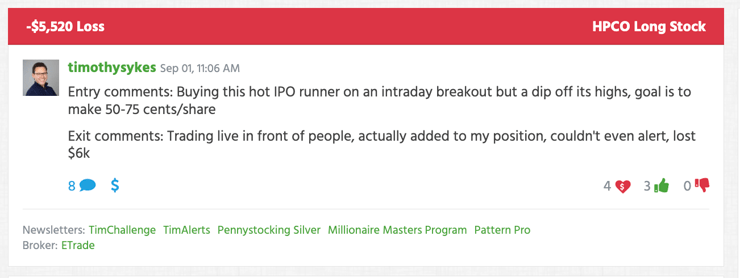

In fact, I had one of my worst trading days of the year last week…losing $6,000 by making some bonehead mistakes in two ticker symbols.

Now, if an experienced trader like myself can make these mistakes…you better believe newbies can too.

That’s why I’m going to break down what happened, so hopefully, you don’t won’t make the same mistakes.

Remember, before becoming a profitable trader, you must kill everything that isn’t working first.

Breaking Down My Worst Loss of 2022

Background: low-float IPOs have been running hot. Ticker symbols like ATXG shot up from $7.50 to $1200…HKD went from $13.52 to $2,555…and a slew of others…

That’s why I had my eyes on the ticker symbol HPCO…

I saw it trading in the 7s at the open and called it out to my students at my live training in Miami.

But I didn’t jump on it immediately, and before you knew it, it was trading above $9 and then $10+.

The stock did exactly what I thought it would do, and while that made me feel like I was on the ball, it also gave me a sense of FOMO.

My secondary play was to wait for a panic sell and jump in.

And while the stock did sell off back to the high 7s, where I wanted to be a buyer, it wasn’t a fast sell-off. Sometimes when a stock has momentum early in the day, it will gradually sell off for the entire session. I like fast and sharp moves lower, and this wasn’t one of them.

Of course, it went right back to the 10s…

So here I am live, in front of about 100 students…calling out these plays like a maestro…but yet to pull the trigger on the trade.

After bouncing around for a bit, the stock broke out and went to new highs in the 11s…

I wasn’t going to chase it higher, even though I had some built-in FOMO.

The play was to wait for a potential panic sell…

But instead of waiting for confirmation, I started slowly buying as it sold down…and adding along the way.

Averaging down is not something I recommend to newbie traders. It can wreck your psychology as well as damage your trading account. When you have enough experience and wins under your belt, there will be moments when you can break the rules.

Regardless, I felt that to give myself a fighting chance at making money, I would have to add more size to my position to improve my price.

However, the selling started to accelerate…and to make matters worse…I had choppy wifi…and I didn’t even know it was selling that hard — my screen was frozen!

The stock went from $10.90 to $9.90 in about a minute.

Here’s what I wrote to subscribers:

Learning Lessons

Lesson #1: I was oversized

On a typical trade, I will put in about $10K-$15K. However, I had over $60K in on 6,000 shares in this situation. When you oversize a position, you leave yourself with little room for error. It can get even scarier when you’re oversized and trading a super volatile stock, like HPCO.

Lesson #2: The market has a way of humbling you.

Going into the trading session, I was trading relatively well. I had thought I figured out the pattern on how to trade these junk IPOs, and I even called out the first two moves in HPCO, so my cockiness also played a role in this trading loss.

Lesson #3: If You Miss Your Trade, Let It Go

The best trade for me would’ve been to take a long during the morning panic sell. I did not do that. But maybe because I was in front of a live crowd, I was compelled to find a new trade to show my students. Clearly, that backfired.

But it’s something I see a lot of newbie traders do. They miss their initial entry, and instead of moving on to the next trade, they let FOMO interfere and chase a bad entry.

Some newbie traders might have added to their position even more or held on to the trade until it reversed. HPCO never bounced back. I knew I was wrong, and I got out.

More Breaking News

- AppLovin’s Stock Jumps Amid Optimistic Analyst Upgrades

- Vizsla Silver Corp. Sees Stock Flux Amid Strategic Movements

- Morgan Stanley’s Bold Moves Boost Cipher Mining’s Prospects

- Under Armour Battles Data Breach Amid Revenue Challenges

And although the loss was relatively big for what I’m used to these days…I wasn’t stubborn enough to jump back in…nor did I revenge trade to try to regain the losses.

Bottom Line

There are over 250 trading days in a year. If you’re an active trader, you’ll have your fair share of moments of bad judgment. The key is not to let it impact you on the next trade. And to learn from your mistakes. I hate it when traders talk negatively about themselves and trading when they are on a cold streak because it doesn’t serve them. Always stay positive. Draw inspiration from other successful traders, and try to figure out what they’re doing to get positive results.

That’s why my challenge is so awesome. It gives traders of all skill levels a chance to learn from some of my millionaire students during market hours…when it matters the most.

Click here to learn more about my challenge and how it is helping so many traders reach their financial goals.

Leave a reply