$1 Million Thank Yous to Promoters: Key Takeaways

- Singles add up, exemplified daily to the tune of $1 million+, two years running.*

- Thank you, promoters for the predictable patterns you create!

- “Sykes and his crew are in on it!” Proof promoters pimp the pump below…

This Pattern Got Me Across the Line*

Long story short, I had a solid $2,719 day on September 27.* That might not seem like anything great but remember, small gains add up. Those trades put me over $1 million on the year for the second year in a row.*

The truth about my milestone is…

It doesn’t matter that much to me. I donate 100% of my trading profits to charity.* And I take it trade by trade. But there are still lessons…

How I crossed the $1 million mark exemplifies a seemingly timeless pattern. And it’s another example of a weird new promoter tactic.

We’ll see how the rest of the year goes, but I’m cautiously optimistic that the stock market madness will continue.

Table of Contents

Thank Yous

2025 Millionaire Media, LLCI’m grateful for all the opportunities in the market over the past two years. I have two special thank yous…

Dear Promoters

You guys rock! I couldn’t have done this without you. Promoters create predictable patterns. I don’t buy into their BS, and I don’t short sell like they claim. But I LOVE the dip buy opportunities they create.

Hats Off to StocksToTrade Breaking News

A special thanks to the StocksToTrade Breaking News Chat team.** STT Breaking News chat is my number-one tool right now. I’d guess that half of my 2021 profits are directly, or indirectly, related to Breaking News Chat alerts. They’re that good.

Yes, I’m an investor in STT. But I’d use it even if I wasn’t.

A Warning to Traders Who Want to Break Free

Don’t let promoters fool you. They say, “Diamond hands. HODL! Only the weak sell.”

That’s just WRONG! I’ve had big trades in my career, but my average win is $1,696.* That’s my sweet spot. Many, many of my trades are smaller wins and losses.

As you’ll see below, promoters lie and attack me as part of the process. So be careful. More importantly, if you’ve fallen for their BS, just accept it. Learn from it. Start to focus on the process. Until you accept that you got swindled, it’s nearly impossible to learn a real strategy.

Seriously, psychological studies should be done on these people who can’t get over the fact that they’ve been swindled by unethical promoters & since they’re unable to admit that, they refuse to learn rules that can help them…it really is fascinating, I’ve seen it too many times

— Timothy Sykes (@timothysykes) September 29, 2021

The Trades Behind My Million Dollar Milestone

These are the trades that took me over $1 million in profits for 2021*…

More Breaking News

- WNS Surpasses Market Expectations with Strategic Alliance and Recognition

- Core Scientific Unexpected Surge: Could Acquisition Boost Growth?

- SaverOne: The Latest Updates and Market Trends

Red Cat Holdings Inc. (NASDAQ: RCAT)

RCAT was an ‘early bird catches the worm’ trade. I usually don’t trade premarket. But I was in Europe and awake. I saw the StocksToTrade Breaking news alert about a contract with NASA.

That’s a huge legitimizer for a tiny company. My trade alert said, “I think this can go to the $4s. Goal is to make 5%–10%.” Here’s the chart with my entry and exit…

It got choppy, so I got out for a small win. It did eventually get to the $4s. I didn’t know it would get there, it was just a possibility based on the news. But I’m not that patient so my goal was to make 5%–10%. I made an $875 profit on this 5% win.* (Starting stake: $17,200.)

But that trade didn’t get me over the $1 million mark. It was this trade…

Trans Global Group Inc. (OTCPK: TGGI)

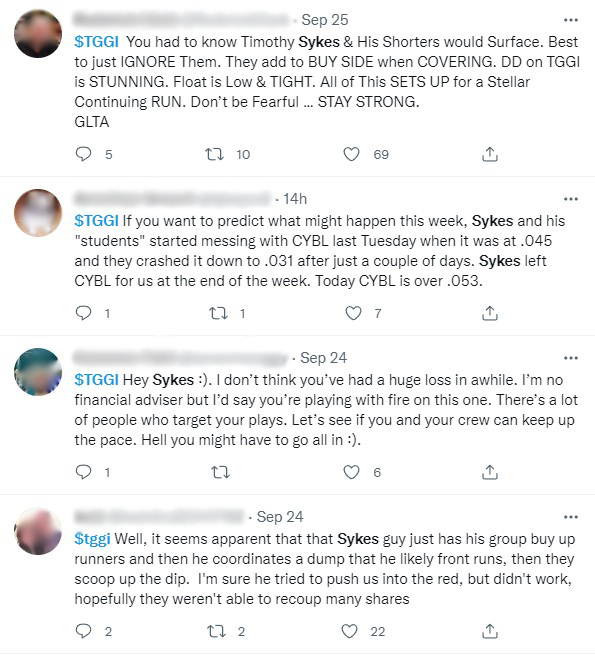

I love that this was the trade that put me over the top. It’s another example of promoters attacking me on social media right before they start dumping shares.

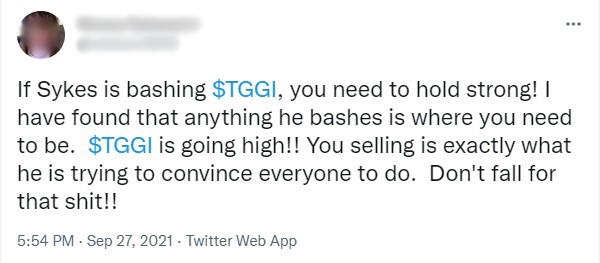

Attack of the Promoters!

They come up with these social media attacks because they want someone else to blame. “Oh, it must be Sykes. They must be conspiring against us.”

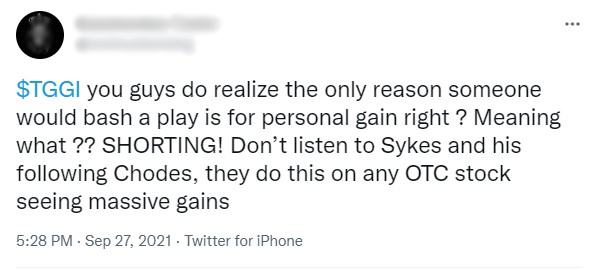

That’s a small sample of the hundreds of tweets by promoters and their followers. I’m not conspiring and I’m not short selling — it’s a joke. This is five or six pumps in a row. So why do they attack me?

I can only speculate why, but my guess is the promoters, and whoever is paying them, is looking to dump shares into big runups, so they need someone to blame. They claim I'm shorting (which I don't do anymore) & I become the moron bagholders enemy instead of the promoters/dumpers

— Timothy Sykes (@timothysykes) September 28, 2021

The promoters give away the fact that it’s probably about to crash. And the reason it crashes is because whoever’s pumping starts unloading.

Here’s one from September 27, the day of my trade, when I was definitely…

NOT Shorting

All my trades are on Profit.ly for anyone to see. I’ve taken one short in the past two years. To put it in perspective, that’s one out of 2,041 trades. (Between September 30, 2019, and September 30, 2021.)

Even when I was a short seller, I would NEVER short a 1- or 2-cent stock. The fees are too high and the risk is too great. These promoters are inept and lazy. Here’s another…

First, I never bashed TGGI — only the promoters. That’s because I want them to do better. Second, I don’t tell anyone what to do. I alert trades to share my thought process. Everything I teach is to help students become self-sufficient. Never follow alerts from anyone. Ever.

Why I Want Promoters to Do a Better Job

Promoters don’t seem to understand that I want them to do a great job. The higher their promoted stocks go, the better the dip buy opportunities.

Finally, they try to divert attention from their pumping so they don’t get investigated…

They’re so incompetent it’s unbelievable. No experienced short seller is shorting a 1-cent stock. Again, thank you promoters for your social media tactics. And for helping me see this obvious pattern.

Now, any time the promoters start attacking me, this is what I’ll think…

- It’s almost the end of the pump.

- Promoters are looking for somebody to blame.

- Watch for panics to dip buy because they’re about to crash the stock.

Enough about promoters…

The Trade That Took Me Over $1 Million in Profits in 2021

Did I mention their tactics open the door to panics? Sure enough, that’s exactly what happened…

I love panic dip buys and I cannot lie. I get a ton of questions on this strategy. It’s not an exact science. Frankly, I make mistakes sometimes. But after 20+ years trading this setup, I’m pretty consistent. This was a $1,379 win.* (Starting stake: $18,616.)

If you want to see how I trade this setup, you’ll love this. Discover how I take advantage of “The 9:30 a.m. Effect” when you register for my…

No-Cost “Panic Profits” Training

One last trade review because it was another great alert from StocksToTrade Breaking News**…

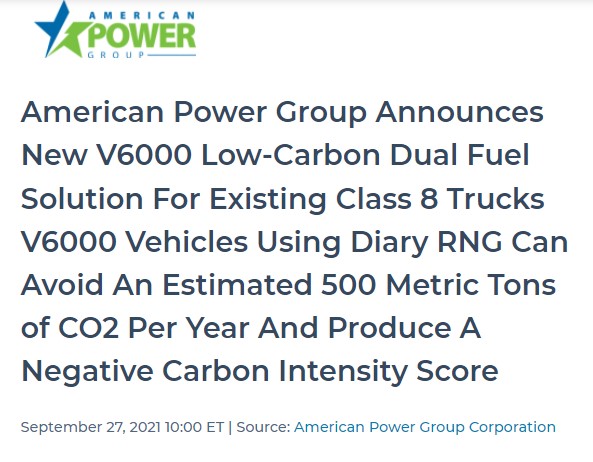

American Power Group Corp. (OTCPK: APGI)

APGI spiked fast based on this news…

It was moving too fast, so I waited for a dip. The dip was fast, too…

I tried to get out near the highs but couldn’t get executed. So I took the $466 win and moved on.* (Starting stake: $1,604). Thanks again, StocksToTrade Breaking News.

Those three trades got me past the $1 million milestone for a second straight year. Again, I’m grateful and happy to donate 100% of my profits to charity.*

Trading Tools and Resources

I’ll keep this simple…

- Use StocksToTrade Breaking News Chat.

- Watch the no-cost Panic Profits training.

- Learn the basics of trading penny stocks with the 30-Day Bootcamp.

Dip buys and StocksToTrade Breaking News Chat spikes are working for me right now. With the right tools and strategy, you can trade from anywhere. Even if you have a busy schedule. Do it!

What do you think of the trades that got me past the $1 million milestone in 2021? (And the crazy promoter tactics!) Comment below — I love to hear from ALL my readers!

DISCLAIMERS

*While Tim Sykes has enjoyed remarkable success trading stocks over the years, earning an aggregate sum of over $7.2 million in trading profits between 1999 and 2021, his primary income derives from the sale of financial education products and subscription services offered by various businesses and websites in which he has an ownership stake.

Results are not typical and will vary from person to person. Making money trading stocks takes time, dedication, and hard work. Most who receive free or paid content will make little or no money because they will not apply the skills being taught. Any results displayed are exceptional. We do not guarantee any outcome regarding your earnings or income as the factors that impact such results are numerous and uncontrollable.

It takes years of dedication, hard work, and discipline to learn how to trade. Individual results will vary. Trading is inherently risky. Before making any trades, remember to do your due diligence and never risk more than you can afford to lose.

**Tim Sykes has a minority ownership stake in StocksToTrade.com.

Leave a reply