Allogene Therapeutics Inc. (NASDAQ: ALLO) spiked 160%* in the last three trading days. Starting Friday, February 14.

There were multiple opportunities to profit along the way …

The spike started after the company announced bullish trial data from its treatment for Lymphoma during after hours on February 13.

Look what happened next … On the chart below, every candle represents one trading minute:

Not sure how to build a position on +100% runners like this?

I can teach you.

Trade Opportunities

The hottest stocks in the market like to follow specific trade patterns.

The patterns are a manifestation of human nature on a stock chart.

See … People behave predictably when they’re stressed. Like when they have a couple thousand dollars in a stock that’s spiking +100%.

As traders, my students and I step back from the emotion and recognize the larger framework that’s created.

The patterns are always the same. Ever since I discovered this framework during the dot com boom, over two decades ago.

And in 2023, when AI rocked the market, I immediately saw the potential for AI to help my students learn these patterns.

After a few months of prompting the AI over and over again, it started to learn my process for profits.

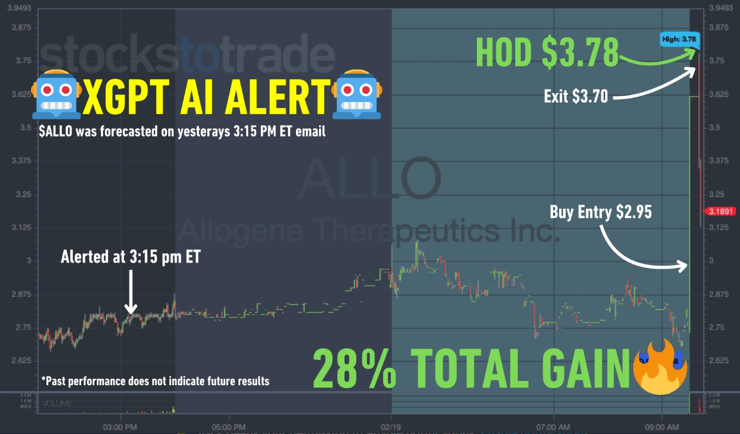

The AI, XGPT, alerted two trades on ALLO during the recent spike. One trading day after the other. Monday was closed for President’s Day.

Take a look at the alerts below. My AI can find support levels on the hottest stocks and then give recommended buy and sell points that follow my patterns!

More Breaking News

- Red Cat Holdings Poised for Growth as Drone Orders Surge

- HPE’s Strategic Partnerships and Expansions Set to Boost Market Trajectory

- SunOpta’s Acquisition Boosts Stock by 32% Amid Key Industry Moves

- Coty Faces Uncertainties with Earnings Miss and Strategy Revisions

It’s incredible how far this technology has come.

Here’s the alert from Friday, February 14. Every candle represents one trading minute:

Here’s the alert from Tuesday, February 18:

Follow my trade process on the market’s next hot stock spike …

>> Use The Trade Alert From XGPT <<

You can also prompt the AI with your favorite stock at any time. It will give you a trade plan as if you asked me directly!

It’s only a matter of time until there’s another MASSIVE spike. Take a look at my post on X below:

Literally EVERY single day there's a giant runner, today it's $JTAI which I nailed from the $5s (profiting nicely but selling too early as usual) and now it's allll the way into the $11s, but I'm even prouder of SEVERAL upcoming https://t.co/occ8wKmlgm students who absolutely… pic.twitter.com/ZgdhiCYG5Y

— Timothy Sykes (@timothysykes) February 19, 2025

Cheers.

*Past performance does not indicate future results

Leave a reply