The three-comma club has a new member … and the Kanye West billionaire controversy is on.

Recently, Kanye made the “Forbes” Billionaires list — that news would excite most entrepreneurs. But not Kanye.

He claims he’s been a billionaire for years, and that “Forbes” underestimated his worth. So who’s right? Don’t worry, we’ll get to that.

But first … Why take the time to look at Kanye West’s success?

Similar to my in-depth look at his fellow billionaire (and coincidentally, sister-in-law) Kylie Jenner, there’s a lot to learn from Kanye’s rise to riches.

By looking at what he did to get there, it can inspire you to expand your own knowledge and improve your chances of becoming successful.

Let me know if you like these research reports — share it on social media and tag me!

Table of Contents

It’s Official: Kanye West Is a Billionaire

2026 Millionaire Media, LLCRecently, Kanye West made the “Forbes” Billionaires list. He ranks in at #1,808 with an estimated net worth of $1.3 billion. It’s been an interesting journey, to say the least.

Who Is Kanye West?

Unless you don’t have internet, social media, or any news access, you’ve probably at least heard of Kanye West. Among his many titles? Rapper, fashion designer, entrepreneur, and of course, Mr. Kim Kardashian.

He’s been preaching to the world that he’s a billionaire for a while … Then again, he’s been known to exaggerate in the past. So, again, who’s right?

The Kanye West Billionaire Controversy

The controversy started in 2019 when “Forbes” featured Kanye in its cover story. The article focused on the stratospheric success of his fashion line Yeezy.

But the “B” word wasn’t mentioned in the article — and Kanye wasn’t pleased. He publicly protested: “When I did Forbes, I showed them a $890 million receipt and they still didn’t say ‘billionaire.’”

He’s not shy about labeling himself a billionaire. As he continued, “When people say it’s crass to call yourself a billionaire, I say I might legally change my name to Christian Genius Billionaire Kanye West for a year until y’all understand exactly what it is … It will be on the license plate.”

Then, in March 2020, “Forbes” released its annual Billionaires list. Prominently not included? Kanye — who once again took issue.

As he put it in a text that “Forbes” tweeted, “You’re toying with me and I’m not finna lye [sic] down and take it anymore in Jesus name.”

It probably didn’t help that his (younger) sister-in-law Kylie Jenner was on the list, either.

Claiming a worth of more than $3 billion, Kanye gave “Forbes” access to his records. What did they find?

Is Kanye West Really a Billionaire? Yes, But It’s Complicated…

Kanye’s been known to blow things out of proportion in the past … Like when he upstaged Taylor Swift’s acceptance speech at the MTV Music Awards…

But in this case, it turned out he was right. He is a billionaire, largely owing to his stake in Yeezy, a clothing and shoe line.

However, he may not be the multi-billionaire he’s boasted to be in the past. At the time of this writing, the “Forbes” Billionaires list logs Kanye at a net worth of $1.3 billion.

Per “Forbes,” this still doesn’t appease Kanye. In an article, they note, “’It’s not a billion,’ West texted us last night. ‘It’s $3.3 billion since no one at Forbes knows how to count.’”

How Does “Forbes” Determine Billionaire Status?

Before we talk about how Kanye made it all happen, let’s talk about how “Forbes” determines billionaire status.

In 2012, they revealed a little bit about the methodology behind their research.

There are as many as 50 reporters and investigators from multiple countries involved in the process. That process includes meeting with candidates and their people, like attorneys and financial advisors. The idea is to get as much info as possible for a solid valuation.

What goes into a person’s net worth? Things like stakes in companies, property, art, and investments. Of course, establishing that is much easier with someone who owns a large or mega-cap public company … say, Amazon or Berkshire Hathaway.

It’s far from foolproof and requires a lot of research … This could in part explain why Kanye wasn’t listed until recently.

Kanye’s Humble Beginnings

Kanye wasn’t born in the limelight … In fact, he had a pretty unremarkable middle-class upbringing.

Kanye was born in Atlanta, and his mother raised him mostly in Chicago. She acted as head of the English Department at Chicago State University before she retired to be his manager.

He was always drawn to the arts. He started producing music in the 1990s, moving up the ranks and working with artists including Alicia Keys, Janet Jackson, Jay-Z, and Ludacris.

His transition to rapper started with a crash — literally. In 2002, he reportedly fell asleep at the wheel, resulting in a collision. His jaw was shattered and had to be wired shut. The experience changed him … And inspired him.

Two weeks later he recorded a song, with his jaw still wired shut. It was the basis of his first album, which became a hit. That started his rise to superstar. But it wasn’t just his musical talent that made him a star or a billionaire…

What Really Made Kanye Famous

2026 Millionaire Media, LLCHonestly, Kanye’s larger-than-life personality is what really makes him famous.

I mean, we’re talking about a guy who nicknamed himself Yeezus and wrote a song called “I Am a God.”

For better or worse, he’s not afraid to let his voice be heard. Here are a few crazy stunts he’s pulled over the years…

2004: At the American Music Awards, Kanye really thought he should win the Best New Artist Award … So much so, that when country singer Gretchen Wilson won, he got up and left the show. He later commented, “I felt like I was definitely robbed … I was the best new artist this year.”

The result? A whole lot more talk about Kanye than the actual award winner.

2009: Taylor Swift won the “Best Female Video” at the MTV Video Music Awards — and Kanye wasn’t happy about it at all. He jumped on stage, grabbed the microphone, and proclaimed that Beyoncé should have won the award. He got kicked out of the ceremony … But it also made him a household name.

2013: On Kim Kardashian’s birthday, Kanye rented out AT&T Park in San Francisco to stage an elaborate proposal, complete with Jumbotron, orchestra, and plenty of friends and family looking on.

2015: In an acceptance speech at the MTV Video Music Awards, Kanye said, “Y’all might be thinking right now, ‘I wonder did he smoke something before he came out here?’ And the answer is yes, I rolled up a little something, I knocked the edge off.” In the same acceptance speech, he announced his plans to run for president.

Also in 2015, he publicly proclaimed his financial woes, famously releasing a wave of tweets claiming that he was $53 million in “personal debt” and demanding that Facebook’s Mark Zuckerberg invest $1 billion in him.

A ton of people thought it was pathetic … But it also got a ton of attention.

So are these the actions of a crazy, unhinged individual? Or a series of brilliant publicity stunts?

The Power of Publicity

Kanye seems to take the attitude that you shouldn’t read what they write about you … Instead, just measure it in inches.

Like it or not, these crazy moments have only increased the mythology around Kanye. You can’t buy that kind of name recognition.

For Kanye, that powerful personal branding equals infamy, attention … and plenty of profits from album sales and profitable partnerships.

Social media and press can be extremely powerful tools.

You’ve seen it before.

For example, when Elon Musk tweeted that he thought Tesla, Inc.’s (NASDAQ: TSLA) stock was priced too high, it created huge moves in the stock.

Not all attention is bad, though. Consider the story of how my friend Brother Nature went viral on social media … He used his fame to change the world for the better.

In short: don’t underestimate the power of public attention.

What Makes Kanye So Rich?

Touring Kanye’s personal assets is an adventure in fashion, music, mansions, cars, crazy public housing, and yes, even livestock. Let’s explore what makes him so wealthy.

More Breaking News

- Battalion Oil Stock Surges Amid New Gas-Treating Agreement

- American Airlines Flexes Financial Muscle with Strong Liquidity and Debt Reduction

- Sony’s Q3 Earnings Beat Expects Increased Market Confidence

- Strategy Growth: Bitcoin Ambitions Spark Investor Optimism

Yeezy

In spite of Kanye’s notoriety as a music artist, most of his wealth actually comes from the line of sneakers he produces with Adidas (OTCQX: ADDYY).

Yeezy isn’t a simple asset. On the one hand, Kanye owns it. On the other hand, it’s strongly tied to Adidas, which is responsible for production, marketing, and distribution.

There are two parts to Yeezy: an apparel line and a shoe line. The shoe line is where the money is. According to “Forbes,” the shoe line is said to have made about $1.5 billion in 2019.

Kanye’s agreement with Adidas involves 15% in royalties. That’s pretty amazing when you consider that Michael Jordan’s royalty rate for Nike’s Air Jordan series is more like 5%.

According to “Forbes,” Kanye’s stake is likely “worth about $1.4 billion. But it’s a private, highly illiquid $1.4 billion; our rule-of-thumb for private assets like that is to lop off at least 10%. That’s $1.26 billion.”

Music Career

Kanye isn’t just a shoe mogul … He’s also considered the highest-earning hip-hop artist, bringing in about $150 million in 2019.

Let’s put that in perspective. Number 2 on the list is Jay-Z, who reportedly made $81 million in 2019. Number 3 is Drake, who’s reportedly made $75 million.

Other Investments

When Kanye submitted his financials to “Forbes,” there was some pretty interesting stuff on the list, including:

- About $81 million in “buildings and improvements

- Nearly $21 million in land

- About $17 million in cash

- Around $35 million in stocks

- $3,845,162 in vehicles

- $297,050 in livestock … They live on his land in Cody, Wyoming, BTW.

You Can’t Trade Kanye, But You Can Trade Adidas

No, you can’t directly trade Kanye West. But if he were a stock you can bet he’d be crazy volatile.

But you can trade Adidas, the company he partners with. How has Yeezy affected the stock?

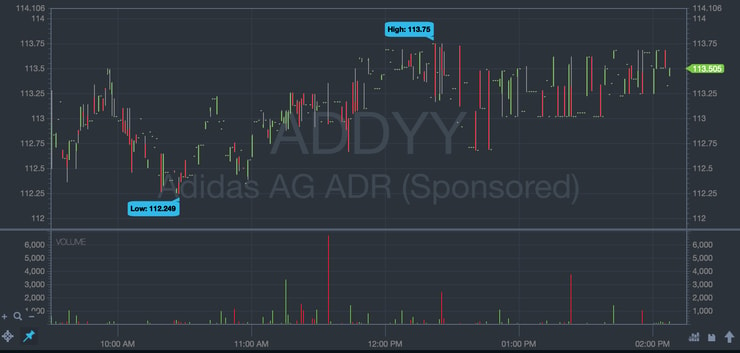

Adidas (OTCQX: ADDYY)

Adidas officially announced its collaboration with Kanye in December 2013. At the time it didn’t have a huge impact on the stock, which was trading in the high $50s and low $60s.

The stock actually dipped in the time between the announcement and the official product release in 2015. But once the initial product release sold out in about 10 minutes in early 2015, the stock started to go up.

Between the beginning of 2015 and the end of 2015, the stock went from the low $30s to close to $50. Check it out:

Since then, the stock has increased steadily — the current share price is in the $110s.

Coincidence? Kanye probably doesn’t think so.

Wanna Learn More?

If you liked this research report, be sure to check out my report on Kylie Jenner, where I talk about how she’s a self-made billionaire thanks to her insane social media following and beauty empire.

Let me know if you like reading reports like this — if it gets good feedback, I’ll keep doing it to help you learn!

What lessons did you learn from this report? Are you ready to invest in your own personal success? Leave a comment and let me know your thoughts!

Leave a reply