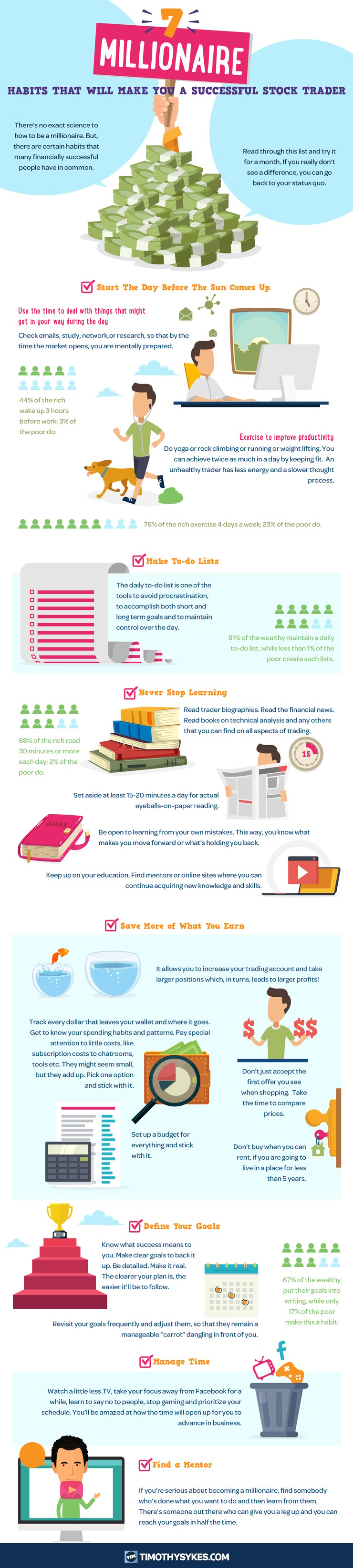

Sorry to say, but there’s no exact science to how to become a successful stock trader. However, that having been said, there are specific habits that many of my millionaire trading challenge students have in common. See for yourself how cultivating them can improve your career and your chances of making millions!

- Start the day before the sun comes up. Waking up early gives you time to get centered before the market opens. Use this time to take care of errands, work out, and perform necessary research before the market opens. This way, when the market opens, you’ll have improved mental clarity and focus, and you can devote yourself entirely to making money!

Staggering statistic: 44% of the rich wake up 3 hours before work; only 3% of the poor do.

- Make to-do lists. A daily to-do list is one of the things that sets successful traders apart from those who fail. A to-do list helps you stay accountable to both long and short-term goals, and it helps your attention from straying and prevents procrastination.

Staggering statistic: 81% of the wealthy maintain a daily to-do list; less than 1% of the poor do.

- Never stop learning. Once you stop learning, you start dying! Learning about everything you can, and in every way you can (books, news, podcasts, etc) will not only keep you current, but it will keep your mind nimble. This is important to stay relevant in the market and to generate great ideas for investments!

Staggering statistic: 88% of the rich read 30 minutes or more per day; only 2% of the poor do.

More Breaking News

- Strategic Acquisition Expands Momentus Inc.’s Horizons

- European Wax Center Signals Confidence with Financial Projections Boost

- SoFi Technologies Stock Surges: Q4 Wins Spark Analyst Upgrades

- Vale S.A. Stock Soars as Goldman Sachs Raises Price Target

- Save more of what you earn. Saving more of what you earn can help you improve your position as a trader. Ultimately, this means that even by following the same processes, you’ll make more money over time because you have more money to trade with. Keep an eagle eye on your expenses, and get better about saving: it can add up to a big difference in your trading career!

- Define your goals. Get more specific than just “become rich” with your goals. Make clear, detailed goals that feel real and motivating to you. The more clear your plan is, the easier it is to follow. Goals are like your own personal road map to success!

Staggering statistic: 67% of the wealthy put their goals into writing; only 17% of the poor make this a habit.

- Manage your time. You have more time to trade than you might think. Binge watch TV slightly less, get off of Facebook and prioritize trading. You’ll be amazed by the effects of devoting more time to trading and studying on your overall career.

- Find a mentor. A mentor is someone who is further along in their career than you. You can learn what they did right, and what they did wrong. This can help give you career shortcuts and help you from losing money! The benefits of a mentor simply cannot be overstated.

How many of these millionaire habits do you have? What can you work on in 2018? Leave a comment with your answer and be truthful as to become my next millionaire trading challenge student, you’re going to need to be honest with yourself…and with me too!

Leave a reply