- What are penny stocks and how can you trade them? Read on for a full guide.

- Wall Street fat cats may laugh at my trades — see why my top students and I couldn’t care less.

- Traders just like you can learn to trade these stocks. Find out if you have what it takes!

Let’s be real. You probably found this post by googling something like “how to get rich quick trading penny stocks.” Or maybe you watched “The Wolf of Wall Street” and got intrigued.

Sorry. You won’t get rich quickly in this niche. But I can show you what’s possible with the right rules. And I can teach you what I’ve learned from more than two decades in the stock market.

First, let me answer a big question…

Table of Contents

- 1 Why Learn From Me?

- 2 Penny Stocks Trading Essentials for 2024

- 3 4 “Secrets” to Profit With Penny Stocks in 2024

- 4 Penny Stocks and Penny Stock Trading: Definitions

- 5 How Penny Stocks Work

- 6 Benefits of Penny Stocks

- 7 How Do Beginners Buy Penny Stocks?

- 8 Best Penny Stocks to Watch in 2023

- 9 Top Penny Stocks by Stock Exchange

- 10 Examples of Recent Penny Stock Runners

- 11 How to Buy and Sell Penny Stocks Online?

- 12 Is Trading Penny Stocks Illegal?

- 13 Know the Rules: Penny Stocks and the SEC

- 14 The Right Way to Start Trading Penny Stocks Today

- 15 Is This Penny Stock Trading Guide Right For You?

- 16 Penny Stocks: Know the Full Story

- 17 Is It Worth It to Learn to Trade Penny Stocks in 2024?

- 18 Penny Stocks: Know the Risks of Trading Them

- 19 Want to Trade Penny Stocks? The Right Mindset Is Crucial

- 20 How Can Investors Find Penny Stocks?

- 21 What is the Best Way to Make Money in Penny Stocks?

- 22 How to Trade Penny Stocks: Start With the Basics

- 23 Must-Know Stock Terms

- 24 What Are the Best Brokers for Trading Penny Stocks in 2024?

- 25 How to Find Top Penny Stocks to Trade

- 26 Develop Your Unique Trading Strategy for Penny Stocks

- 27 My Top Tips for Trading Penny Stocks

- 28 Start Learning How to Trade Penny Stocks — Apply for My Trading Challenge

- 29 Learn the Key Indicators for Trading Penny Stocks

- 30 The Key to Trading Penny Stocks: Chart Patterns

- 31 Stock Chart Patterns

- 32 My Top Chart Patterns for Trading Penny Stocks

- 33 How to Use Financial Ratios for Trading Penny Stocks

- 34 Bottom Line: Start Your Penny Stock Journey and Gear Up for 2024 Trades

Why Learn From Me?

I’ve made millions trading penny stocks. That’s not typical. But other traders have followed in my footsteps…

- Like Tim Grittani, who’s up more than $13.5 million in profits…

- And Mark Croock, who’s made more than $4 million in profits…

- Or Michael Goode, who’s made over $2.6 million and thought I was full of BS before he tried my strategy.

- And I can’t forget Roland Wolf, who’s over $1.1 million in profits.

In the past few years, several young traders who have been through my Trading Challenge hit big trading milestones.

- Matt Monaco has made over $1.9 million in profits.

- Power couple Jack Kellogg and Mariana Hincapie are up over $12.6 million and $1.6 million respectively.

- Kyle Williams has made over $5 million.

Do I have your attention? Good. Let’s talk about one of the most hated — and misunderstood — trading styles out there: day trading penny stocks.

Penny Stocks Trading Essentials for 2024

It sounds counterintuitive, but forget about the money when it comes to trading penny stocks. Instead, focus on these three keys first — Let’s look at each more closely. knowledge, preparation, and experience.

#1. Build Your Knowledge Account

To become a top trader, you must focus on your education first.

I always say to build your knowledge account first. The money can come once you have the right foundation.

Penny stock trading isn’t about investing in value stocks. Their revenue means next to nothing to me — so does all the content that analysts produce.

I don’t care about their dividends or other forms of compensation they offer. Penny stock trading isn’t about accruing interest on your money…

It’s about recognizing patterns, trading with discipline, and building solid trading plans.

How do you do that? That’s where Step #2 comes into play…

#2. Prepare, Prepare, Prepare

My strategies involve trading the most volatile stocks in the market. You must come prepared.

See how I prepare for every trade here.

Then, go through my “Trader Checklist Part Deux” guide. It explains, in detail and with examples, the seven indicators I use for every trade.

#3. Gain Experience

You can’t gain enough experience if you can’t stay in the game. Unfortunately, most traders blow up their accounts before that happens.

No matter how much you study, you need screen time and trade time. So I suggest new traders start small and size up over time. Learn to take singles and cut losses quickly. Focus on the process.

You can also start with paper trading. Platforms like StocksToTrade (which I helped design) have paper trading simulators for practice.

All successful traders have go-to patterns and practice risk management. They established that through experience.

Top tip: All my top students studied and practiced for years before finding success.

Ready to dig in?

4 “Secrets” to Profit With Penny Stocks in 2024

First of all — there are no secrets when it comes to trading. Becoming a self-sufficient trader requires hard work, patience, and a bit of grit.

Here are the trading pillars I teach my students…

Use Technical Analysis

Get intimate with candlestick patterns, trend lines, and resistance levels. Utilize articles and data to strengthen your understanding. This isn’t fortune-telling — it’s about recognizing patterns and making informed decisions.

Stay Informed With Market Trends and Trending Industries

Knowledge is power. Read, watch, absorb. Whether it’s oil and gas or the next hot tech trend, stay updated. Subscribe to a reputable newsletter and use it.

Implement Effective Risk Management Strategies

Set strict stop-loss positions. Never risk more than you can afford to lose. This isn’t just advice — it’s survival.

Cultivate a Strong Trading Mindset

The biggest enemy you’ll face is between your ears. Trading is an emotional game — don’t let fear or greed control you. Patience and discipline are your allies.

Penny Stocks and Penny Stock Trading: Definitions

Despite the name, ‘penny stock’ actually refers to a stock trading at under $5 per share.

Yes, they can trade for fractions of a penny, but a $4.95 stock is also considered a penny stock.

Pennystocking as a verb means trading penny stocks. Sometimes it follows the same trajectory as buying and selling regular stocks of large-cap companies like Google or Amazon.

But the percent change of large caps is too minimal for me. I want big price swings!

Pennystocking is a unique trading style that requires a specific strategy and mindset. While penny stocks are often associated with high risk, they also present unique opportunities for day trading. The volatile nature of these stocks can lead to significant gains if traded correctly. It’s crucial to understand the market dynamics and develop a solid trading strategy — here’s how you day trade penny stocks!

How Penny Stocks Work

What if I told you I don’t believe in any of the penny stocks I trade?

I know. It’s cynical and counterintuitive.

Generally, people think trading is about finding a company to believe in, then buying and holding its stock for years.

Penny stocks are the opposite. Most of them eventually fail. But before they fail, they can experience massive spikes.

Because of their small size, these companies feel the impact of certain news catalysts in a big way.

Trading penny stocks is not just about buying low and selling high. It’s about understanding the market, analyzing trends, and making informed decisions. A well-defined strategy can make a significant difference in your trading outcomes.

Here’s how I find penny stocks pre-spike.

Benefits of Penny Stocks

Why are investors drawn to penny stocks? There are a few reasons…

These aren’t blue-chip stocks. We’re talking a few bucks, sometimes pennies per share. The entry barrier is low, and the upside can be significant.

Reason 2: Easy to See Gains

Penny stocks are volatile. While this presents risks, it also provides the opportunity for rapid gains.

Reason 3: Possible Price Growth

Imagine getting in on the ground floor of the next Apple. It’s a long shot, but the possibility is enticing.

Unlike well-known stocks, penny stocks have less competition from institutional investors.

Reason 5: Can Begin Trading with a Small Account

You don’t need a hefty bank account to start. This is where many investors cut their teeth in the stock market.

How Do Beginners Buy Penny Stocks?

First, you’ll need a brokerage account. From there, you can buy and sell stocks online, managing your investments and watching the market trends.

Best Penny Stocks to Watch in 2023

The hot market in early 2021 gave us crazy spikers and meme stock volatility. It was a wild time to be a day trader.

Things haven’t been as insane since. But there’s always some action — and something to learn.

The market has regained most of its 2022 losses — led by the brand-new AI hot sector.

The Nasdaq and tech stocks led the recovery. This was well-needed after the banking crisis that started off the year and rocked the financial sector.

Other sectors have also been picking up. Consumer discretionary stocks have been hot, led by cruises. Biotech stocks are hot as always.

Short squeeze supernovas are back on the market’s radar. Carvana Co. (NYSE: CVNA) has been on a tear, squeezing up 700% through mid-July.

My students and I stay prepared. When the market provides opportunities, we’re ready.

After earning $2.2 million in 2020 and 2021, I made $133,000 in 2022 while most traders lost money.

Even when the market’s slow, you can find plays. And things can heat up at any time. Are you ready?

Top Penny Stocks by Stock Exchange

OTCs are my favorite penny stocks to trade. But you can find penny stocks on the NYSE, Nasdaq, and AMEX, too. Below are the top penny stocks I’m watching, by exchange.

Top 5 NYSE/AMEX Penny Stocks

Top 5 Nasdaq Penny Stocks

Top 5 OTCQB/OTCQX Penny Stocks

Top 7 OTC Pink Sheet Penny Stocks

Sign up for my no-cost weekly watchlist here.

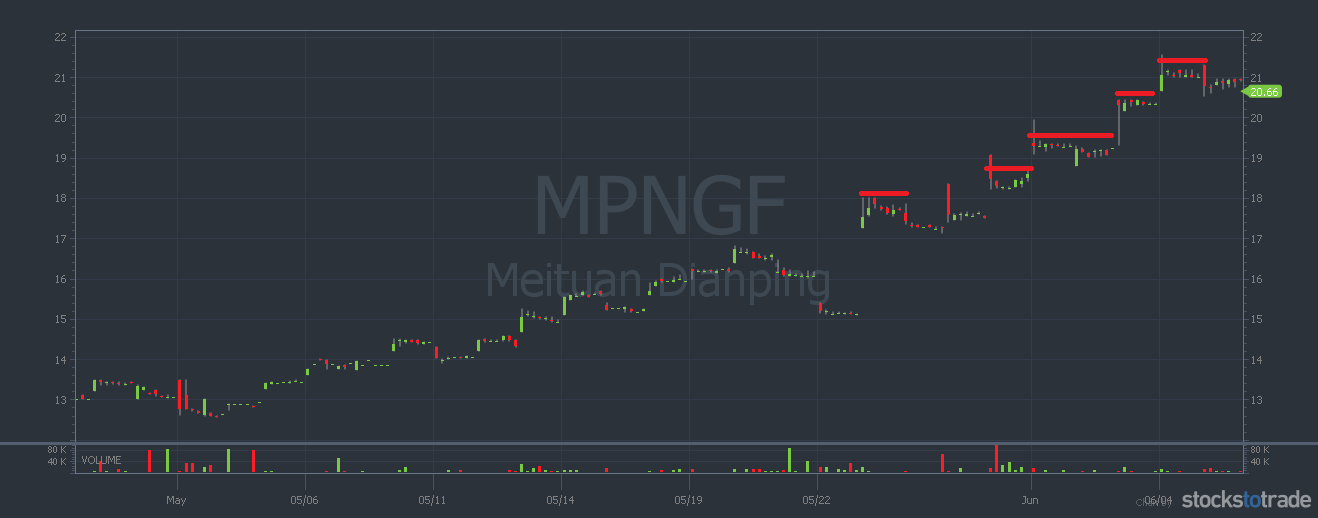

Examples of Recent Penny Stock Runners

One reason I love penny stocks is their ability to spike — 100%, 200%, or even 300% in a day.

The three stocks below are examples of recent penny stock runners.

Keep in mind I don’t consider any penny stock company to be a good long-term investment. To me, penny stocks are trading vehicles. So as you study these recent penny stock runners, notice how fast they can fall, too…

One World Universe Inc. (OTCPK: OWUV)

This stock went on a massive run in December 2021 with impressive strength.

It’s a joke of a company with a website that’s “Under Construction.” But it’s in the metaverse and partnered with the NFL. Plus, this press-release machine is good at hype.

I traded this for a $552 win (starting stake $10,822) on a first green day.

Engage Mobility Inc. (OTCPK: ENGA)

Here’s a perfect example of a sketchy shell company.

Some penny stocks exist solely to bring other companies public. They’re called shell companies. It’s one way a private company can offer shares in the public market without an IPO.

I traded it for a $280 gain (starting stake $1,350) after the StocksToTrade Breaking News Chat team alerted an acquisition. That’s over 20% profit!

Breaking News is my go-to weapon for finding plays. It alerts me to important news articles in stocks and the overall economy, giving me a crucial trading edge. The things it spotlights range from new products to photos of officials doing noteworthy things…

Roughly half of my recent trades have been direct effects of Breaking News.

Get a 14-day trial of Breaking News Chat here — only $17!

How to Buy and Sell Penny Stocks Online?

The process is simple — select the stock, decide the number of shares, and execute the trade. Brokerages have made this process user-friendly.

Is Trading Penny Stocks Illegal?

Trading penny stocks is completely legal.

But penny stocks can be super shady.

Yes, some trade on big exchanges like Nasdaq. But many trade through OTC (over-the-counter) exchanges.

There’s a world of difference in terms of standards between OTCs and Nasdaq- or NYSE-listed stocks. The regulations aren’t as stringent for OTCs, which means there’s more potential for fraudulent behavior.

Here’s the thing … As a penny stock trader, this can work in your favor.

There are a ton of schemes around penny stocks, like pumps and overhyped promotions … Your job is to see through them and take advantage of the short-lived spikes they can create in the market.

I know the general public frowns on this niche. I’ve actually had people back away from me upon learning what I do for a living. I chalk it up to ignorance.

Trading is different than investing. In investing, people mitigate risk by diversifying their portfolio — buttressing the riskier picks with more conservative investments like dividend stocks. They can provide a steady income stream and reduce your overall risk. Learn more about this approach in this guide on investing in dividend stocks.

There are legitimate and legal ways to profit in penny stocks. But you MUST…

Know the Rules: Penny Stocks and the SEC

The SEC’s rules for penny stocks vary.

Listed stocks (NYSE, Nasdaq, etc.) have strict listing requirements.

Stocks trading on the OTC markets don’t have as many requirements. Pink sheet stocks have just one: register a Form 211 with the OTC Compliance Unit.

That’s why it’s a buyer-beware market and why I get in and out of trades on these stocks quickly.

I don’t invest in penny stocks — never hold and hope.

The Right Way to Start Trading Penny Stocks Today

Never believe that these tiny companies will change the world. You’ll decimate your account when the stock inevitably crashes and burns. I know from personal experience. (More on that in a bit.)

Sure, a penny stock could turn into the next big thing. But it probably won’t.

So what’s the right way to trade penny stocks?

Expect the worst. Know that most of these companies won’t succeed … but they could experience some huge spikes before they fade into oblivion.

There are two broad strategies to trade penny stocks: long or short.

- Going long: Despite the term, “long” in my trading strategy refers to a short-term, buy-and-sell trade. For me, it’s a short-lived affair — intense, then over. And it can happen again with a repeat runner. I may hold overnight or through the weekend but not for weeks or months.

- Going short: This means short selling a stock. As a short seller, you believe the price will drop. It’s still buying low and selling high … but in reverse.

Is This Penny Stock Trading Guide Right For You?

Again, this guide isn’t for people who want to get rich quickly.

No matter what some jerk says in a YouTube ad, there are no guarantees in the stock market. For every person who gets rich, hundreds — even thousands! — blow up their accounts.

Most traders fail. This guide is for those who want to trade smart.

It’s for traders who want to understand penny stocks and work toward their goals the right way … over time and with discipline.

Boring, right? Trading isn’t always fun. Executing an order can be exciting … But trading is a lot of research, scanning, keeping watchlists, working hard, and waiting for the right setups.

I’ll be real. For me, trading penny stocks was about getting rich … at first. And I’ve made over $7.4 million trading these sketchy stocks.

Early on, I bought a bunch of fancy cars and fulfilled my childhood dream. I’m over that. Now I donate all my trading profits to charity. And these days, I get the most joy from teaching and my charity Karmagawa.

My point? Goals can change. Trading penny stocks could be part of you reaching them, whatever they are.

Penny Stocks: Know the Full Story

Again, these are NOT stable, established companies. They’re usually small. They might be new and in an up-and-coming sector or even be in danger of going out of business.

This part’s important: Unless these companies list on a bigger exchange, they’re not required to make the same SEC filings as their bigger counterparts.

So you can’t take things for granted with penny stocks as you might with bigger companies.

Again … penny stocks can be sketchy.

But it also means that I think you can learn to trade penny stocks faster than larger securities.

The low price point means you can start trading with a small account and learn as you go. Yes, your returns may be small … but so are your losses. It’s one way to scale up slowly, over time.

Is It Worth It to Learn to Trade Penny Stocks in 2024?

Listen, I’m biased. Penny stocks have made me millions.

Are they worth it? Can they help you grow your account? I think so. But these are possibilities, not promises. You need to know these things:

- Penny stocks are NOT for every trader.

- Traders need a solid work ethic.

- You have to learn to think for yourself.

- Always be willing to do research.

- Discipline is mandatory.

- You’ll learn a LOT over your entire career.

- You must build trading plans and stick to them.

If you can’t do ALL of these things, then penny stocks probably aren’t worth it for you.

But if you’re willing to educate yourself and become a self-sufficient trader, then yes, I think it’s worth it.

Penny Stocks: Know the Risks of Trading Them

All trading is risky. That means penny stocks too.

- They’re generally not as regulated as large-cap stocks.

- Penny stocks are volatile.

- Most of these companies fail.

- Pump-and-dump schemes are rife.

- There’s a lack of information and reporting.

- Many of these stocks have poor liquidity.

Guess what? I don’t like risk. You don’t have to either…

How to Minimize Risk When Trading Penny Stocks

To me, you should hate risk so much that you’ll do everything possible to avoid it!

It’s simple: If you take huge risks in the stock market, you stand to lose a huge amount of money. In some cases, you could lose even more than you invested in the first place.

Not my idea of a smart trading strategy.

If you want to stay in the game for the long run, practice smart risk management.

For example, never risk more than 10% of your trading account on a single play. If you have a small trading account, maybe limit that to 1%.

Set boundaries based on your risk tolerance.

Then, write down your own rules and stick to them.

Need help figuring out the rules? Start here.

Want to Trade Penny Stocks? The Right Mindset Is Crucial

Trading penny stocks requires a specific mindset, especially when it comes to failure. If you always need to be right, this isn’t the game for you.

In trading, failure is unavoidable. I’ve failed over and over.

Don’t believe it? In my book, “An American Hedge Fund” I recount some of my biggest mistakes and losses in full detail.

Get your copy for no cost here.

Instead of trying to avoid failure, learn from it. If you’re willing to work hard, accept failure, and learn from your mistakes, pennystocking could be right up your alley.

How Can Investors Find Penny Stocks?

Many tools can help you track down promising penny stocks. Use screeners to filter by price, volume, or specific industries. Read analyst reports and company filings.

What is the Best Way to Make Money in Penny Stocks?

There’s no one-size-fits-all answer here. Some traders go long, others go short. Some play the news, others focus on technical analysis. The best strategy? The one that works for you.

How to Trade Penny Stocks: Start With the Basics

As I mentioned before, you must start your trading career with an education.

You need to learn what penny stocks are, how they work, and how to identify their patterns.

A good starting point? This guide and my student Jamil’s book “The Complete Penny Stock Course.”

It covers all the basics and more. From there, if you want to take it to the next level, consider joining my Trading Challenge.

Once you’re ready to start trading, you need a few key things…

Stockbroker

To trade stocks, you need a brokerage account. Your broker is the gateway between you and trades. Choose a good one … Do your research and check out this guide for more tips.

Stock Screener

A stock screener can help you narrow down the many stocks available to trade. I use StocksToTrade, which can also help with the next item…

Charting Software

Before every trade, you need to perform a detailed stock analysis.

There are two key types of stock analysis: fundamental analysis and technical analysis.

StocksToTrade can help you do both: it has awesome charting software and links to stock news, SEC filings, and even social media mentions.

With day trading penny stocks, technical analysis — reading the charts — matters more. Chart patterns show me how a stock’s performed over weeks, months, or even years. That helps me build my…

Trading Plan

A trading plan is where you plot out entry and exit points, risk, and profit goals. Ideally, you base the plan on careful research and stick to it.

Must-Know Stock Terms

Trading is harder if you don’t understand basic trading terms. Here are a few key ones:

- Buy: To buy shares of a stock

- Sell: To sell shares of a stock

- Short sell: To sell borrowed shares

- Buy to cover: To buy back shares you’ve sold after borrowing

- Bid: The highest price someone will pay to buy

- Ask: The lowest price someone will accept to sell

- Spread: The difference between the bid and ask prices

- Uptick: The following trade results in a higher price

- Downtick: The following trade results in a lower price

Want more? Every trader should know these terms.

Where Can Traders Buy and Sell Penny Stocks?

You can find some penny stocks on major exchanges, but certain stocks don’t meet the requirements of the bigger exchanges due to size, profits, and so on.

Companies like these trade on the OTC markets. OTC stocks tend to be lower in price but higher in risk. They’re generally up-and-coming companies, and OTC listing requirements aren’t as strict as the NYSE or Nasdaq.

To trade these stocks, you’ll need a certain broker …

What Are the Best Brokers for Trading Penny Stocks in 2024?

In the past, I wasn’t a huge fan of any specific broker.

I’d tell traders to find the broker that sucks the least for their needs.

What should you look for? You want a reliable broker that can execute your orders, and that has the stocks and services you’re looking for. I know a lot of people use TD Ameritrade, Schwab, or Robinhood.

Robinhood isn’t my top choice for penny stock traders. Even though they have no minimums, you won’t find a lot of the penny stocks (like OTCs) that I love to trade on that platform.

But I’m changing my tune on brokers in 2024. I’ve found a broker I’m pleased to work with: TradeZero. Check out my interview with the founder and CEO here:

I’m using my TradeZero account for the newest small account challenge. Join me!

You can create an account here.

How to Find Top Penny Stocks to Trade

Wanna find great stocks to trade? Here’s how to get started.

Use a Penny Stock Scanner Every Day to Find Opportunities

Remember how I mentioned StocksToTrade earlier? I helped design this platform to fit a day trader’s everyday needs.

A scanner like STT can help you narrow down the best stocks for your strategy. You filter thousands of stocks based on criteria that you set.

And powerful scanners should come with powerful tools. Just check out STT’s Breaking News Chat feature. I’ve found so many trades thanks to the Breaking News Chat team.

The scanner you use is your choice. Just make sure it has everything you need to help you daily.

Develop Your Unique Trading Strategy for Penny Stocks

You must learn to think for yourself. Too many traders start off thinking they can follow other traders or alerts. But it’s impossible. Penny stocks move fast.

And every trader has a unique style … and certain strengths and weaknesses. So work on increasing your knowledge and developing your trading style.

A lot of factors play into trading success — or lack thereof. Know this: None of the top traders from my Challenge follow other traders’ alerts. They develop their strategies. All I do is provide the training wheels.

My Top Tips for Trading Penny Stocks

Want some real insider tips about how to get ahead as a penny stock trader? Here goes…

- Educate yourself. This is key. Get smart and trade smarter.

- Be adaptable. Patterns repeat, but it’s not an exact science. Markets change. So unless you want to become extinct as a trader, be nimble and adaptable.

- Maintain a strong penny stocks watchlist

- Keep a trading journal

- Learn from your mistakes. Have you ever lost $15,000 on a single play? I have (starting stake $210,000). My mistakes are numerous, but I’m still successful. That’s because I learn from my mistakes and cut losses quickly!

Start Learning How to Trade Penny Stocks — Apply for My Trading Challenge

My Trading Challenge is based on my 20+ years of experience as a trader. The goal? Help traders help themselves … I want you to trade smart, stay safe, and be self-sufficient.

During my time in the market, I’ve learned a lot — and I share it all with my students.

I don’t accept everyone. I might be the hardest-working trading teacher out there, and I want people to appreciate my lessons.

It’s up to you to do the heavy lifting. I want you to use my teachings to develop your strategy.

The Challenge has everything you need:

- Interactive webinars with me and my top students

- More than 7,000 video lessons

- Access to my incredible chat room

- And more!

Ask yourself this: What’s the best that could happen if you dedicate yourself to learning how to trade penny stocks?

Learn the Key Indicators for Trading Penny Stocks

I call myself a glorified history teacher because I constantly look to the past. It’s how I try to figure out how stocks might move in the future.

You have to consider key indicators to determine how a stock might perform in the future.

And you need to learn to read chart patterns and understand them. It takes time and practice.

Here’s a bit more on indicators and charts…

Check for These Positive Indicators Before You Trade

These signs that indicate a stock could continue to go up:

- Positive earnings and new contracts

- Positive financing

- New partnerships

- Increased trading volume

- Positive industry news

Negative Stock Indicators

These signs could indicate you should stay away … or consider going short.

- Financing secured through desperation

- Rumors of negativity from within the company

- Poor industry news

- Reduced trading volume

The Key to Trading Penny Stocks: Chart Patterns

I mentioned the importance of charts before. And I know it seems hard at first. Just start practicing and you can learn to read chart patterns.

Also, look at several time frames for an overall view of a stock’s momentum and past performance.

Chart Types

Here are the four most common types of charts:

- Bar

- Candlestick

- Line

- Area

I favor the candlestick — learn why here.

Bar and line charts are simple but don’t tell you much. I find it laughable that people try to rely on oversimplified charts to make trading decisions … but that’s just me. And I don’t know anyone who prefers area charts.

Stock Chart Patterns

Chart patterns describe how a stock price moves over time. Patterns help you make educated guesses about a stock’s future performance. Again, it’s not an exact science.

Clean Stock Chart

This is my favorite type of chart. The stock’s price moves in one direction — up or down — with regular but brief changes in direction that quickly reverse.

Pay attention to clean charts. They’re highly predictive, which is great for traders like me.

But you don’t want a chart that looks too clean, like an upward or downward trend with almost no variation.

An extremely clean chart often precipitates a steep increase followed by a steep decrease in price. If you’re not fast enough, you could lose significant cash.

Clean Bullish

Know the terms bull and bear market?

A bull market trends upward, while a bear market trends down. The same applies to chart patterns.

A clean bullish chart shows a steady upward trend. The stock price might fall on occasion, but it jumps right back up — often higher than before its brief decline.

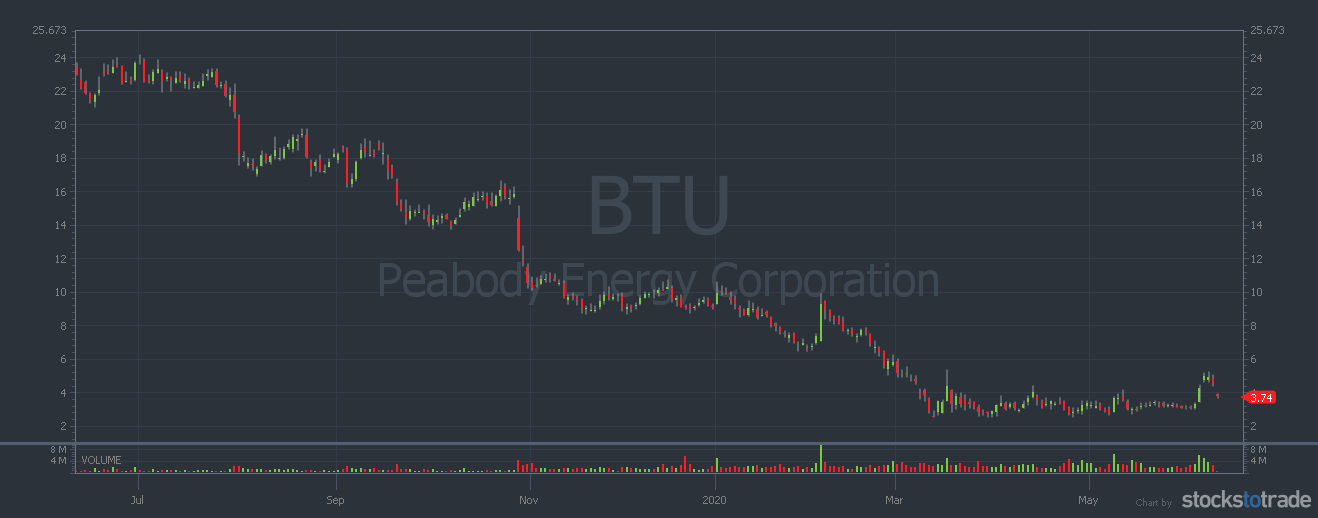

Clean Bearish

A clean bearish chart is the opposite of a clean bullish chart. There’s a definitive decline in stock price over time. It might spike every occasionally, but the downhill pattern is evident at a glance.

It often happens after a steep price increase. A company might announce news that excites investors. The stock price shoots up but can’t sustain, so it begins to fall back.

Clean Breakout and Clean Breakdown

Clean breakouts and clean breakdowns show that a stock has either broken through resistance or fallen below support.

The chart is clean because the pattern either repeats or shows significant pattern repeats before the breakout or breakdown.

Clean Cup and Handle

This is a shape you can spot on certain charts. A downward trend is followed by an upward trend — it looks like a cup. In a clean cup and handle, the downward and upward trends are smooth.

After the cup there’s a pullback — that’s the handle. If the cup and handle plays out like the classic pattern, it then continues upward. After the pullback, there’s a breakout over the level formed by the cup. It’s difficult to play this type of chart but not impossible.

Messy Stock

I encourage you to look at messy stocks. There’s no discernible pattern. It’s all over the place and its peaks and valleys don’t repeat reliably.

So learn from these charts, but don’t trade on them. There’s no way to predict what the stock will do because you don’t have a pattern to follow.

Messy Breakdown

A messy breakdown starts with an upward trend. At first, the chart looks pretty clean (and appealing). Then, seemingly out of nowhere, it’ll drop.

The pattern becomes messy from there.

My Top Chart Patterns for Trading Penny Stocks

Now, onto the good stuff! Nobody — except my Trading Challenge students — use these patterns, because they’re mine.

I created them after watching stock charts and trading for years.

The Supernova Penny Stock Chart Pattern

We’ll start with my favorite. The supernova looks like a stock chart exploded. It might have modest peaks and valleys over several months, then skyrocket for a short period.

I love supernovas. If you learn to ride the momentum, the potential gains can be meaty. I’ve seen penny stocks shoot up to 10 times or more in price. Learn more about this pattern in my Supernova webinar replay.

The Stair Stepper

This stock pattern looks just like a staircase viewed from the side. It goes up, flatlines, then goes up again. There might be a few dips along the way, but the stair-stepper pattern repeats.

The Snore

Ignore this stock pattern at all costs. It’s incredibly boring and lacks liquidity and volatility.

The Crow

I named this pattern the crow because it’s like watching a bird pick off your cash one chunk at a time until there’s nothing left. If you start to see a crow pattern, get out immediately.

Here are 13 penny stock chart patterns to study now.

How to Use Financial Ratios for Trading Penny Stocks

Financial ratios include things like price to earnings (P/E) and earnings per share (EPS).

It’s important to know these things — but they’re not my primary focus when trading penny stocks.

Bottom Line: Start Your Penny Stock Journey and Gear Up for 2024 Trades

You made it this far — congratulations!

That tells me you’re not one of the fools looking to get into penny stocks to get rich quick… Or at least you understand that there’s more to trading than just buying, selling, and becoming a millionaire in a month.

Penny stocks aren’t for everyone. They’re volatile, the companies can be sketchy, and they present a significant level of risk for you as a trader.

If you’re willing to take the time to educate yourself and scale up slowly, you’ll be taking the right steps to build a strong foundation and work toward trading smarter.

Leave a comment and tell me if you’re ready to commit to your future. How willing are you to put in the work and become a smart penny stock trader?