An NFT is a digital asset that proves that the person who holds it is the owner of a specific file. Think of it as a digital certificate of ownership — one that is transferable but secure. These qualities appeal to a growing community of artists, collectors, gamers, and traders. There are even digital landlords, with NFT deeds to real estate both in the real world and the metaverse.

You know how people have always liked to make counterfeit copies of art, or anything that’s worth money? The problem is worse on the internet.

Digital files let anyone with a computer make perfect copies of art, music, college diplomas. NFTs are unique tokens that prove ownership of the original.

While NFTs represent a new frontier in the digital asset space, it’s important to remember that traditional stocks still offer significant opportunities for investment. The stock market is vast and dynamic, with a multitude of top-performing stocks across various sectors that could potentially offer lucrative trading opportunities. Diversifying your portfolio by investing in different sectors can help mitigate risk and increase your chances of earning profits. If you’re interested in exploring more top-performing stocks, here’s a list of 10 top stocks to invest in.

NFTs could be technically considered part of the Consumer Discretionary sector. But in practice, they tend to run in sympathy with the Cryptocurrency sector.

Table of Contents

What Are Non-Fungible Tokens (NFTs)?

NFT stands for “non-fungible token.” Fungibility is an economic term that means that the good or asset being described is interchangeable with another unit in its class. If you spend $100 on some sneakers and then return them, the $100 bill you get back doesn’t have to be the same $100 bill you originally used.

It’s the same if you substituted the money in the above example with cryptocurrency… although crypto is so volatile that the sneakers likely won’t be worth the same amount of crypto you paid for them.

NFTs, however, can’t be substituted for one another. If you trade an NFT worth $500 for a pair of Nike Air Jordans and you both decide to trade back, you’d be pretty mad if they gave you a different NFT worth only $100.

The second part of the term is “token.” Like crypto tokens, NFTs are stored on a blockchain — the unchangeable, unhackable digital transaction record maintained by many computers across the network. The NFT tokens then link to a digital file elsewhere. Anyone can download the NFT’s file — the part that’s valuable is the token.

The Best NFT Stocks in May 2024 — Sector Leaders

Let’s unpack what the ‘best NFT stocks’ should mean to you. I definitely don’t mean that they’re the best stocks to invest in.

I don’t think that any stocks are ‘safe.’ What I look for is volatility, and the best NFT stocks have plenty of it!

Your job as a trader is to profit from volatility, do NOT fall in love with any trade or asset as a trade is not profitable until you lock in your profits & getting emotional can muddy the waters. Similarly, it's difficult to cut losses fast if you become too emotionally involved

— Timothy Sykes (@timothysykes) December 7, 2021

When you’re learning about a sector, pay attention to the sector leaders. Their charts can tell you a lot about the health of the sector.

When they’re running, their momentum can affect their entire sector and create the sympathy plays I like to trade!

While we’ve highlighted some of the best NFT stocks to trade, it’s crucial to understand the different sectors in the market. Each sector has its own characteristics and trends that can impact your trading strategy. Understanding these sectors can help you identify potential trading opportunities and make informed decisions. If you’re looking to understand the different sectors in the stock market, here’s a comprehensive guide on investment sectors.

Coinbase Global Inc [NASDAQ: COIN]

Founded in 2012, Coinbase is the leading cryptocurrency exchange platform in the United States. The company intends to be the safe and regulation-compliant point of entry for retail investors and institutions into the cryptocurrency economy. Users can establish an account directly with the firm, instead of using an intermediary, and many choose to allow Coinbase to act as a custodian for their cryptocurrency, giving the company breadth beyond that of a traditional financial exchange. While the company still generates the majority of its revenue from transaction fees charged to its retail customers, Coinbase uses internal investment and acquisitions to expand into adjacent businesses, such as prime brokerage, data analytics, and collateralized lending.

eBay Inc. [NASDAQ: EBAY]

eBay operates one of the largest e-commerce marketplaces in the world, with $74 billion in 2022 gross merchandise volume, or GMV, rendering the firm a top 10 global e-commerce company. eBay generates revenue from listing fees, advertising, revenue-sharing arrangements with service providers, and managed payments, with its platform connecting more than 132 million buyers and roughly 20 million sellers across almost 190 global markets at the end of 2022.

It recently established an NFT marketplace on its platform. It’s striving to become a mainstream way of participating in this insider-y sector, accepting a broad range of payments, not just cryptocurrency.

Nike Inc. [NYSE: NKE]

Nike is the largest athletic footwear and apparel brand in the world. It designs, develops, and markets athletic apparel, footwear, equipment, and accessories in six major categories: running, basketball, football (soccer), training, sportswear, and Jordan.

Nike has entered the NFT space through its purchase of RTFKT Studios, a designer of virtual sneakers. Elon Musk bought a pair for over $90,000.

How to Trade NFTs

Learning how to trade NFT stocks starts with your education.

You need to learn how NFTs work and how to identify their patterns.

The Tim Sykes NFT Club will help you in all aspects of NFT trading.

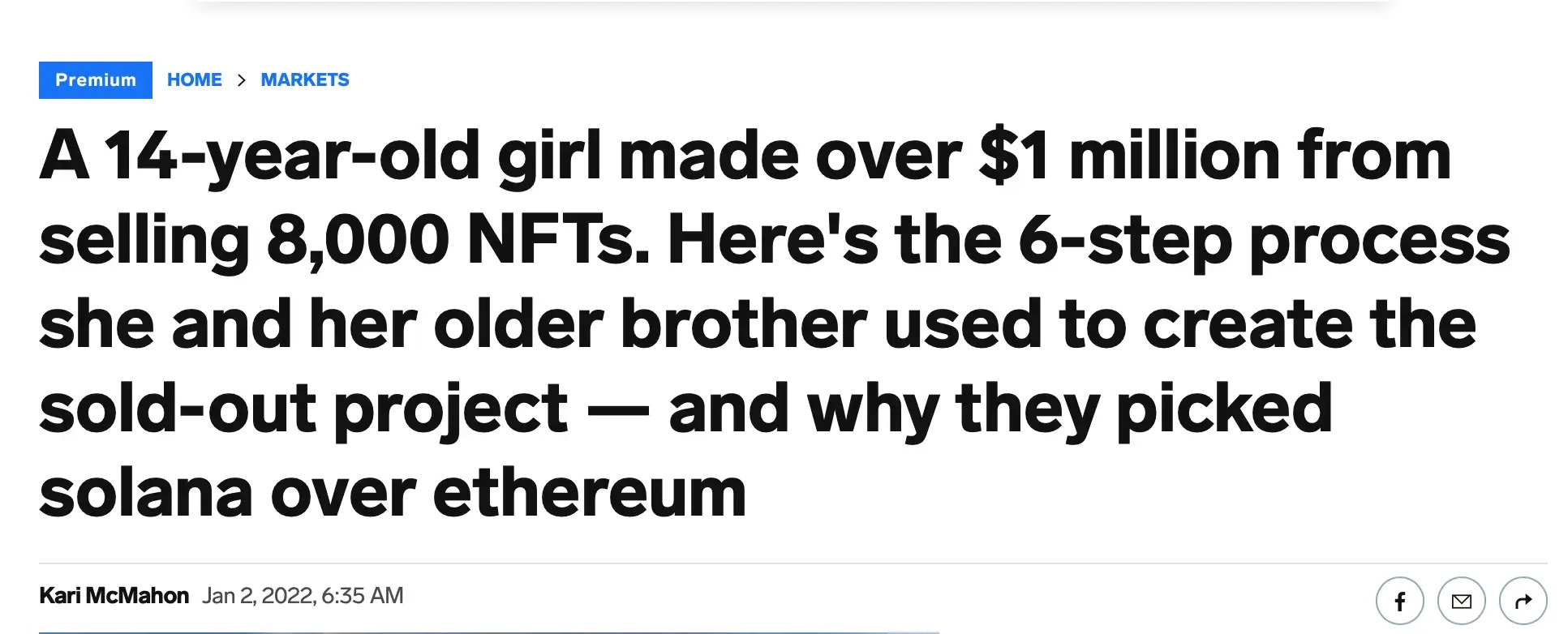

It’s led by another one of my successful former Trading Challenge students, Adam Jarrett. Adam collaborated with his 14-year-old sister to release a million-dollar NFT collection…

Adam had already become a six-figure penny stock trader at the time of his pivot to NFTs…

But he soon found that trading NFTs was more his style.

He adapted some of my penny stock strategies to the world of NFTs and has found a way to navigate this overwhelming market…

There’s a much bigger learning curve for trading NFTs than trading penny stocks.

It’s more important to be able to detect the signs that an NFT collection will take off before other NFT traders.

That’s why we’ve designed a course together…

Join the Tim Sykes NFT Club here!

Trading NFTs is a new and exciting venture, but it’s important not to overlook the opportunities in traditional stock trading…

The tech sector has been a hotbed of innovation and growth, offering numerous opportunities for savvy traders. If you’re interested in exploring the potential of tech stocks alongside your NFT trading, check out this list of top 6 tech stocks to trade.