Shorting penny stocks has become a popular trading strategy … But newbie traders, beware. It’s a risky one.

What exactly does shorting stocks mean? In short, it’s the opposite of buying low and selling high. I’ll get to the full details in a bit.

First, know why a lot of new traders can get in trouble with shorting penny stocks. They think that since most penny stock companies are junk, they can short any stock that’s up. The thinking is these stocks will eventually fail.

And yeah, most of these companies are junk, but that doesn’t mean they’ll all fail … at least not right away. And that can get you into a lot of trouble if you’re stubborn and don’t cut losses quickly.

Here, I’ll break it all down for you. Read on to learn what short selling is, how to short a stock, and some of the HUGE dangers of short selling…

Table of Contents

- 1 Shorting Penny Stocks: The Basics

- 2 Which Stocks Can Traders Short?

- 3 How to Start Shorting Penny Stocks Like a Pro

- 4 The Downside to Shorting Penny Stocks

- 5 Can You Short Stocks Under $5?

- 6 How Do You Tell if a Stock Is Heavily Shorted?

- 7 Which Brokers Allow Traders to Short Penny Stocks?

- 8 Frequently Asked Questions About Shorting Penny Stocks

- 9 Conclusion

Shorting Penny Stocks: The Basics

When you’re shorting penny stocks, you’re betting that the price will go down. Instead of buying low and selling high, you borrow shares from your broker at a price you think is too high. Then you sell the borrowed stocks and ideally buy them back later at a lower price.

You then profit off the difference when you return the shares to your broker.

With short selling, your order executes just like a sell order. When you buy to cover your position, it’s the same as a buy order.

This is why short squeezes can be so powerful. Nervous shorts trying to cover their positions bring more volume into the market.

Short squeezes are a huge risk to short-sellers. More on that later…

Which Stocks Can Traders Short?

Traders can short most stocks. But you’ll need to borrow the shares from your broker. Your ability to short depends on whether they have the shares available to borrow.

A lot of brokers don’t allow traders to short penny stocks. They think it’s too risky. So while you can theoretically short any stock, you may not be able to find shares to borrow.

Some brokers are better than others for this. It’s another reason to always do your research before choosing a broker.

If you want to short sell a hard-to-borrow stock, you can contact your broker and ask them to locate shares. But you’ll be paying a premium for borrowing those shares along with a locating fee.

And newbie alert — this can get even harder for thinly-traded penny stocks. Do your research before trying pro moves!

How Do You Know if a Stock Is Being Shorted?

To see how many shares of a stock are short, you can check websites like Yahoo Finance or finviz. The problem is that the information is usually outdated. You can use it as a guideline or estimate, but don’t consider it completely accurate and up to date.

Yahoo Finance provides the number of shares short under the Statistics tab. But it rarely lists this info for OTC penny stocks.

Finviz shows the short interest as a percentage or ratio of the overall float of the stock. But if you’re using the free version, they won’t even list OTC stocks.

OTC Short Report is an OK site for finding historic shorting data on OTC stocks.

To be honest, I feel bad for even name-dropping these services. They’re decent, sure, especially for something free. And I know a lot of you out there ask about them.

Let’s get real for a second — good traders don’t look too hard at these stats. If you’re trading OTC stocks, you already know that about 25% of volume comes from short sellers anyway.

Instead, you need to look at a stock’s movement. The best indicator of whether a stock is being shorted is the price action and chart pattern.

And if you want the most advanced stock screener on the planet, you’ll look at StocksToTrade. This platform was designed by traders to show all the stuff we look for. It has real-time data, awesome charting abilities, and tons of customizable scans. Try it for 14 days for only $7.

(Full disclaimer: I’m an investor in StocksToTrade, and I proudly helped develop it.)

How to Start Shorting Penny Stocks Like a Pro

Betting against worthless or near worthless companies at inflated prices can be done well…

But it’s not easy. Honestly, I don’t recommend shorting for new traders. Learn to go long first. Then branch out your strategies from there.

If you only watched “The Big Short” and don’t have any strategies of your own yet — start studying! Begin with “The Complete Penny Stock Course” by my student Jamil. It’s a solid foundation in my lessons.

The first step is to find a stock you think will drop in price. You’ll need to be able to short sell it when its price is high and buy it back for a lower price.

Next, borrow the shares from your broker. If they have the shares, you can place a sell order.

Once you have a position, the next step is to watch the chart and price action and wait for the stock to drop.

The last step: cover your position when the stock hits a support level or your goals for the trade. Then you buy to cover to close your position and return the borrowed shares to your broker.

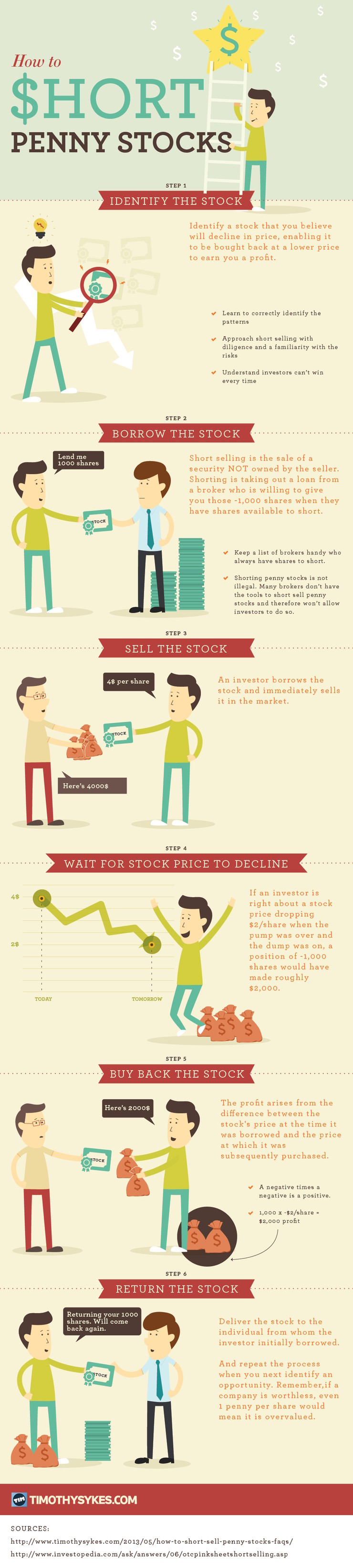

I created the infographic below as an introduction on how to short sell penny stocks.

Tempted to short? I’ll warn you again. Gain experience first. You need to learn how to trade penny stocks in any situation before shorting. Otherwise — you can blow up your account.

This is just the start of your education. Next stop: check out the new 30-Day Bootcamp I made with one of my top students, Matthew Monaco. In 30 days, you can build a solid foundation. Bonus: You get “The Complete Penny Stock Course” book I just mentioned.

The Downside to Shorting Penny Stocks

There are BIG downsides to shorting penny stocks. It’s why I don’t recommend short selling for new traders…

As I said earlier, the biggest risk with short selling is the potential to get caught in a short squeeze. This is what happens when many short sellers buy to close out their positions.

That can cause the stock to spike even higher.

A short sell can lead to infinite losses. If there’s a squeeze, shorts who don’t or can’t cash out can get crushed.

The stock can keep going higher and higher. At some point, shorts need to cover all the stocks they’ve borrowed on margin.

If you long a stock, what’s the worst that can happen? You lose the amount you have in the trade if the stock drops to zero. But with short selling, you can lose more than you have in the trade — or in your account.

Say a stock goes supernova. It spikes huge and runs higher and higher. Brokers can start closing shorts’ positions (although this is rare).

In the worst case, brokers do a forced buy-in and cover your position. You have no control over your losses. You may wanna hold out for the drop, but your broker forces you out.

I hear the horror stories from people who’ve blown up their accounts. They figure a drop is gonna come, and keep waiting until they run out of money to cover.

Another downside to shorting is the extra costs. There are fees plus interest for borrowing shares from your broker. Before you take a position, figure out whether there’s potential for profits after all the fees. Sometimes it’s not worth it.

You need to have a trading plan in advance. You’ll need to be prepared for when a perfect red day setup comes along. Otherwise, you might find there are no shares available for shorting. The fees for locates can outweigh any potential profit.

Can You Short Stocks Under $5?

You can short stocks under $5 — as long as your broker allows it. Check their penny stock lists before you commit.

Some brokers don’t allow shorting penny stocks. Others just won’t have the shares to borrow but will locate them if you ask.

What Is the Best Stock Under $5?

These stocks are too volatile and move too fast for me to tell you which penny stocks to buy or short. I teach students to become self-sufficient traders. I share the tools and patterns I’ve used over the last 20+ years in the market.

If you want to learn how to trade penny stocks, take some initiative and invest in your education. No, looking for which penny stocks to short on Reddit doesn’t count.

I have tons of FREE resources to help you learn the basics. All of the following I make available at absolutely no cost.

First, check out my penny stock guide and my YouTube channel.

If you want to know what stocks I’m watching, subscribe to my weekly stock watchlist.

And if you want alerts for hot penny stocks going supernova, sign up for my Supernova Alerts, gratis.

Understand that my watchlists and alerts are only there to help you learn the process. Use them as confirmation when you find those runners. Never follow any traders’ alerts. Not even mine.

Ready for the next step in your trading education? Apply for my Trading Challenge. I only accept the most dedicated students who take their education seriously. You’ll get access to all my DVDs, video lessons, and live trading and Q&A webinars with me and my top students.

How Do You Tell if a Stock Is Heavily Shorted?

To tell if a stock is heavily shorted, you can check the websites I mentioned earlier. Search Twitter to see what other traders are saying about the stock. Sign up for StocksToTrade, it has a built-in social media search tool.

The biggest thing: study its charts, price action, and SEC filings.

Look back at the daily chart and see what the stock’s done in the past. Just like traders, stocks have a memory. If they have a history of failing to hold spikes and have a lot of red candles on the daily chart, watch out. Chances are whenever they gap up on news, shorts will be there.

With enough experience, you can see the selling by the price action. Every time it tries to spike, do traders sell into it … and it ultimately fails? Check the SEC filings. Is there dilution, toxic financing, or insider selling?

If so, chances are that shorts will join in on the selling pressure.

Check out this chart for Camber Energy Inc. (NYSE: CEI). It never seems to hold its spikes or get an uptrend going. If you’ve done your homework, you’ll see a pattern of toxic dilution.

Which Brokers Allow Traders to Short Penny Stocks?

Before you open a brokerage account, do your research.

If you plan to short sell penny stocks, you’ll need a broker that allows shorting and has shares to borrow. Check ahead of time so you won’t be disappointed later…

For example, a lot of new traders want to know if you can short sell penny stocks on Webull or Robinhood. Well, Webull allows short selling, but Robinhood doesn’t.

Too many newbies don’t do their research. They open Robinhood accounts because that’s what everyone is doing. Then they’re disappointed to find that they can’t short.

(And if you’re wondering about SureTrader, it closed shop in 2019.)

You’re never married to a broker. Try them out … See if they have shares to borrow, good executions, and responsive customer service. If not, move your money elsewhere.

Some of my students use Interactive Brokers, Centerpoint Securities, or TradeZero to short sell penny stocks. Again, do your own research. I don’t do sales or customer service. I teach students how to trade penny stocks.

For my top brokers, check out this post.

Frequently Asked Questions About Shorting Penny Stocks

Here are a few frequently asked questions I get about shorting penny stocks…

More Breaking News

- BigBear.ai Expands Partnerships and Strengthens Financial Position

- Coca-Cola’s CEO Sells Shares: Market Reactions and Financial Insights

- Bitcoin Crash Sparks Sharp Decline in Cryptocurrency Stocks

- GTM Stock Falls Amid Latest Earnings Report and Market Reactions

Is It Illegal to Short Sell Penny Stocks?

No, it’s not illegal to short sell penny stocks. But each broker is different and may or may not allow it through their brokerage accounts. Make sure you do your research before opening an account.

Is Interactive Brokers Good for Shorting?

Interactive Brokers usually has shares available to short, but not always. It’s one of the two brokers I use. But brokers come down to personal preference. You might have to try a few to find the best one for you.

What Are the Most Heavily Shorted Stocks?

These are from companies with dilution, no cash on hand, and excess promotion. Press releases or promotions that bring the stock price up usually get sold into by insiders. Or they announce toxic financings at lower prices, which brings in more short sellers.

Conclusion

Short selling has risks. There’s the possibility of huge losses. This strategy requires focus and discipline to cut losses quickly. Don’t hold and hope when short selling — you risk blowing up your account.

If it’s a strategy you want to learn, try paper trading on StocksToTrade before risking your own money.

Study hard and learn key patterns for shorting, like the first red day after a pump. And only stick to those setups. It can help you find shorting opportunities.

But you also have to be able to adapt to market changes. And lately, the risks of short selling outweigh the rewards.

What do you think? Do you short sell penny stocks? Let me know in the comments… I love to hear from you!

Leave a reply