SPECIAL 50%+ OFF BLOWOUT HOLIDAY SALES HERE ON NEWSLETTERS AND HERE ON DVD STUDY GUIDES…give the gift of knowledge/education/self-sufficiency this holiday season!

Yesterday, the SEC put out a press release detailing its charges against Samuel DelPresto – a penny stock promoter they’re accusing of pocketing more than $13 million dollars through elaborate pump and dump schemes, saying that he:

“[T]eamed up with others to secretly obtain control of substantially all available stock in four microcap companies and to facilitate coordinated trading that created the appearance of liquidity and market demand for the stocks. After unwitting investors were enticed through promotional campaigns to buy the stock at inflated prices, DelPresto dumped his shares on the market.”

Criminal charges are pending in the U.S. Attorney’s Office for the District of New Jersey, and Regional Director of the SEC’s New York office goes on to say:

“The series of fraudulent schemes alleged in our complaint enticed unwitting investors to pay inflated prices for four companies secretly controlled by DelPresto and others and then left the investors holding the bag when the manipulative activity ceased and the stock price dropped.”

The story’s been getting a ton of press in the financial news, but there’s one big problem…

It’s not new news.

The SEC lists four companies as having been manipulated/pumped by DelPresto, including BioNeutral Group (BONU), NXT Nutritionals Holdings (NXTH), Mesa Energy Holdings (MSEH), and Clear-Lite Holdings (CLRH).

And you know what? I exposed/busted 3 out of 4 of these pump and dumps over 5 years ago!

Let’s take a look, so you can learn how to spot/expose these yourself too since they still are happening regularly…shall we?

Mesa Energy Holdings (MSEH)

For starters, here’s an article I wrote back in March of 2010: “10 Reasons Why Mesa Energy Holdings, Inc. Will Drop 50%+.”

If you ask me – and clearly, more people should have asked me/read my blog – this one was pretty much a no-brainer as it followed the EXACT rules of what a penny stock pump looks like:

First, my students and I came across a ton of promotional mailers for MSEH (some of which had the SEC-mandated disclaimers made invisible) – all sent out by a penny stock promoter we were already watching because of his shady activity in the past.

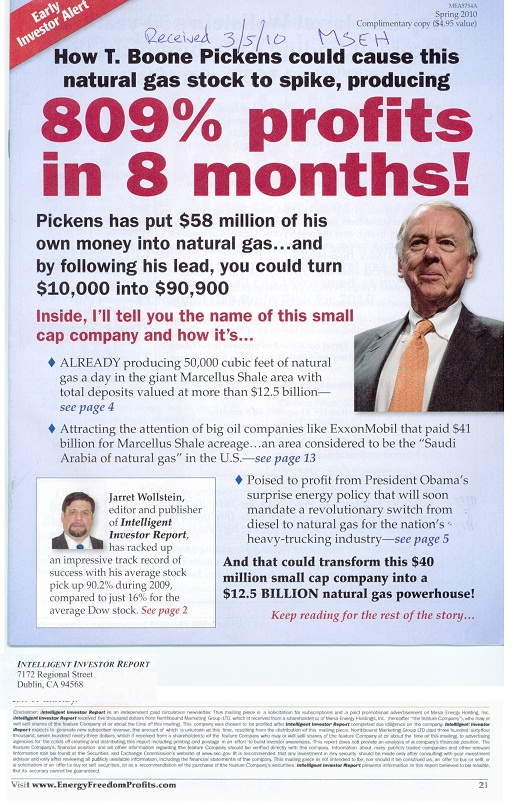

Next, came this beauty of an advertisement, which the Northbound Marketing Group admitted to paying more than $364,000 for:

(And just in case you weren’t keeping track, this is the same kind of marketing fluff they used for Americas Energy Company (AENY), NXT Nutritionals Holdings Inc. (NXTH), Clear-Lite Holdings, Inc. (CLRH) and Jayhawk Energy Inc (JYHW) – each of which dropped 99% from its high, post-promotion.)

If you dug a little deeper – like I did, and like I teach my students to – you would have seen the warning signs on this pump and dump a mile away:

- MSEH released press releases featuring “engineering reviews” claiming that “revenue over the life of the project could be as much as $405 million gross before expenses, or $332 million net of expenses.” Sounds great, except the “independent licensed petroleum engineer” behind the predictions was Jeffrey Chadwick… who also happened to sit on MSEH’s advisory board.

- One of the company’s quarterly reports from late 2009 detailed the verrrrry low prices shareholders were in at – some as much as 90%+ discounts over current prices. Jeez, you think the fact that they have millions of shares to sell at market rates might give them a reason to get promoters to send out more than $364,000 in advertisements??

- MSEH owned up to needing cash – as much as $1+ million just to make it to the end of the quarter, and then $10+ million to complete their ambitious project. Trust me. It’s no coincidence their stock rose 10X at the same time they needed to raise capital tied together with he promotional mailings. It’s a classic penny stock pump and dump, it doesn’t get any more clear cut.

I won’t bore you with the other seven or so signs that led me to call this stock out (watch this guide to penny stock promotions if you really want to know).

The bottom line, though, is that – since I busted this pump and dump wide open back in 2010, my students were able to profit to the tune of $20,000+ shorting the stock before it dropped 90%+ in price within a few months.**

My prediction was strong enough that it picked up national attention, which just makes you wonder why it’s taken the SEC so long to catch on…

Clear-Lite Holdings (CLRH)

One month after my expose on MSEH, I caught wind of another major penny pump and dump happening – this time, Clear-Lite Holdings (CLRH).

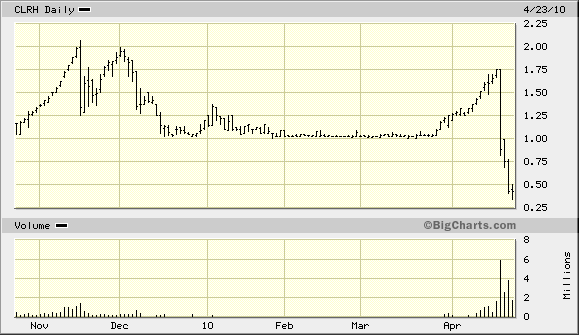

This one came to us courtesy of notorious promoter Courtney Smith, and it’s reported that he received nearly $500,000 for the mailer that drove CLRH from $1.00 a share to $1.75 a share (before its post-mailer drop of 77% down to $0.43 a share all within a few days).

Check out that fun drop when everything fell apart:

Even more fun is the way one of my TIMalert subscribers picked up on this scam. Here’s his message:

CLRH saw the address for their “corporate headquarters” on yahoo 102 North East 2nd Street Suite 400 Boca Raton 33432. I literally live down the street and the headquarters is mailbox in a UPS store….

and

on their florida corp filing they use PMB 400 which is correct for a ups box(private mail box) as you are legally not to use suite anymore for those types of boxes (i believe) like they do on their website

Their. corporate. headquarters. was. a. UPS. box.

Here’s a closer look at the actual corporate headquarters of Clear-Lite Holdings:

More Breaking News

- Oracle’s $50B Cloud Expansion Plans Fuel Stock Surge

- Valterra Platinum’s Q4 Forecast Drives Anticipation Amidst Earnings Surge

- TeraWulf’s Strategic Expansion Ignites Market Interest

- Skyward Surge: Momentus Inc. Soars and Faces Market Dynamics

I honestly don’t know which is more outrageous. This complete and utter scam, or the fact that it’s taken the SEC this long to bring charges against Samuel…

NXT Nutritionals Holdings (NXTH)

Finally, NXTH – another penny stock pump and dump I busted wide open back in March of 2010.

This one was actually a fun one for me, because my adversary in the whole thing bought me a whole bunch of press attention.

Turns out, when you take on Shaquille O’Neal, the media pays attention…and although it was a bit scary for me at first, I eventually prevailed since all I did was post facts!

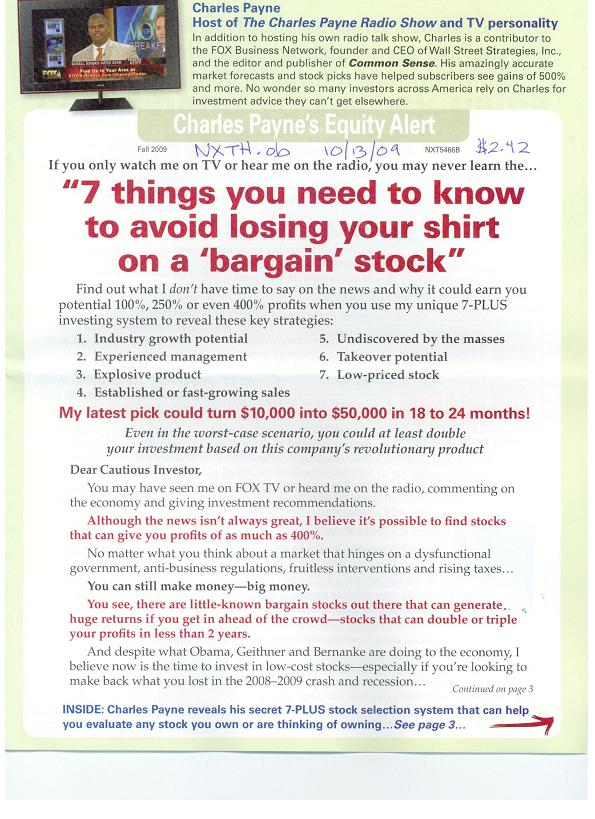

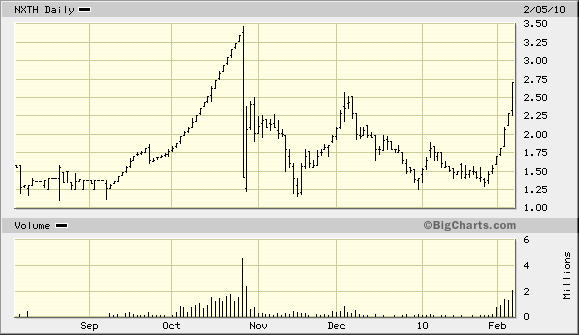

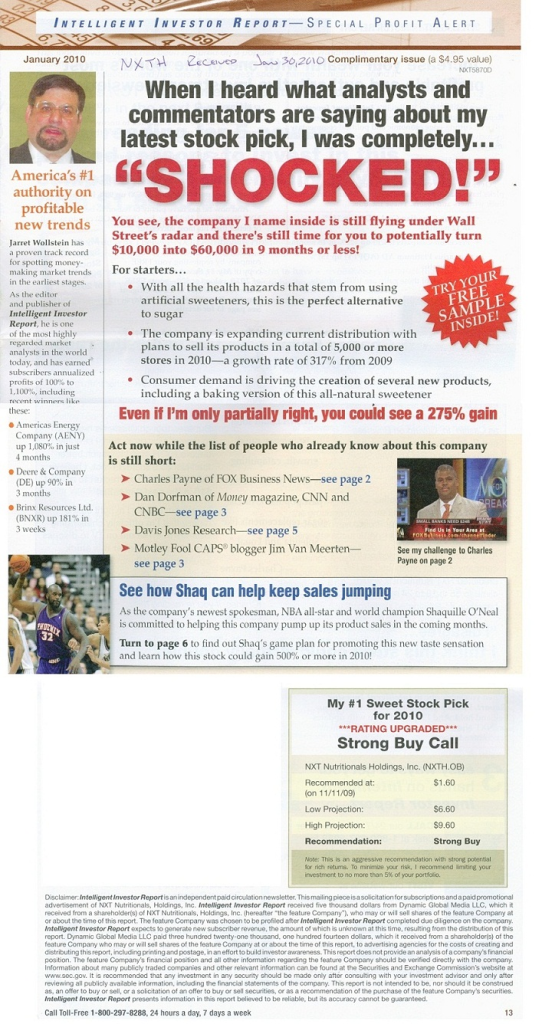

I’d already called out NXTH for shady promotions when this $500,000+ mailer came out:

I took some heat for that one too, with NXTH’s sleazy CEO telling Dan Dorfman on the Huffington Post that the stock collapse was due to “short sellers like Tim Sykes” (despite the fact that I never shorted it, I only exposed the mailer).

Imagine my surprise, then, when I found NXTH being pumped YET AGAIN:

Wouldn’t you know, that next pump just happened to coincide with a $320,000+ mailer coming out at the same time insiders were likely dumping into the propaganda-based buying.…

I actually got a cease and desist letter from Shaq’s lawyers on this one, but the promotional mailers were so inaccurate, I couldn’t just stand by and do nothing so I refused to take down my blog post and Shaq eventually backed out of the deal when the stock dropped too low and he sensed he might’ve been duped…although he still is proud to admit that he’s into penny stocks even now and I wish someone those who lost on NXTH went after Shaq directly so maybe he would wise up!

If you would have read the SEC filings like I did, you would have seen that, despite all their press releases, NXTH’s sales actually dropped 60%+ during the first 9 months of 2009.

Not to mention the fact that, one day after raising $5.6 million, NXTH’s stock collapsed another 29% today to just $0.77 per share – an astounding 76% drop from the $3.22 highs created by the first promotional mailer all within days.

The signs were all there – and even better, they let my students profit if they had the best brokers for penny stock short selling. Here are two that walked away with solid, if not great, profits (even though I hadn’t shorted this joke of a stock at that point yet):

Got taken out of my NXTH position by my profit sl @ 2.48 for a $2000 profit. Wasn’t at the computer during that time otherwise I might have stayed in longer because I could have watched the action around that level. I’m not getting back in today. $2900 total on the pump so far, I shouldn’t get ahead of myself.

-nifri

+550 on NXTH

-BN

And here’s how my students and I accidentally made $22,000 in an hour on NXTH when we caught its collapse later on.

You can probably guess by now I’m not that smart or great at math so how was I able to beat the authorities to these pump and dumps so quickly, right?

These stocks are a joke…all you have to do is learn about penny stocks here, see how the game works and you can spot these pump and dumps a mile away just like me and my millionaire trading challenge students do EVERY single time!

Let me repeat, do you want to know the signs that’ll help you spot penny stock trading pump and dumps five years before the SEC – and how you can profit off of these moves when you see them?

Join me.

Students in my Millionaire Challenge, my TIMAlerts and my DVD courses all know how to leverage promotional mailers, how to read SEC filings and to separate fact from BS when it comes to pump and dumps.

You can be one of them.

I’m willing to share all of that with you as well, but only if you’ll work hard to put the knowledge it’s taken me more than 15 years to acquire into practice. Traders who are as lazy/sketchy as the stocks I mentioned above need not apply.

Leave a reply