I prefer penny stock trading as I’ve never had success nor met anyone who has consistent success trading options, but I encourage everyone to try EVERY strategy possible and make their own decisions.

Below is the opinion of a new trading challenge student on the subject:

What is a Penny Stock?

According to the SEC the definition of a penny stock is as follows – The term “penny stock” generally refers to a security issued by a very small company that trades at less than $5 per share. Penny stocks generally are quoted over-the-counter, such as on the OTC Bulletin Board(which is a facility of FINRA) or OTC Link LLC (which is owned by OTC Markets Group, Inc., formerly known as Pink OTC Markets Inc.); penny stocks may, however, also trade on securities exchanges, including foreign securities exchanges. In addition, the definition of penny stock can include the securities of certain private companies with no active trading market.

Download the key points of this post as PDF.

What is an Option?

Options are contracts giving the purchaser the right to buy or sell a security at a specific price within a certain period of time. The seller also holds an obligation to fulfill the transaction, that is to sell or buy, if the long holder chooses to “exercise” the option before its expiration. An option which gives the right to buy something at a particular price is called a call option; an option which conveys the right to sell something at a specific price is called a put option. Options expire on the third thursday of every month.

So what are the Similarities and Differences?

Both, PennyStocks and Options are tradeable securities, you can buy and sell options on the exchanges in similar ways to shares. If there are more buyers than sellers the price will rise, and if there are more sellers the price will fall. However, what you must understand is that a Option is a derivative. Its price moves on speculation to what traders think the stock will do in the future.

Similarly both types of securities have Bid-Ask prices and therefore a spread. But what is different will soon become clear. Options have an expiry date and a strike price. The strike price is the price at which the security would be bought or sold.The transaction has to occur before or on the expiry date of the option. Once you have bought or sold the option the strike price does not move, in fact the strike price never moves. The option has its own price, that moves the same way as the price of a Stock.

Lets look at an example:

Trader 1 wants to buy a call option in $F,(i.e T1 wants to buy the right to buy a certain amount of shares in Ford on or before a certain date in the future). I will use Yahoo Finance for this example.

More Breaking News

- China SXT Pharma Launches AI Supply Chain Overhaul for TCMs

- Novo Nordisk’s Shares Surge as FDA Targets Illegal Drug Marketing

- Sezzle Inc. to Announce Q4 Results in Late February

- Cipher Mining Hikes Price Target Amidst Bold Strategic Moves

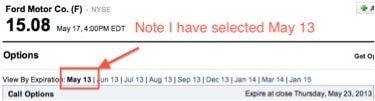

Firstly you must go to your broker and take a look at the list of expiry dates.

By selecting May 13 , T1 will need to exercise the option before or on the third thursday in may, which is the 23rd May.

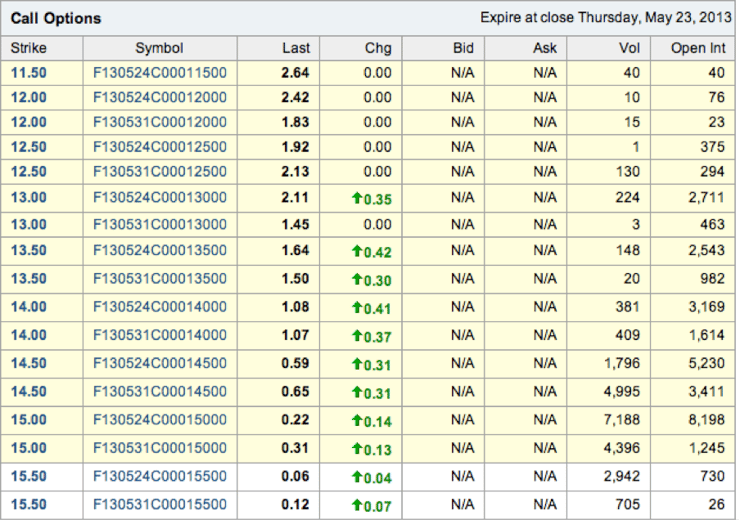

You can then look down the list of call options for this particular expiry. (Please note I wrote this post at the weekend when the markets were closed, therefore the Bid-Ask price will not show).

If T1 thinks that the price will move upwards, from its current trading price of 15.08, he is likely to buy a call option which strike price is the same as or less than its current trading price. For the sake of this example T1 will buy 100 x F MAY13 13.50 CALL @ 1.50 per Option. This means that T1 would have just paid $150 dollars for the right to buy 100 shares in the Ford Motor Company before on on the 23rd of May 2013.

So lets see what could happen.

The price of F rises to $20 per share, and T1 exercises the option. He therefore buys 100 shares in F for 13.5 per share, costing a grand total of £1350, he then goes to sell these shares on the market for $2000 ($20×100 shares). T1 has then made a $650 on the trade, but wait, don’t forget to subtract the $150 he paid for the option in the first place. T1’s net profit for the trade is $500.

However, if T1 gets it wrong and the price falls, he simply doesn’t have to exercise the option, thus leaving the loss at $150 dollars.

One thing that should be mentioned about pennystocks is that they can be very easily manipulated and pumped, fortunately for us the manipulators aren’t that smart. To learn more about how to profit from penny stock pump and dumps sign up to one of Tim’s plans by clicking here, alternatively to watch one of Tims DVD’s, simply click here.

Unlike PennyStocks there is no set limit on how many options there are, theoretically, if a company has 1Bn shares in circulation, there could be 2Bn options in circulation at the very same time.

You also may be able to find arbitrage on the option market, although it is rare. It is possible to profit from an option within 5 seconds or so, it is even possible to program computers to spot arbitrage opportunities and place the trades automatically.

To find out more about options trading check out this trader and sign up to one of his plans by clicking here.

Leave a reply