Time for another expose to cut through the far too many misconceptions and lies being spread about trading and penny stocks, as a followup to THIS and THIS because the market has been SO hot lately (as you can see HERE) and too many people aren’t taking proper advantage…little by little I’m working hard to get the good information out there, so I REALLY appreciate when I get comments like this from students:

11:49AM garcilamd: Tim, Wanted to say that you seriously stepped up the quality of your teaching lately. Lessons are spot on, keep it up!

— Timothy Sykes (@timothysykes) July 15, 2016

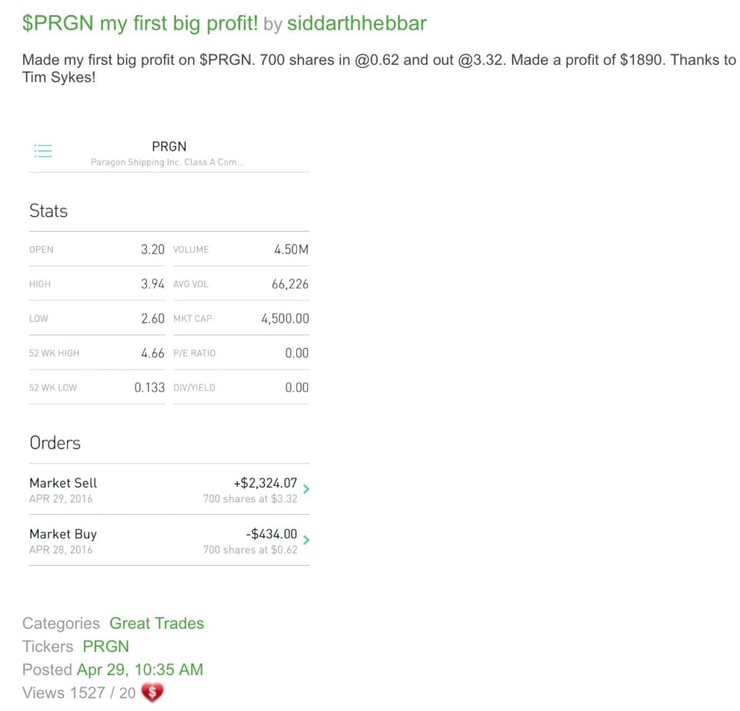

First let me show you some recent screenshots/tweets from my students that far and away cut through ANY negativity associated with penny stocks and mind you these trades have been on the EXACT pattens I’ve catalogued HERE for the past decade and personally traded and made millions with** for the past two decades:

just past 100,000 profits over 4 month in challenge great teaching. thankyou @timothysykes screen shot of the day pic.twitter.com/SHVrSMsb0A

— stevendu (@Steven1_994) June 8, 2016

It’s official today I’m up above my $100K profit mark. Never would have thought this possible. Thank you @timothysykes for starting tools

— AirplaneJane (@jane_yul) July 8, 2016

@timothysykes I didn’t have as much money as I wanted to put in but got some $OPTT at 4.43 to get it out at pic.twitter.com/zriw5mL0az

— Kaue (@kauecosta13) July 15, 2016

Got an awesome congratulations delivery today, courtesy of @timothysykes, for passing $3 million… https://t.co/RO2uzeuelE

— Tim Grittani (@kroyrunner89) July 8, 2016

Nearly doubled my 5k acct on $MGT this wk. Locked profits before the drop. Couldn’t b happier! Thank u @timothysykes pic.twitter.com/CWNWekt8tB

— Bryan Stearley (@Just_BS_n) May 18, 2016

You can see hundreds more recent comments from students HERE too**…it’s really inspiring stuff!

More Breaking News

- Vale S.A. Stock Soars as Goldman Sachs Raises Price Target

- Exponent Sees Promising Growth with Dividend Increase and Upbeat Q4 Earnings

- China SXT Pharma Launches AI Supply Chain Overhaul for TCMs

- Insider Stock Sale Raises Questions About Micron’s Market Position

Do I brag too much about my students’ success**? Yeah probably, but so what, I’m damn proud of them.

And remember to have the proper perspective about these students’ thousands of dollars in profits, or even few million dollars in profits**…it’s ALL VERY small time stuff on Wall Street, no Ivy Leaguer math whiz, algorithmic trader would be caught dead trading these stocks and going for such “small” sums of money.

Wall Street is a MASSIVE multi-trillion dollar industry where ALL of the stuff I talk about is wayyyyyyyyyyyyy too small and irrelevant for the true Masters of The Universe/BSDs and that’s fine by me because the competition in penny stocks is WEAK…and that’s why regular people have such an advantage….that is if you can be content with more modest profits, and that’s best case scenario vs. infinitely larger industries like forex and options where you can make millions in an hour or day** (of course the gift is also the curse as your odds of success up in those scalable niches are FAR worse and the competition is FAR greater and give how big those markets are you can’t control your risk like you can with penny stocks).

This is what experience has taught me over the years: you have better odds of success trading small, it’s not a disadvantage, it’s an advantage because last time I checked the upside of making a few million dollars** within a few years STILL get your EVERYTHING you’ve ever wanted, allowing you to live the dream life and you’re not screwed up in the head like the billionaires I’ve met over the years…and it’s just easier in this niche (if you know the rules)

Aim small, miss small, that’s a rule by which I trade and live.

When I closed my multi-million dollar hedge fund** and began teaching and I went back to my trading with my $12,415 roots in late 2007, many people had thought I’d lost everything (if you read this, you’ll see I didn’t, that’s the problem with the lack of transparency in finance that continues to this day as too many allegedly successful traders don’t show their ENTIRE track record publicly so you literally have no idea if they’re really successful or not…many just claim to be for attention, popularity, ego and business fraud), after all teachers are those who can’t do and in the trading and investing world all that matters is how much money you make and ideally you can take a little management % of a great deal of money that you have under management, right?

A great many Wall Streeters make their seven and eight figures/year income** by taking 1-2% management fees on hundreds of millions and billions of dollars in assets, trying to do the seemingly impossible, beat the S&P 500 and make 8-10%/year on average.

The problem is that for people with small amounts under $50,000 or God forbid under $25,000 or even under $5,000, making 10% per year or even 20%-30% per year** (which would make you a legend on Wall Street if you managed large amounts of money) doesn’t do you much good until you compound all that growth and you MIGHT become a millionaire by the time you’re Warren Buffett’s age!

That’s no fun, my top trading challenge students and I became millionaires in our 20s and 30s**…that is fun!

So for me as a teacher looking to create more millionaire trading challenge students (like this guy who has now gone from a few thousand to $3+ million in 4 years**), it’s IMPERATIVE that I show the differences of big account vs. small account trading and why Wall Street’s strategies, and their favorite scalable, leverage loving niches like Forex, should be totally irrelevant to people looking to grow their accounts within a few years, and more importantly, with the odds on your side if you study reliable patterns like THESE for going long and THESE for going short.

Mind you, for me it hasn’t been easy trading with such a small account after you’ve made millions**, your ego doesn’t like it, the industry doesn’t like it (and they’ll let you know about their distaste often), and you’ll often question yourself why you’re working so hard for such small trading profits when you know the strategy is solid and can make you so much more if you only took bigger positions with a bigger account.

But you tell yourself, you do it for the students, you HAVE to show them what it’s like to trade with similar account sizes as them and my $12,000 account I began with yet again to start 2016 has now grown to $66,000** in just over 6 months, despite a rather rough start filled with small account issues like the PDT Rule.

Let me just say something right now about the PDT Rule, I know many people like using offshore brokers to avoid it (I wouldn’t, it’s not worth the risk as I outlined here) and people like free brokers like this (the worst broker in the world designed to lure in cheapskates who don’t realize the firm makes its money by giving you horrible elections and a severe lack of features), but being limited to making just 3 day trades per week (not 3 overall trades, just 3 intraday trades, biggggggggg difference if you’re willing to hold overnight and focus on great risk/reward patterns like this) IS NOT A BAD THING SINCE IT PROTECTS YOU FROM YOURSELF.

Remember that 9 out of 10 traders lose and why do you think that is? It’s almost entirely due to overtrading and taking trades you have no business being in in the first place — boring stocks, stocks with good stories but bad price action, stocks that don’t react well to good news — and the PDT Rule forces you to be more disciplined and consider the risk on EVERY trade since your trades are so precious.

Next year I’m going to start my account with just $5,000 to make it even harder for me to overcome the PDT Rule and to show you just how disciplined I can be taking the best trades…and ONLY the best trades…never afraid of missing out on trades (FOMO), always considering the risk on EVERY damn trade since all forms of trading are risky (but at least with penny stocks you can CONTROL your risk, which goes against mainstream thinking, hence why my educational business is booming teaching EXCTLY how to do this in 2-4 weekly webinars for these guys)

I’m rambling, but this is a VERY personal subject for me so for now, see some of my recent video lessons to better understand just how great a market environment it is for buyers, especially for buyers of morning spikes no matter how small your account is (literally, see BGI, HMNY, MGT, TRCH, KURA, TWER, CIDM, OPTT, SPU and that’s all this month!)…short sellers not-so-much (which is good since shorting is risky and VERY tough for small accounts to do since many short sellers are successful ONLY because they can average up on their positions, which is impossible for people with small accounts to do and it’s pathetic how these big short sellers think their strategy is the only right/ethical strategy in all of penny stocks

(trust me, I know how they think, I used to be one of those narrow-minded niche traders…but I’ve since evolved and adapted to teach strategies that are more accessible for people with small accounts)

Leave a reply