A little over 3 years ago I made $30,000+ in less than an hour from a rest stop in Molly Pitcher, New Jersey.

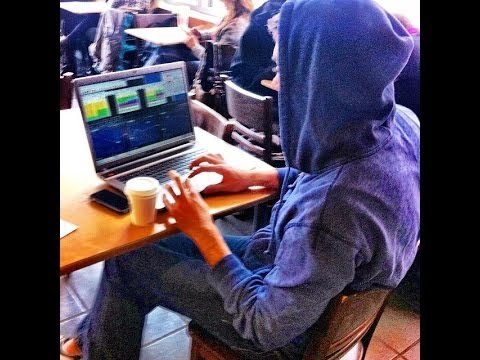

Today my top trading challenge student Tim Grittani used the EXACT patterns taught in my DVD study guides HERE and which we wrote about when he made $200,000 in one day HERE to make $113,500 from a Starbucks…see the amazing video and picture below:

All you lawyers, doctors and investment bankers out there who wasted a decade in school and feel it was worthwhile as proven by your six-figure/year jobs can suck it!

Tim Grittani had $1,500 to his name 3 years ago before becoming my student, now he regularly makes $50,000-$200,000 in one day and has made $1.6 million, nearly $500,000 in just the past 2 months alone.

As I’ve been stressing in videos like these below, you can trade and bank from ANYWHERE in the world once you learn THESE CRUCIAL TRADING RULES and the patterns explained in these free videos…whether it’s your local Starbucks, the Maldives, Bali, The Roosevelt Hotel Penthouse in LA or Rome, Italy:

It was a GREAT day for so many of my newsletter subscribers, much due to my premarket watchlist which predicted the FCEL, PLUG, BLDP, ARTX, UQM crashes before they happened so everyone was fully prepared today.

This was sent out at 8:49am EST this morning:

PLUG, FCEL, BLDP, ARTX, UQM are all up again big premarket and I said yesterday these are the hottest battery plays and that “UQM is trying to break out past multi-month resistance, not sure if it can hold and actually build on its premarket gains.” Well they all soraed some more and UQM was the biggest winner of them all…congrats to those who took me up on that trade…I totally missed it…all of these are potential shorts as early shorts get squeezed and push them to nosebleed prices before the inevitable crash likely later this week/early next.

Check out what a few of my happy students said in the chatroom today:

[10:27AM]ZachCraze:in CDTI @6.65 out @7.33 quick $2550 profit![You’ll Never Look At Starbucks The Same Again [CRAZY PHOTO] Thumbnail](https://content.timothysykes.com/cdn-cgi/image/quality=90,format=webp,width=740/https://content.timothysykes.com/wp-content/uploads/2014/03/unibomber.jpg)

Leave a reply